[ad_1]

In the last 18 months, Leverage Edu has secured $62 Mn in funding despite the gloomy state of the Indian edtech ecosystem

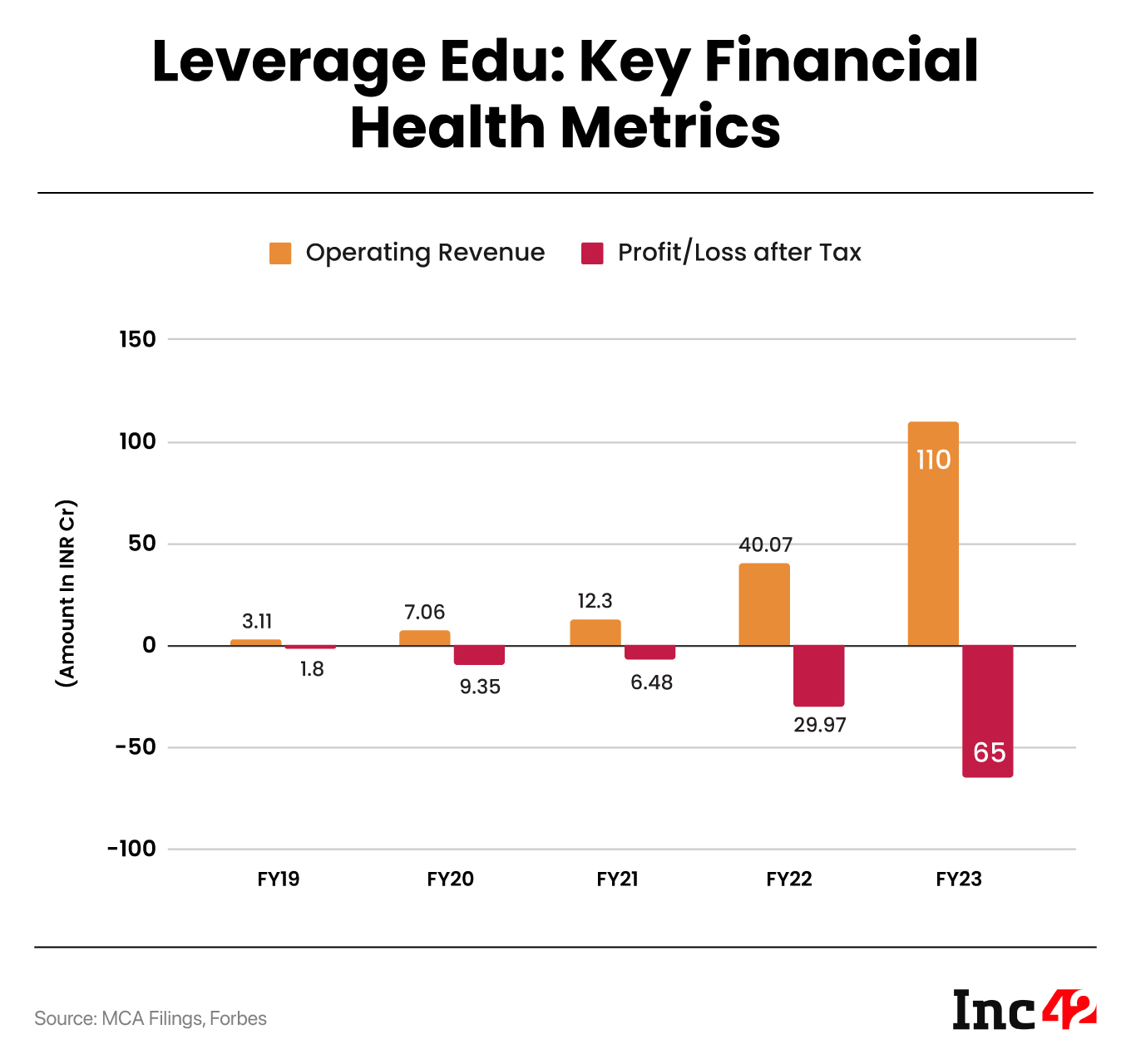

The startup did incur losses at the outset and until a major part of the financial year 2023 but now claims to have turned profitable in Q4 of FY23

Founder & CEO Akshay Chaturvedi is looking at a full year of FY24 profitability with a focus on the UK and the US markets

It was July 3, 2023, and probably one of the busiest afternoons at Leverage Edu’s Noida office. The news of the company’s $40 Mn Series C funding round got leaked, piquing media interest, and the founder & CEO, Akshay Chaturvedi, who wanted to keep a low profile, couldn’t avoid his phone that kept ringing back-to-back.

