[ad_1]

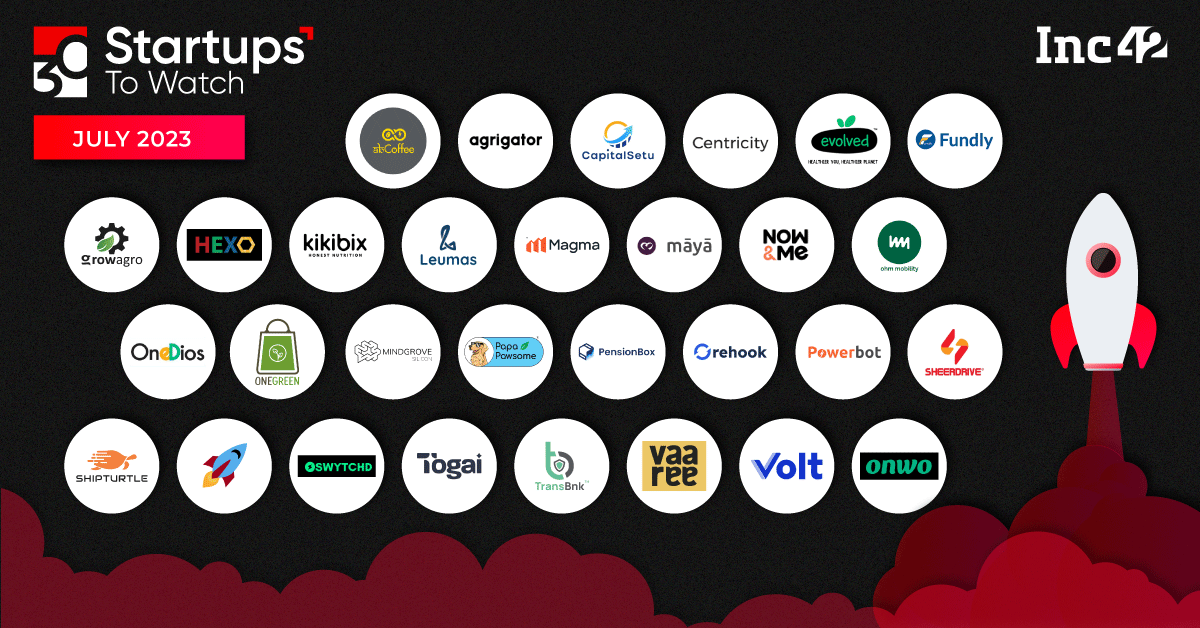

After spending two months on the drawing board, we have returned with the 38th edition of ‘30 Startups To Watch’ with a laser-sharp focus on sustainability

We believe that the crucible that is the current market will forge and shape companies that will make headlines throughout the next decade

This edition of ‘30 Startups To Watch’ features 17 startups operating in the B2B space, eight ventures in the B2C segment, and the remaining five startups holding the B2B2C flag

After two years of unmitigated growth powered by the rocket fuel of FOMO-driven funding, India’s startups are facing a reckoning. With startup funding plunging to 2020 levels, volatility in public markets and the US economy on the verge of entering a recession, the world is looking at similar conditions as the Global Financial Crisis (GFC) of 2008.

However, the present moment might also be the best time to build a startup. Flipkart, Dream11, Policybazaar, EaseMyTrip and Zomato – all storied names in India’s startup ecosystem – were founded during the height of the GFC when global markets were facing an extinction-level event.

The crucible that is the current market will forge companies that will make headlines throughout the next decade. Startup funding is in a freefall zone and investors have tightened their purse strings significantly, making selective deals. However, the bullishness for early bets remains as high as ever.

We have always had the opportunity to discover the market leaders of tomorrow with ‘the 30 Startups To Watch’ column, and this endeavour holds more prominence right now.

Recognising the immense responsibility we have on our shoulders, we took a step back, talked with startups and investors backing them and reprioritised what kind of startups need the spotlight the most today.

After spending two months on the drawing board, we have returned with the 38th edition of ‘30 Startups To Watch’ with a sharp focus on sustainability, echoing the sentiment across global markets.

30 Startups To Watch: July 2023

No startup that was selected has raised more than $4 Mn in funding, with many securing less than $500K in investment and still turning a profit. While these 30 companies employ more than 650 employees cumulatively, 17 startups have 20 employees or less.

The list is loaded with fintech, ecommerce and enterprise tech ventures, with a total of 20 startups. We have also featured startups from the currently relevant fields of generative AI and semiconductors, with one startup each from the two red-hot industries.

More interestingly, the 38th edition of ‘30 Startups To Watch’ features 17 startups operating in the B2B space and only eight ventures making waves in the B2C segment. The remaining five startups hold the B2B2C flag.

