[ad_1]

Pixxel was founded in 2019 with a primary thesis that the extant satellite data was not enough for advanced applications, which the startup wanted to solve for with hyperspectral imaging satellites

Today, the biggest use cases for Pixxel are related to hyperspectral imagery for agriculture fertiliser makers, oil and gas companies, mines

Currently, the startup’s focus is on launching the first six of the 24-satellite constellation — named Fireflies — by next year

It was 2017 and a team of young BITS Pilani engineering students were competing at the SpaceX Hyperloop Pod competition in Los Angeles — the only team from Asia at that edition. While they missed out on the winner’s trophy, the seed of innovation had already been sown in the mind of Awais Ahmed, a BITS student at the time. The seed has germinated to become Pixxel, one of India’s promising spacetech startups today.

Ahmed, cofounder and the CEO at Pixxel, was always intrigued by the mysteries of outer space. At BITS, he was exposed to various space-related projects and the Hyperloop competition only solidified his ambition to work in this field.

“While we were there in Los Angeles at the SpaceX HQ, they took us on a tour of the SpaceX factory. Looking at those rocket engines being built… the Falcon 9 booster, it crystallised in my mind that I want to work in spacetech for the rest of my life,” Ahmed told Inc42.

It took months of studying the space industry, the possibilities that were waiting to be unlocked before Ahmed pitched an idea to batchmate and friend Kshitij Khandelwal over a video game session.

Ahmed recalls that when Pixxel was founded in 2019, his primary thesis was that the extant satellite data was not enough for advanced applications. Pixxel’s focus was therefore on solving for such applications with hyperspectral imaging satellites.

Simply put, hyperspectral imaging is a remote sensing technology where an imaging spectrometer collects images at different wavelengths that go undetected in single-bandwidth imaging sensors.

While it was developed as early as the 1980s, the tech was restricted by the large size of high quality cameras and therefore the imaging was not high resolution enough in most cases. Plus, spacetech in general has come several generations ahead in the past 40 years.

With the India space sector just opening up for private-sector participation around 2019, Pixxel pitched its hyperspectral imaging satellites which should be able to detect events and phenomena such as the otherwise invisible gas leaks, underground oil leaks, crop diseases and infestations, soil nutrient quality, and much more.