The milestone, as many would say, was truly remarkable, considering the state of a majority of the Indian edtech players post-pandemic. Despite this, Chaturvedi managed to secure funding twice, totalling $62 Mn, in the last 18 months, with the company’s valuation now soaring to $150 Mn.

However, the journey wasn’t without its challenges. Launched in 2017, Leverage Edu is a study abroad platform that helps students apply to universities abroad. During the first 10 months of the pandemic in 2020, the startup faced a significant setback when people were forced to stay in the confines of their homes. This particularly hit Leverage Edu, as travel restrictions gave the startup’s revenue stream a sudden death.

Against all odds, the company persevered, retaining its 80-member team and forming valuable alliances with international universities, which laid the foundation for the success that was yet to come.

With his passion for travelling and forging new partnerships, Chaturvedi has been able to join hands with over 700 universities across the globe since the inception of Leverage Edu. Some of the key universities in the startup’s portfolio include University of Liverpool, Queen Mary University of London, University of Illinois Chicago, Macquarie University, St Lawrence College, Nipissing University, among others. Notably, Canada Apply Board stands as the only other platform, which boasts more than 1,200 universities in its network.

Other notable companies in the sector are Leap Scholar, which offers end-to-end solutions to students ranging from personalised guidance on top universities, IELTS coaching, and visa services, among others, and Eruditus, which is mostly focussed on executive education from top business schools.