In our most recent editions of this series, we have witnessed a growing wave of startups catering to other businesses. Usually, these startups are either already profitable or are about to turn a profit, which ensures better exit opportunities for investors who have burnt their fingers already and are looking to make safer bets.

For Indian startups, however, the present is anything but the time to play it safe.

With that, we bring you the 38th edition of the 30 Startups To Watch list by Inc42.

Editor’s Note: The list below is not meant to be a ranking of any kind. We have listed the startups alphabetically.

abCoffee

Stirring Up Indian Coffee Culture With Grab-and-Go Playbook

Coffee is undeniably one of the most beloved beverages in India, with coffee chains like Starbucks, Tim Hortons, and Cafe Coffee Day being quite popular. However, the prices at these chains have been notoriously high, with markups reaching as much as 1,700%. That remains true with the presence of local speciality coffee chains, even as India is the world’s eighth-largest exporter and the fifth-largest producer of coffee.

Having experienced European coffee for many years and after extensive research on Indian coffee varieties and roasting techniques, Abhijeet Anand started abCoffee in 2022 from a single outlet in Mumbai. The startup has nine tech-enabled, grab-and-go outlets in Mumbai, with one coming up in Delhi NCR soon.

abCoffee prides itself on its efficient service, claiming that customers can get their favourite beverage and be on their way in just 90 seconds, provided they place an order right before arriving at the outlet.

The QSR coffee chain sources green beans from across the country and roasts per its in-house recipe. abCoffee has 95+ SKUs across five categories, including hot and cold beverages and ground coffee.

The startup has multiple revenue streams, including direct sales via its QSR outlets, online sales via delivery partners like Swiggy, Zomato, Magicpin and Dunzo and online orders via the website. So far, abCoffee claims to have sold 103K+ cups of coffee to more than 31,000 customers. It reported an ARR of INR 3.4 Cr as of July 2023.

In the short term, abCoffee plans to expand to major urban hubs of the country, with 323 outlets by 2024. By 2026, the startup plans to set up more than 6,650 outlets across India, with an ARR of INR 6,656 Cr.