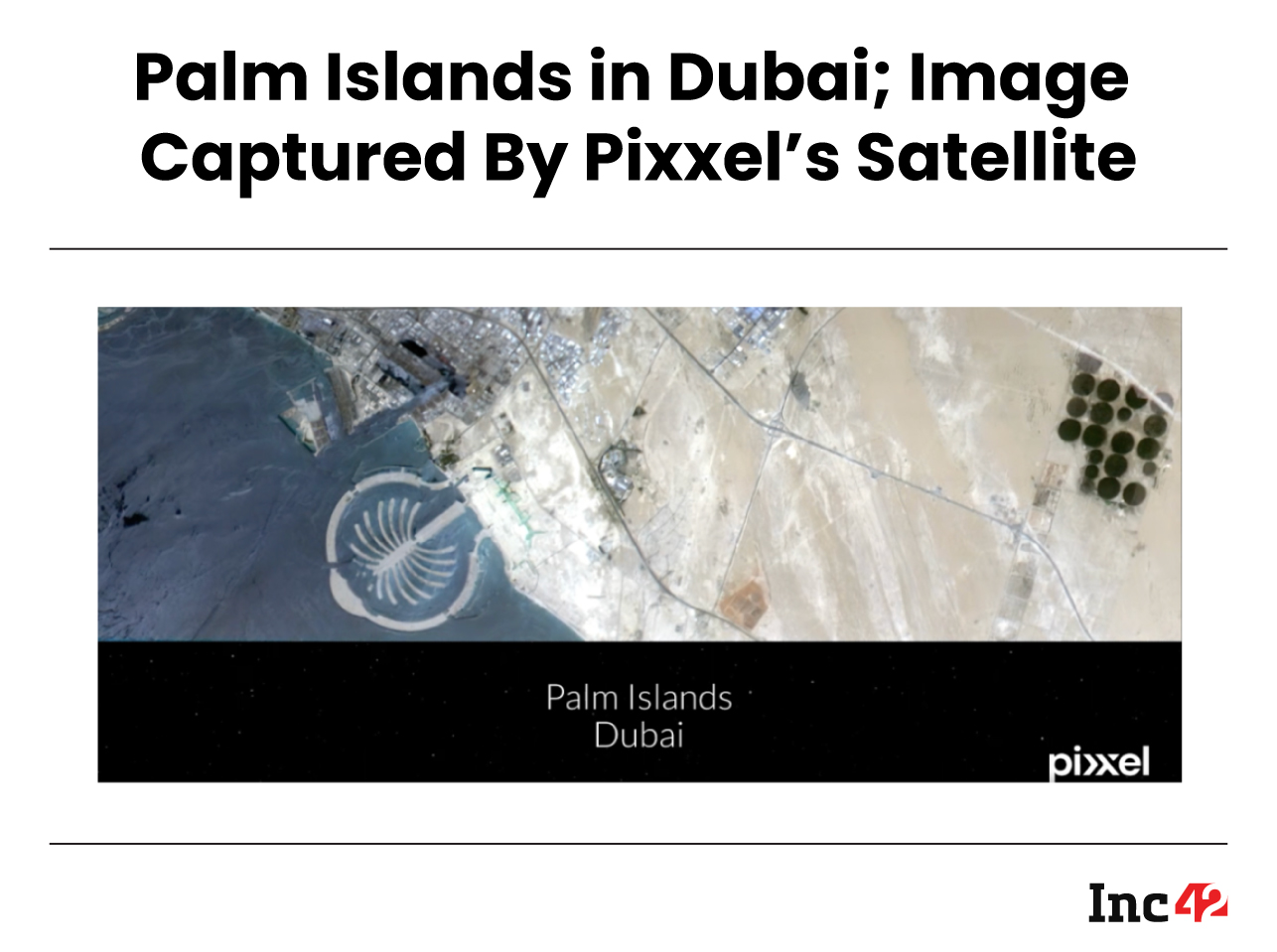

Hyperspectral imaging (sample below) is able to mark out areas on a satellite map using distinct colours in real-time and identify a wide spectrum of patterns. Four years after Ahmed and Khandelwal decided to build Pixxel, the Bengaluru-based startup is now close to deploying what it calls the “world’s first hyperspectral satellite constellation” comprising 24 satellites.

Building A Global Business From Day One

Pixxel’s cofounders began work on the startup in the last years of college. In 2019, the startup was selected for the Techstars accelerator programme in Los Angeles, where Ahmed and Khandelwal got to work on projects alongside veterans from NASA, the US Air Force and aerospace giant Lockheed Martin among other industry majors.

This not only gave Pixxel a place to test innovative ideas and great mentors, but also their first major external investment besides a $500K previous investment at a BITS event in the US. The Techstars experience was also pivotal in helping the company establish important connections in the US, which is currently Pixxel’s biggest market.

“Our business had to be global from day one. You can’t possibly ignore the fact that the US is the largest market and the second largest is Europe. I think that participation in Techstars early on helped us realise this fact,” Ahmed recalled.

The likes of growX Ventures also joined Pixxel’s cap table in that $700K pre-seed funding round in 2019. But building in spacetech at the early stage requires a lot more capital. On the tech side, Pixxel’s team had managed to build and demo small earth-imaging satellites. But the Covid-19 pandemic was a setback for bigger launch plans.

Even as the company was perfecting its technology during this time, it raised a seed round of $5 Mn led by Blume Ventures, Lightspeed Ventures, and growX Ventures and later it raised $2.3 Mn from Omnivore VC and Techstars.