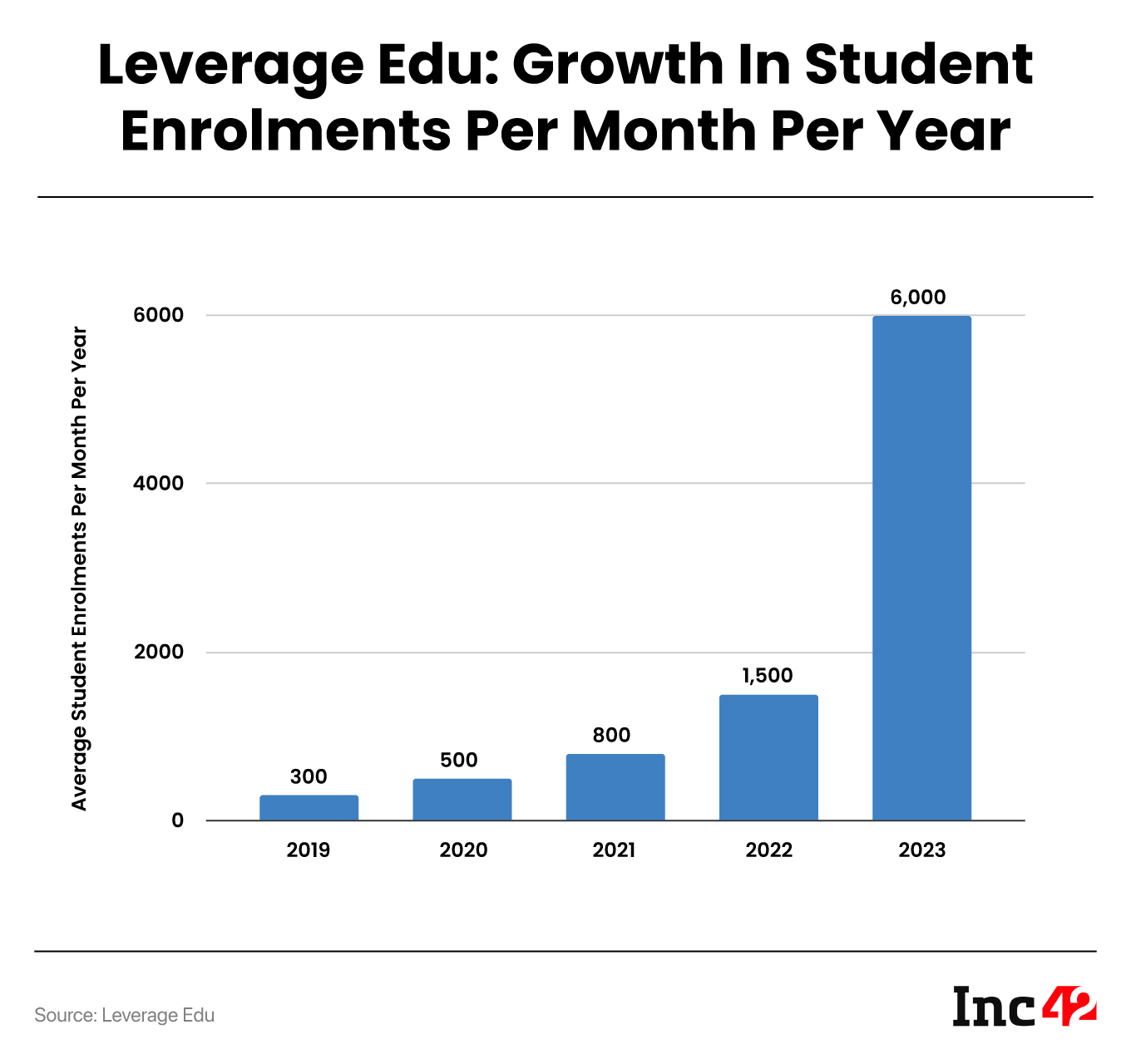

With a dedicated team of over 950 members, of which 200 people hold ESOPs, and an impressive 0.7 Mn downloads across three apps – Study Abroad With Leverage Edu, LeverageIELTS, and the recently launched LeverageTOEFL, Leverage Edu claims to serve a strong community of 8 Mn-plus students aspiring to study abroad.

Like many other edtech startups, Leverage Edu did incur losses at the outset and until a major part of the financial year 2023. However, the tides seem to be turning now as the company claims to have turned profitable in the fourth quarter (Q4) of FY23 (January to March 2023). The company is yet to get its filings audited for the quarter. Furthermore, the edtech plans to double its revenues, setting its eyes on a full year of profitability in FY24 (April 2023 to March 2024).

Chaturvedi’s Humble Beginnings

Speaking with Inc42, Chaturvedi said, coming from a lower-middle-class family, his parents wanted to see him excel in studies and become fluent in English to secure a good job, which he did.

Before starting his career, Chaturvedi was involved in many side hustles, and it’s hard to imagine a single field that he may not have pursued before commencing his Leverage Edu journey.

Chaturvedi has tonnes of experience under his belt, ranging from working with two of the Big Four accounting firms, KPMG and EY, to being a writer, a mentor, a researcher and an investor with multiple firms.

However, Leverage Edu came into being only after he left his job at EY in 2014 to pursue MBA, setting his eyes on Oxford University. Even though he got selected, he did not have the funds to embark on Oxford avenue to pursue his plan, adding much to his chagrin.

As a result, the undeterred young Chaturvedi took a parallel route that led via the Indian School Of Business (ISB) to quench his thirst for higher studies (MBA) from a top-notch business school. Since then, he has not looked back.

Although what nudged him to pursue MBA is a story worth listening to from the horse’s mouth.

“During my stint at EY, I learnt that one out of every four Chinese kids in America studied with New Oriental Education, a Nasdaq-listed company worth a staggering $22 Bn-$23 Bn. The founders also have a movie on their journey — ‘American Dreams in China’. This moment proved to be a turnaround of a lifetime, as somehow I was able to connect with the idea of establishing a venture that would someday be worth millions of dollars if not billions,” he said.

The Point Of No Return

Two pivotal events unfolded while Chaturvedi was pursuing his MBA at ISB. First, he built ISB’s internal app, Leverage, where students could connect with higher-education experts for advice. And hardly did he know back then that the app will one day mature to become a full-fledged edtech business.

Second, his dream of studying abroad turned into reality when he received an offer letter from Draper University in the US, granting him a fully funded scholarship for the DFJ Fellowship program, a prestigious entrepreneurship boot camp.

But, the only roadblock was that he did not have sufficient funds to sponsor his travel and accommodation.

“I was puzzled and instinctively wrote a cold email to Kunal Bahl of Snapdeal. Surprisingly, he replied with an INR 85K cheque,” the founder reminisced with a smile. “Moreover, TiE supported with INR 1.25 Lakh that took care of my accommodation.”

Chaturvedi Still Had Miles To Go…

The fellowship programme fuelled his desire to create something impactful, something that can add value. It was then he realised how challenging it was to study abroad. With his experience, he was able to relate to the headwinds that many students, who do not have adequate resources, face in their pursuit to study in foreign lands.

Back then (2015-2017), the industry was highly unorganised, and there was a notable absence of a strong brand dedicated to serving students aspiring to study abroad.

Furthermore, there were glaring gaps in this space, crying to be fixed. While many students lacked access to proper guidance on higher education choices, several others received misleading bits of advice that led them astray. And then, there are unscrupulous agents in this sector who take advantage of students.

Loathing how the sector operated, Chaturvedi envisioned a structure that can be trusted to provide accurate career advice to students, the vision that eventually gave birth to Leverage Edu in 2017. Interestingly, the seed of his vision had been sown during his ISB days with Leverage.

After saving up INR 8 to 10 Lakh, he launched the ‘Study Abroad with Leverage Edu’ mobile app.