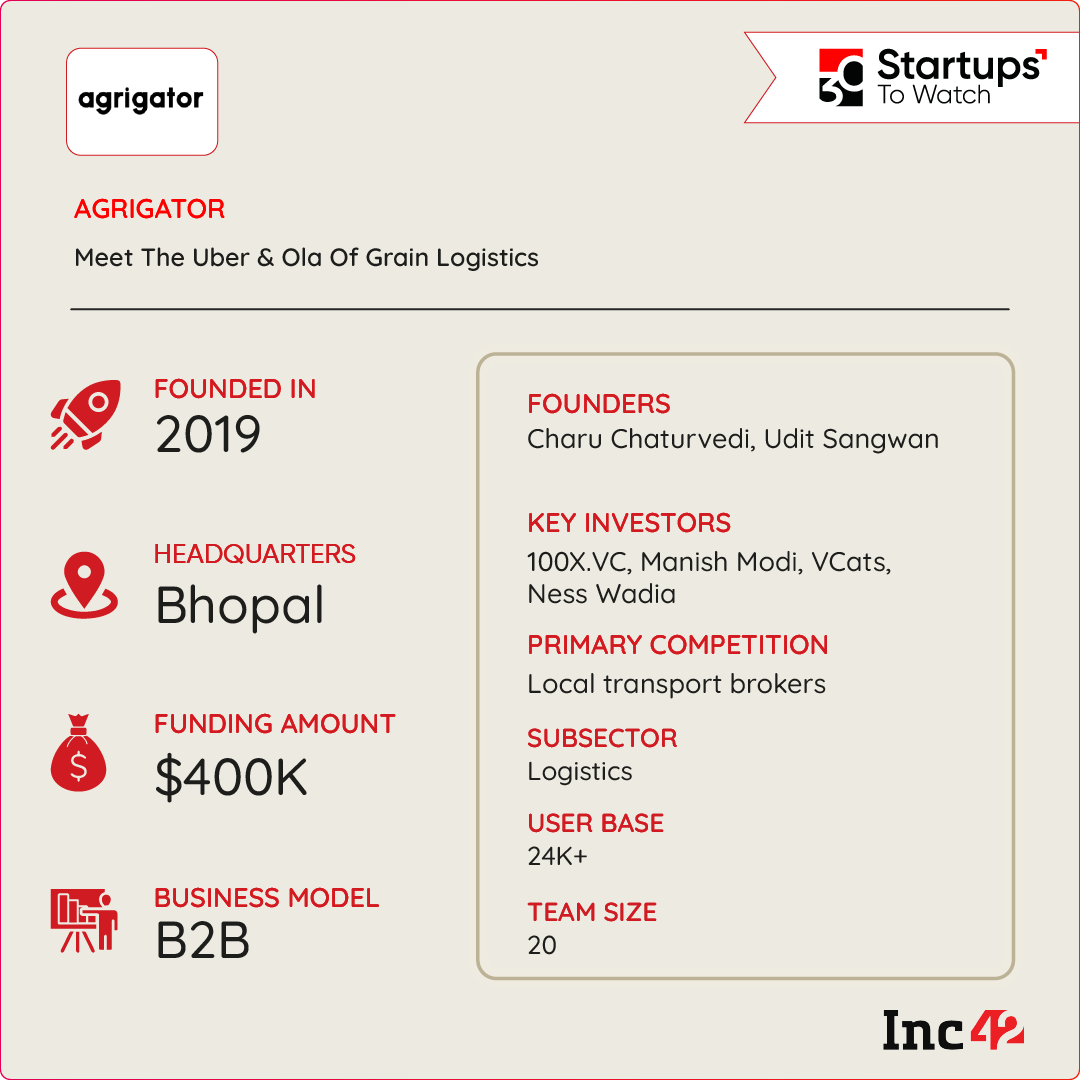

Agrigator

Meet The Uber & Ola Of Farm Logistics

According to a 2021 report by the Standing Committee on Food, Consumer Affairs and Public Distribution, India lost around 412K metric tonnes of wheat and rice between 2017 and 2021, owing to poor transportation and logistics. For context, the amount of food grains lost in transit could have fed 82.3 Mn people for a month.

To alleviate the issues shrouding the sorry state of grain logistics in India, Udit Sangwan and Charu Chaturvedi founded Agrigator in 2019.

Similar to Uber or Ola, Agrigator acts as a platform that connects grain traders and small-scale millers with on-spot logistics services. Truck drivers can sign up on the platform to offer their services, similar to how ride-hailing companies operate. Since its inception, Agrigator has onboarded more than 2,000 truck drivers.

The startup offers multiple services to its customers, including guaranteed truck confirmations within an average of 28 minutes and freight discovery through its freight prediction model, which is patent-pending in India.

Agrigator has its supply network in four states to enable the pan-India movement of grain. In the last three months, the logistics startup has achieved significant milestones, including 9,000 trips and increasing its matching fees from 2.5% to 6%, amassing a user base of 24,000 clients.

They have also joined hands with an NBFC to expedite payments.

Agrigator takes a certain percentage from the payment received by each truck through its platform, making way for the Bhopal-based startup’s core revenue stream. By 2024, Agrigator is looking to increase its revenue by 8% YoY.