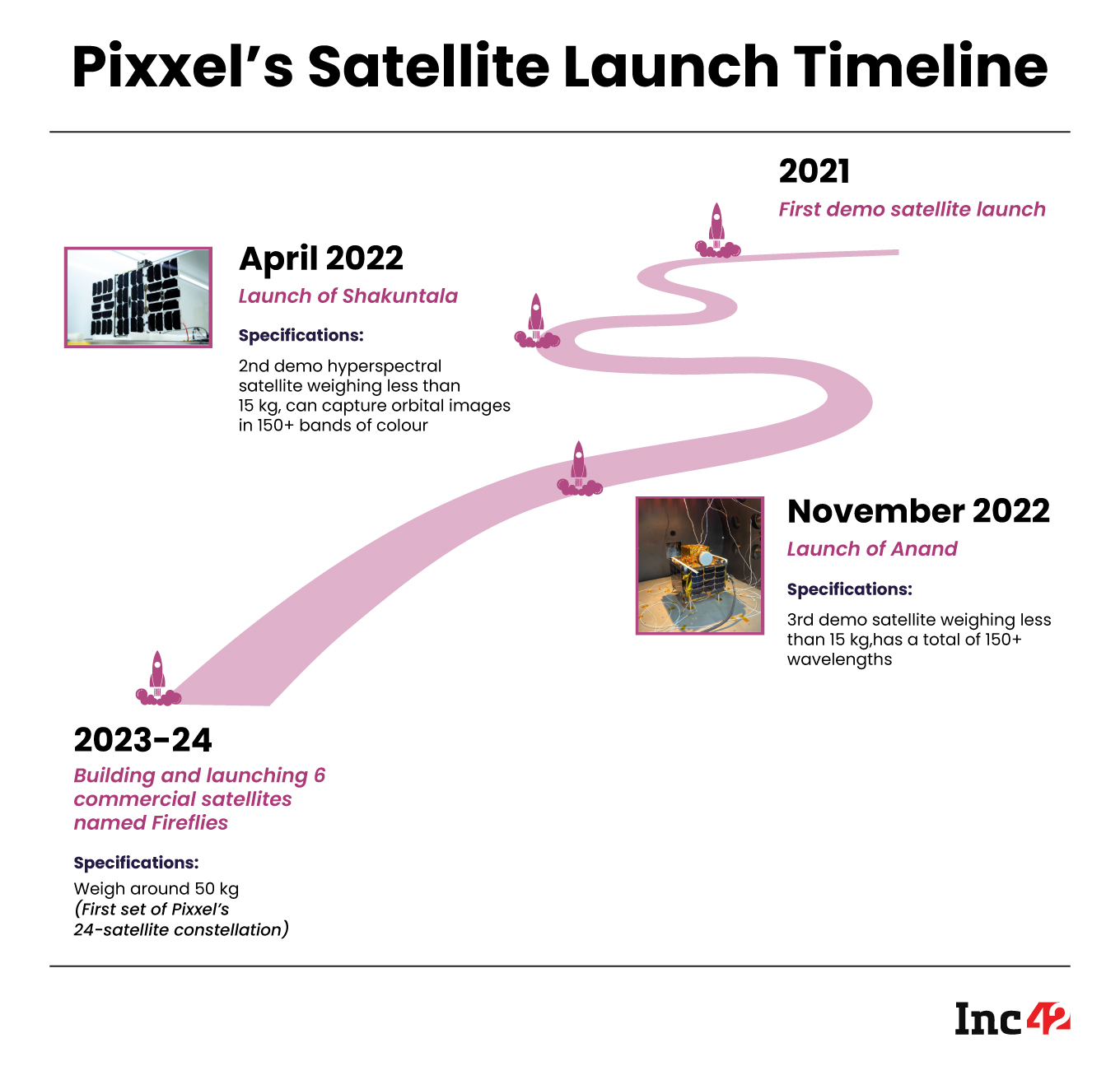

The startup was riding the highs of the buzz around spacetech. Using the capital raised, the company had built its satellite platform and also enough traction in the market. In 2021, Pixxel launched its first demo satellite with SpaceX and in April and November last year, two more satellites were launched, including one with Indian Space Research Organisation (ISRO).