“I kickstarted my journey from there. Although I never intended to be an entrepreneur, I landed up becoming one because I understand the student DNA,” he said.

Leverage Edu’s Playbook To Stay Ahead Of The Curve

Chaturvedi claims Leverage Edu to be the third-largest player globally in sending Indian students to the UK for higher education. In FY24, the founder is aiming to up the ante and has his eyes set on entering the US and bagging Series C funding. The startup is also looking at strengthening its product portfolio by adding loans and English language training courses to the startup’s overall kitty.

“Since we have started to build our channels, the costs have come down. However, it takes time to see a visible effect, and we are hopeful of seeing some of these having a positive impact in our FY24 financials,” the founder said.

The biggest learning for Chaturvedi has been to understand his customers and build the right value proposition for them at the right cost.

“We have done everything in the last six years and we believe we have only scratched the surface as we still have miles to go. And now, we are focussed on building and rebuilding our corporate culture. In addition, my goal is to create incremental cash flows because being profitable is not enough,” the Leverage Edu founder said.

A Paradigm Shift: From Burning Cash To Curbing CAC

Until a larger part of FY22, Leverage Edu burnt a lot of cash. The efforts were towards acquiring 2-3% of the approximate 1.1 Mn students aspiring to study abroad every year from India and investments towards building value-added products and content machines for future organic acquisitions. However, just before the funding winter kicked in, a mentor flagged the amount of cash the company should be burning to acquire new users.

Following this, the edtech startup shifted its focus towards a more sustainable data-led approach. The strategy that it adopted is as follows:

Identifying The Core Serviceable Market: In a matter of months, the team pinpointed 144 micro markets with the lowest cost per lead, highest conversion rates, and strong brand recall.

“We understood that we did not want to win the entire country but only certain micro markets. This helped us in keeping customer acquisition costs at bay,” the founder said.

Enhancing Processes On The University Front: To do this, the Leverage Edu team launched Univalley, an OS for universities to streamline payments and manage applications. Additionally, value-added products like Univalley Admit, Univalley Pay, and Univalley Cred were introduced, aiding quick conversions.

Fixing Loopholes On The Student End: To bring more transparency to their work, the startup created UniConnect, an online student community that engages in open discussion forums involving universities, alumni, and applicants. The startup also employed data analytics to effectively match students and universities.

“Today, we have over 120 Mn visitors on Wings, a content platform, and receive 3K to 4K posts/comments daily on study abroad with Leverage Edu mobile app community with prompt responses from university representatives,” Chaturvedi said.

Building Multiple Value Propositions On Both Supplier and Demand Side: Recognising the comprehensive needs of students going abroad, Leverage Edu developed a range of in-house products catering to various requirements.

Some of these products include Fly Finance (Fly Loans and Fly Forex), Fly Homes (student accommodation), LeverageLive (live learning platform for international edtest prep and English language learning, hosting 1 Mn-plus hour of classes every month), and Ivy100 (boutique premium consulting services for Ivy-league & equivalent universities), among others. This helped the company increase the conversion rate and reduce conversion costs at scale.

“In 2021, we provided loans worth about INR 30 Cr. In 2022, the loans reached INR 270 Cr, facilitated through banks, lending partners, and NBFCs. With an RBI license to remit, our credibility increased, and this year we expect loans to reach almost INR 700 to 800 Cr,” he added.

Ensure Team Productivity: The entire student journey is divided into 36 touch points, each equipped with multiple FAQs answered through the Leverage Launchpad feature. This enhances the student experience, reducing effort throughout the process. The company heavily invests in training and assessment, ensuring team members spend at least six weeks on soft and hard skill training and gaining expertise on multiple universities. This has armed Leverage Edu’s content team of 60 to serve a large student pool with unmatched efficiency.

Leveraging The Market Opportunity

According to Chaturvedi, 15 months ago they would spend about INR 6 Cr a month on performance marketing, which today has come down to nearly INR 15 Lakh. “When you talk about non-variable expenses that we kind of make in the usual day-to-day, I can confirm that we are building the company out of the cheapest place in Noida compared to Bengaluru, Mumbai, or Delhi,” he said.

“Even our marketing costs in hindsight have gone down from $2,400 to $800 per student against the $4,200 we make on each student. Also, now 66% of all our acquisitions are organic/non-paid and 21% are referrals. This led to profitability from December 2022, and the reason we’ve been able to raise funds in the ongoing funding winter is because we were profitable,” the founder said.

Chaturvedi has many plans for the current financial year, and he is hell-bent on boosting the market share of his venture. However, more important for him is to create incremental cash flows as just being profitable is not enough to become a one-stop destination for millions of students who aspire to study abroad.

[ad_2]

Source link