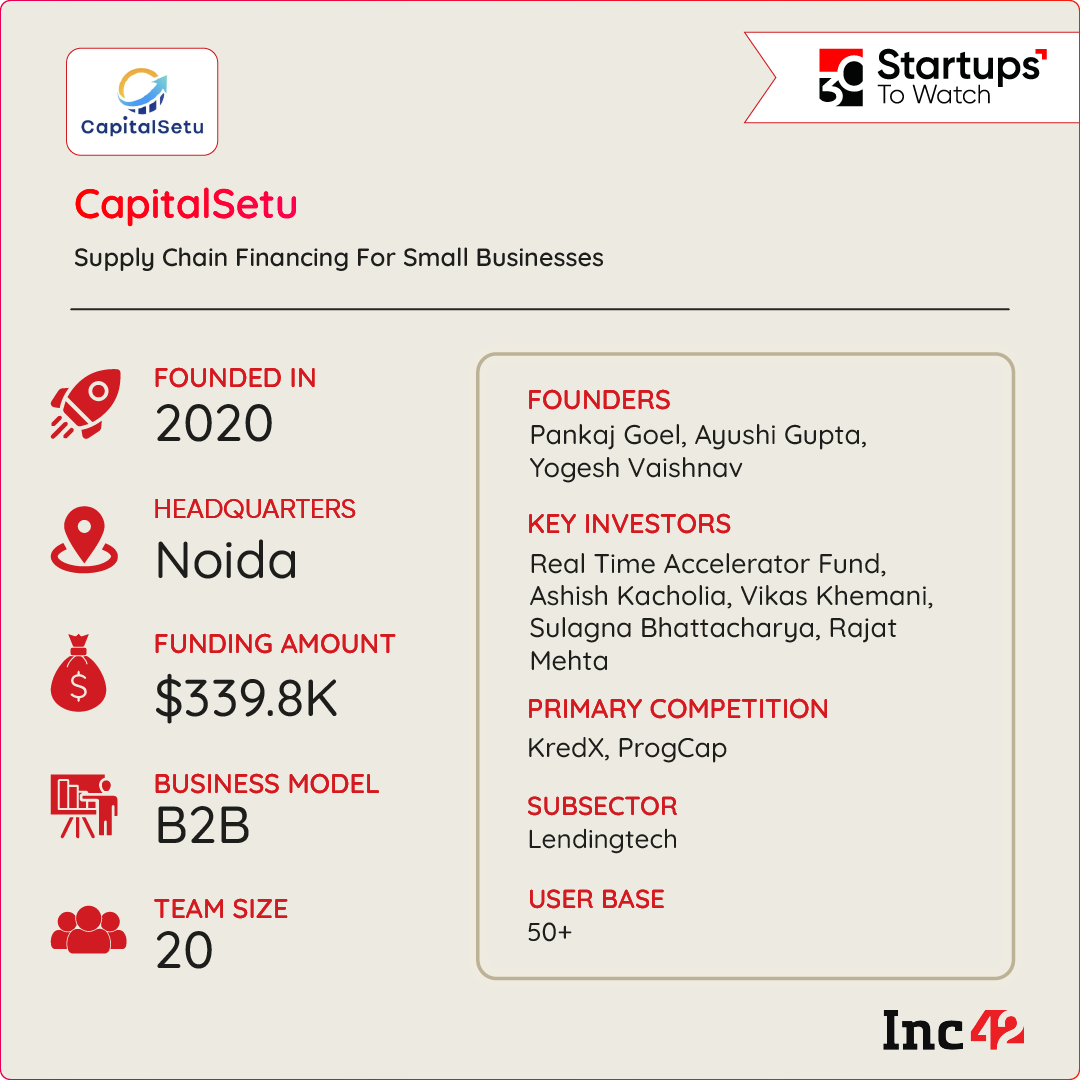

CapitalSetu

Giving Small Businesses A Supply Chain Financing Boost

Per the Ministry of Micro, Small & Medium Enterprises, there were 14.39 Mn MSMEs in India as of February 2023, with more than 99% being micro and small enterprises. These businesses have limited access to financing, which limits their growth.

Pankaj Goel, a chartered accountant, saw an opportunity in the supply chain finance segment for distributors, retailers and MSMEs, which inspired him to start CapitalSetu in 2020. Today, Goel runs the startup with his wife Ayushi and Yogesh Vaishnav, a family friend and the startup’s CTO.

CapitalSetu’s offerings comprise six products, three fintech and three SaaS. Its flagship product, SetuX, is aimed at providing supply chain financing to businesses. With SetuX, the startup helps MSMEs increase the pace of their cash flow by releasing ‘early payouts’ against their invoices.

Further, while the startup’s SetuPay is a peer-to-peer invoice discounting platform, which enables faster payment cycles, its SetuDyna solution offers a dynamic discounting platform through which MSMEs can offer early payment discounts to their respective suppliers.

CapitalSetu’s SaaS product SetuFi is a tally reports and dashboards mobile app. Similarly, its SetuTIP is an app-based trade intelligence platform that offers credit assessments, GST reports, ITR reports, banking reports, and bureau assessments. The startup also offers an order management system, SetuBiz.

CapitalSetu generates revenue through its supply chain finance operations by charging interest and through SaaS subscriptions.

The startup has disbursed INR 250 Cr so far, a quarter of its 2024 target of INR 1,000 Cr loan book in supply chain financing for MSMEs. By 2026, CapitalSetu aims to take disbursals to INR 5,000 Cr across 1 Lakh MSMEs in India.