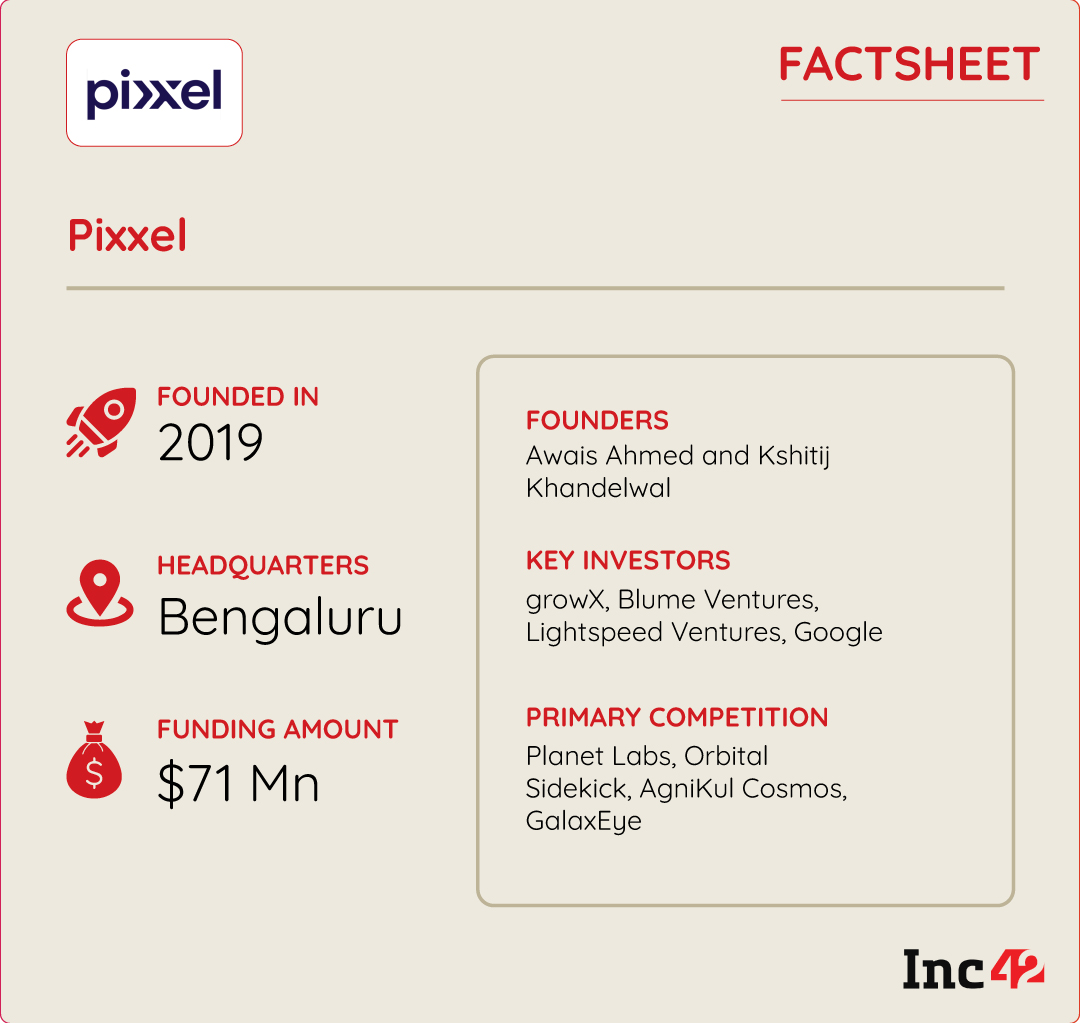

Currently, the startup’s focus is on launching the first six of the 24-satellite constellation — named Fireflies — by next year. Over the course of four years, Pixxel has already raised $71 Mn in total funding. Its latest major round was in June 2023 when it bagged $36 Mn in a Series B round led by tech giant Google and existing investors.

Headquartered in Bengaluru, Pixxel has another office in Los Angeles. From an employee count of 15 people in 2021, Pixxel today has grown to a size of around 140 employees. While a majority of its business today comes from the US and Europe, Ahmed did not indicate any interest in shifting the company’s headquarters outside India.

What Sets Pixxel’s Tech Apart

“Instead of being able to look at information in 10 or so wavelengths that most other satellites do today, our hyperspectral satellites can do it in 300 wavelengths, and that’s what leads to the wealth of information we provide,” explained Ahmed

He claims Pixxel’s imaging capabilities are 10X more than some of the other known names working in hyperspectral imaging today that deal with around 30 wavelengths. This allows the Indian company to capture data with more granularity and with a higher level of accuracy.

While the company has launched 15 Kg demo microsatellites so far, the first six satellites of the Fireflies series set to launch in 2024 will weigh 50 Kg. The startup plans to launch bigger satellites in the near future — even as large as 150 Kg — to capture more data and cover wider use cases.

Today, the biggest use cases for Pixxel are related to hyperspectral imagery for the agriculture fertiliser makers, oil and gas companies, mines as well as groups and organisations working in the environment sector. Pixxel sells both data and analytics insights from the data to these clients, which include the mining giant Rio Tinto and Australian precision agriculture company DataFarming.