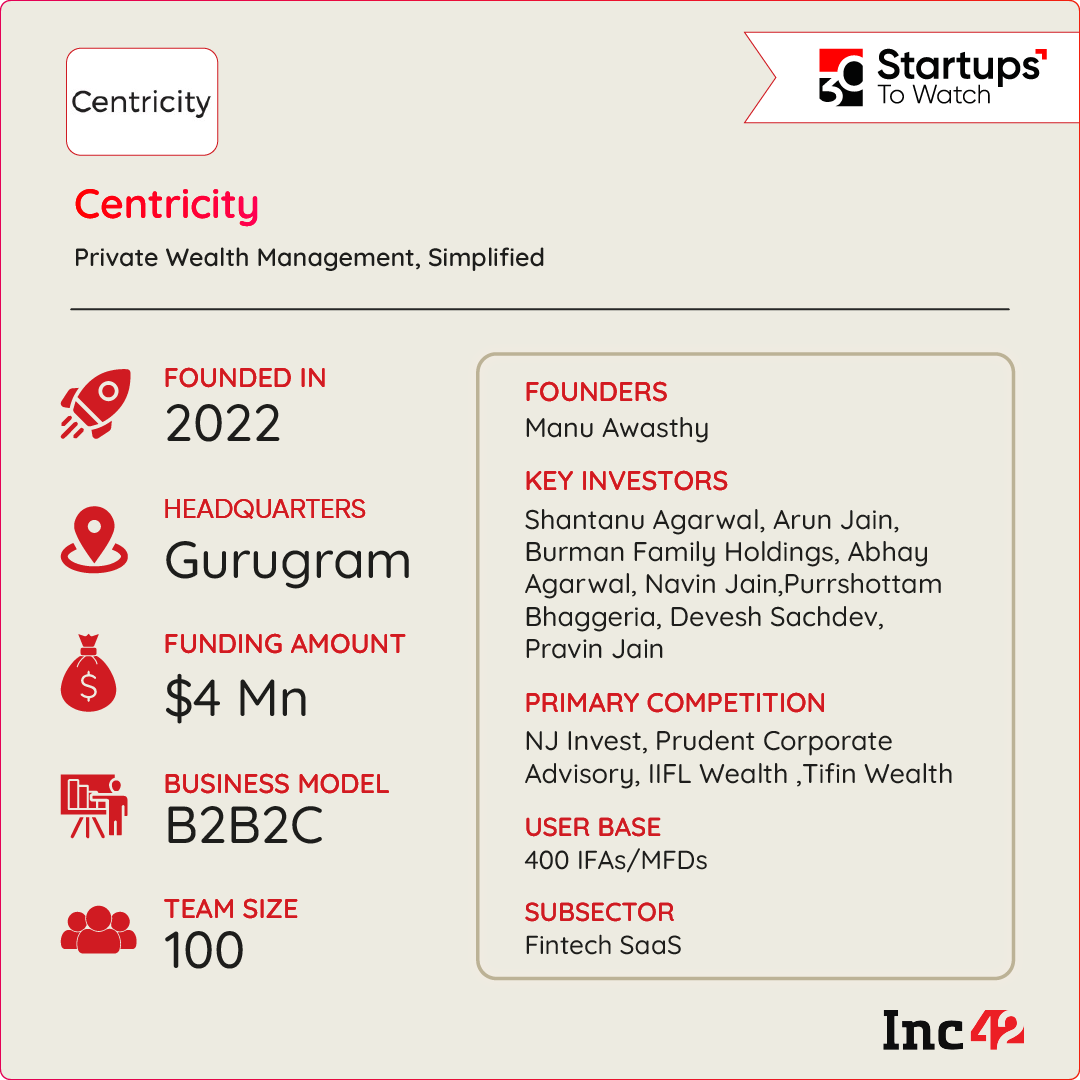

Centricity

Giving Private Wealth Management A Tech Boost

Traditionally, wealth management has been a mostly manual process with limited automation and outdated reporting methods. Due to the unavailability of tech-enabled solutions, the requirements of HNIs and UHNIs have often remained underserved in this segment. In addition, independent financial advisors (IFAs) today need help in scaling up their services amid a dearth of tech solutions.

With India’s wealth management market set to reach $429.70 Bn in assets under management (AUM) in 2023, the lack of tech in the space is telling.

Having worked with single-family offices and UHNIs for over 20 years, Manu Awasthy founded Centricity. The startup offers plug-and-play solutions for IFAs looking to make the transition to the wealth management space or scale their businesses. For HNIs, UHNIs and single-family offices, it offers a suite of tools for efficient wealth management.

Centricity primarily focuses on two products – OneDigital and Invictus. While OneDigital is a digital infrastructure platform for IFAs, Invictus is an insights-generating tool designed for single-family offices (SFOs).

OneDigital enables onboarding, KYC processes, multi-asset transactions, comprehensive investment product listings and comparison tools. Invictus, on the other hand, enables SFOs to assess investment risks, implement policy guardrails, and create asset allocation.

The startup’s revenue accruals come from commissions generated from asset management companies/product manufacturers and fee incomes on secondary bond trades with clients.

Centricity’s short-term plans for 2024 include scaling the technology team, expanding its physical presence, enhancing the product bouquet by adding more products and growing key metrics such as the number of digital partners, product penetration, AUM for OneDigital, and the number of families on the Invictus platform.

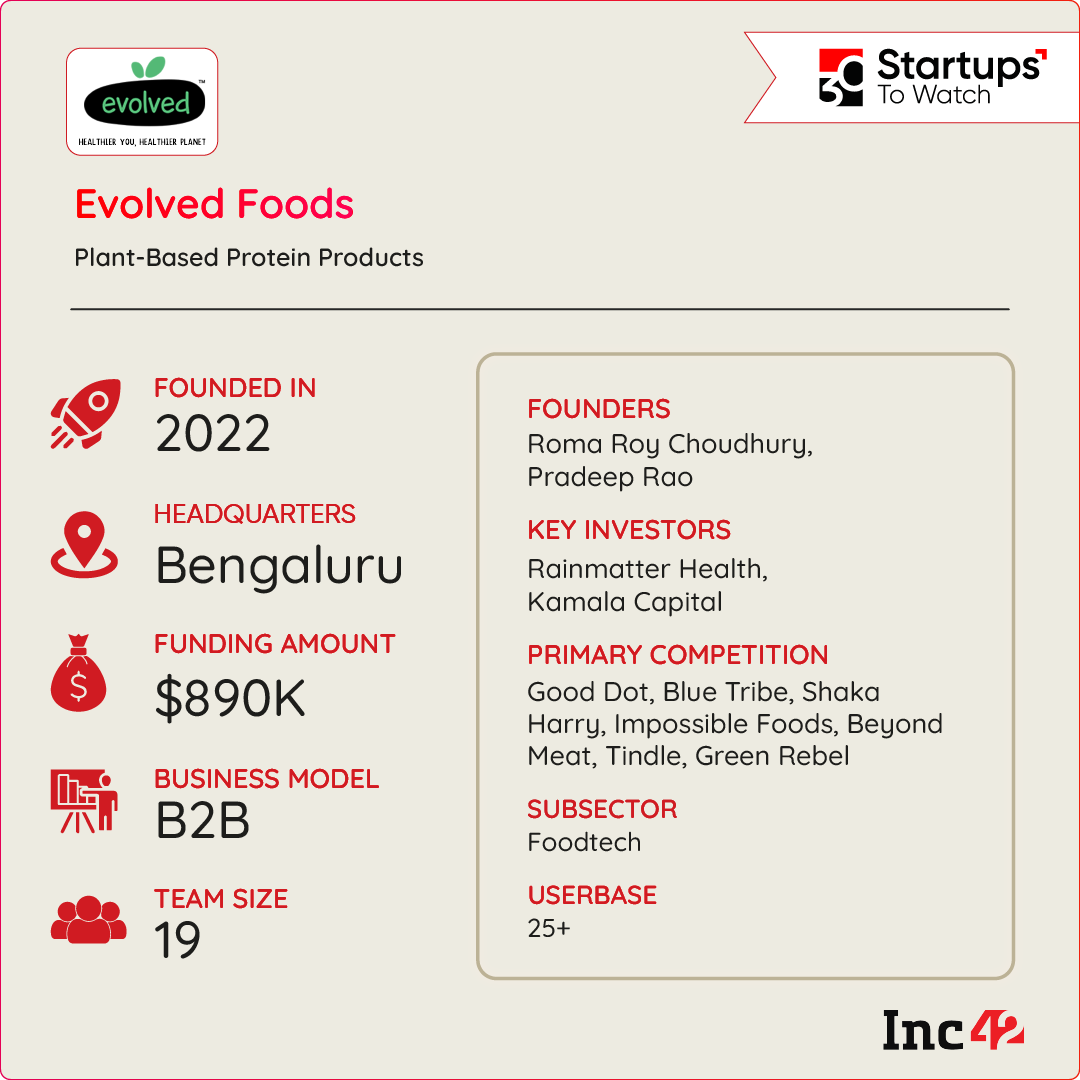

Evolved Foods

Switching To Plant-Based Protein Products

According to the World Health Organisation (WHO), 35% of Indians do not get enough protein. Further, the livestock industry is responsible for about 14.5% of global greenhouse gas emissions, solidifying the case for plant-based alternatives for protein.

To bridge the protein gap and make the most of this opportunity, Roma Roy Choudhury and Pradeep Rao established their plant-based protein startup, Evolved Foods. The founders got the inspiration for the startup from their personal experiences, including a visit to Singapore in 2014 and the subsequent launch of their restaurant in Bengaluru.

Evolved Plant Meat, the flagship product of Evolved Foods, is a 100% vegetarian product that offers 15 gms of protein per 100 gms of serving, has zero cholesterol, and does not contain any animal-derived ingredients. The startup uses soy, coconut and rice protein to manufacture plant-based protein alternatives.

Recently, Evolved Foods also entered the heat-and-serve food category to celebrate the rich regional culinary heritage of India with dishes such as Hyderabadi dum biryani, Chettinad fry, dhaba-style tandoori tikka and Kashmiri rogan josh curry.

The startup operates on a B2B business model, selling its products to 25-plus clients in the food service industry. It is also finalising the launch of its products in the overseas markets and its short-term goal is to start exporting the products soon. In the long term, Evolved Foods aims to focus on developing more plant-based protein alternatives while immortalising Indian cuisine.