“With mining companies, we work on monitoring existing and closed mines because there are a lot of regulatory restrictions that come with mining. If someone is mining near forested land, we need to make sure of the need for reforesting it somewhere else. We need to make sure that their operations are not causing havoc on biodiversity,” explained Ahmed.

Pixxel also works with fertiliser companies in Central Europe where it surveys farmland before sowing season and creates a soil utility map. The tech can identify levels of nitrogen, phosphorus and potassium in the soil to inform farmers and companies on the best areas for use of fertilisers and the kind of fertiliser to be used.

How does the company earn revenue?

For instance, a customer has 100 square kilometres (sq km) of land to monitor. Pixxel might charge the client $10 per sq km per day of monitoring. Each such day would bring in $1,000 in revenue. If the customers want such data for 24×7 use for 365 days, the annual contract would run up to $365,000.

The India Spacetech Story

Pixxel started off at a very important juncture in the Indian spacetech story — the central government had launched the nodal agency Indian National Space Promotion and Authorisation Centre (IN-SPACe) in 2021 to boost private sector participation.

Before 2020, private players could build satellites in India but not launch them and had no way of obtaining the requisite permissions to launch satellites.

Today, India has caught up on the regulatory front and rules are more favourable for startups. But that doesn’t mean there are no disconnects.

“There is still a little bit of a gap in the aspirations in terms of completely liberalising and opening spacetech to actually executing it. For example, I think there needs to be a very clear laying down of what timeline it would take for someone to approve an application, and then so on and so forth, which still is not existing. However, the intent is there,” Ahmed said.

Besides private organisations, Pixxel works in collaboration with various governments around the world. In India, the startup signed an MoU with the Union Ministry of Agriculture & Farmers Welfare (DA&FW) to collaborate on the development of geospatial solutions for the Indian agriculture sector. In this collaboration, Pixxel’s hyperspectral dataset will be used to develop solutions focused on crop mapping, crop stage discrimination, and crop health monitoring.

Even as India grows into a more mature market, Pixxel’s focus, like most other domestic spacetech players, is on the global market to keep scaling up and raking in revenue to build the tech. However, the fact that the entire tech integration and satellite construction takes place in India is still key for Pixxel in competing with western giants.

The Collaborative Efforts For The Growth Of Spacetech

While startups such as Pixxel can be considered pioneers of the new-age Indian space ecosystem, such innovation would largely struggle to attract large customers without partnerships with tech giants.

Pixxel categorises its partnerships into four buckets. Besides component manufacturers of solar panels, batteries, reaction wheels, and others who contribute in building satellites, the startup has tie-ups with the likes of Amazon and Microsoft who have ground stations.

Meanwhile, the likes of SpaceX and ISRO have come to the aid of Pixxel with launch pads and launch vehicles. Pixxel also has partnerships with data resellers and distributors in various geographies in South America, Africa, Europe, and Asia who help in selling its satellite data in these regions.

This has allowed the company to maximise its revenue potential while continuing to build from India. Plus Ahmed believes that the hyperspectral satellite imaging space is relatively untapped so Pixxel has a huge white space to fill.

The execution, the cofounder said, is the biggest challenge.

“So, there’s a series of different challenges, all related to execution. We have proven the concept, we have proven the technology, can we now just take it at a commercial scale and become a profitable company? Because, in space, you can continue to spend but if you can’t sustain yourselves with revenue, then it becomes tougher,” said Ahmed, adding that the supply chain is currently very complex for a startup like Pixxel.

While Ahmed did not reveal Pixxel’s net revenue figure. In its press release for the Google-led funding round, Pixxel claimed its customer base grew by 5x in 2022. As per the startup’s financial filings, in FY21, it earned INR 7.6 Cr as against INR 1.5 Cr in the previous year. In FY21, it also reported a profit of around INR 81 Lakh.

Pixxel competes with the likes of global players like Planet Labs, Orbital Sidekick. While the startup believes that no one in India is working at its current scale, Pixxel could see serious competition from the startup including AgniKul Cosmos and GalaxEye in the future.

Meanwhile, the current focus for the startup is to realise the promise of its Fireflies satellite constellation and develop the infrastructure to support the range of applications it will enable. Pixxel is also building Aurora – an AI-powered geospatial analytics platform to make hyperspectral analysis accessible to its customers.

[ad_2]

Source link