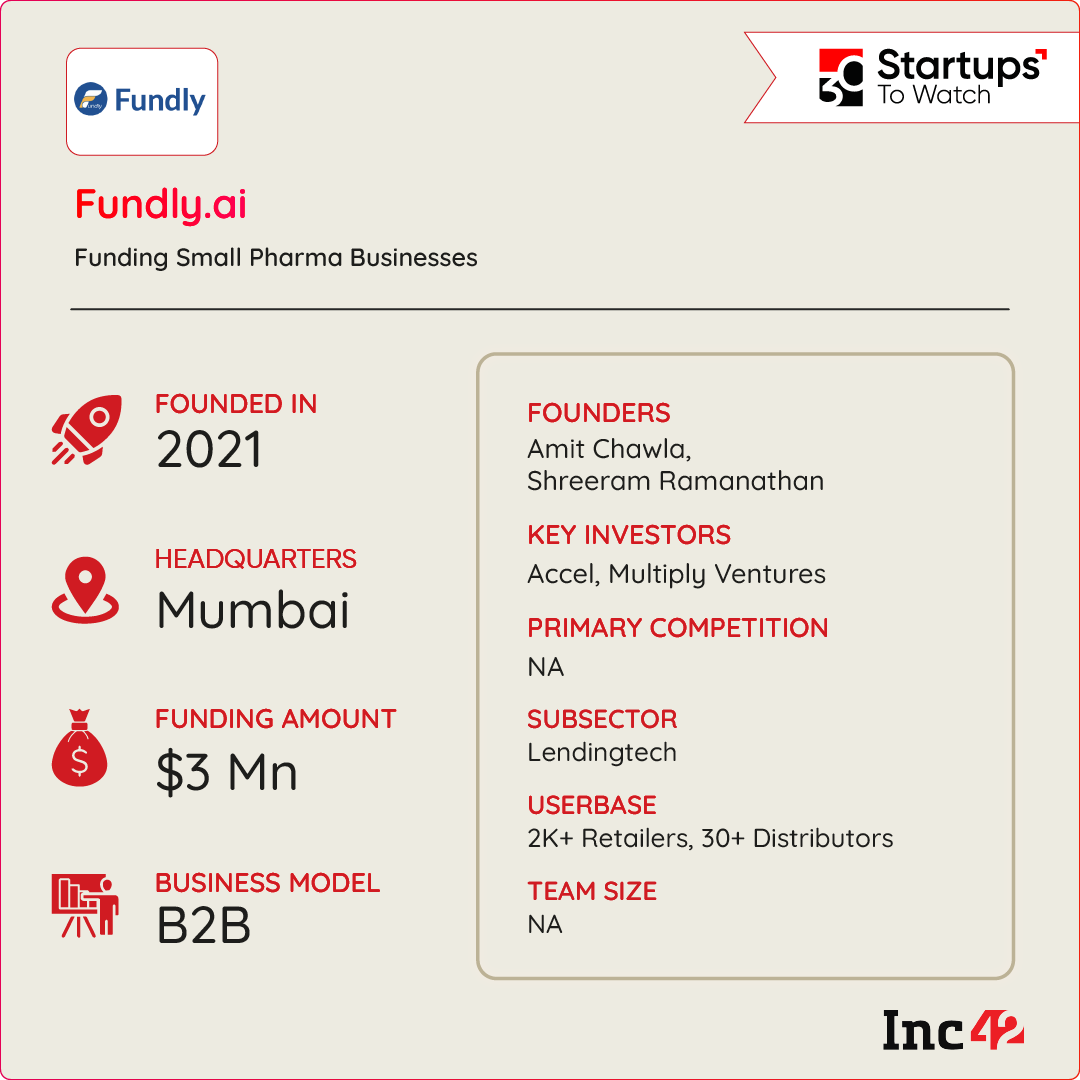

Fundly.ai

Funding Small Pharma Businesses

According to an IBEF report, India’s pharmaceuticals industry is expected to reach $65 Bn by 2024 in market size, further expanding to nearly $130 Bn by 2030. A significant chunk of the industry consists of regular chemist shops across India’s towns and cities.

However, with the rise of online pharmacies, there is a need for financial solutions for small pharma business owners, retailers, and distributors to enable them to compete with major online pharmacies. Amit Chawla and Shreeram Ramanathan, having recognised the gap in the market, founded Fundly.ai in 2021 in Mumbai.

Fundly.ai, which operates at the intersection of supply chain and MSME finance, empowers pharma distribution tail, speciality players and brands by providing them with affordable financial solutions. Fundly.ai’s platform streamlines the financing process, making it easier for retailers and distributors to access funds for their operations.

Fundly.ai offers two products – invoice payment and InstaCash. The former allows small pharma distributors to pay the invoices in advance. InstaCash, on the other hand, is a direct line of credit offered by Fundly.ai to non-registered distributors and small pharma businesses.

The startup has empowered more than 2,000 retailers and 30-plus distributors across 9+ cities and has so far disbursed more than INR 140 Cr in credit. The company plans to deepen engagement with existing customers, invest in technology development, and introduce new product offerings in the short term, on the back of its recent $3 Mn seed fundraise.

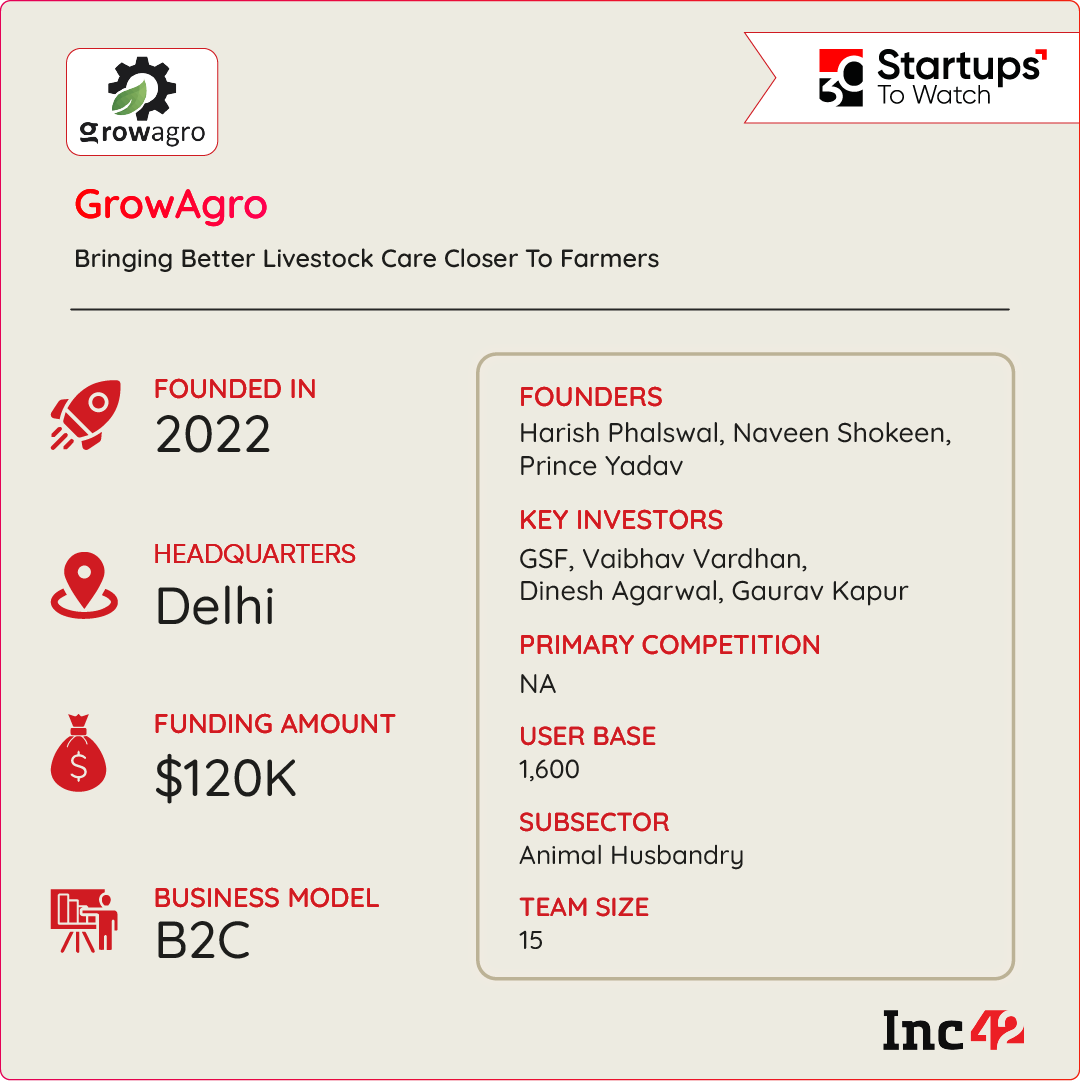

GrowAgro

Empowering Farmers With Enhanced Livestock Care Solutions

According to a report by Mordor Intelligence, the veterinary healthcare market in India is projected to reach $1.86 Bn by 2028. Despite this potential, Indian farmers continue to face challenges in accessing healthcare services for their livestock, as only one government-certified veterinary professional is available for every 21,000 cattle.

This scarcity of veterinary care has resulted in a high animal mortality rate, decreased productivity, and significant negative impacts on the profitability of over 120 Mn farmers engaged in cattle rearing.

Having experienced the bleak realities of rural livestock healthcare while helping their families with livestock management during the Covid-19 pandemic, Harish Phalswalm, Naveen Shokeen, Prince Yadav and Krishna Sharma founded GrowAgro in 2022 to address the gap in the system.

The startup has developed a mobile app that offers farmers multiple healthcare services for their livestock. The app focuses on preventive healthcare, breeding assistance and nutritional consultation. It uses AI-based image recognition technology, which allows farmers to upload images of their cattle to detect potential health risks and get treatment recommendations.

Along with nutrition plans for animals, the app offers AI-enabled solutions for breeding healthier and more productive animals. GrowAgro’s app also facilitates consultations with experienced veterinarians and livestock experts when need be.

GrowAgro charges a consultation fee for personalised expert consultations and offers premium subscriptions to users. Further, the startup earns commissions from every transaction that happens on the app.

Currently, the startup is conducting a pilot in one district of Haryana and plans to expand gradually across North India soon.

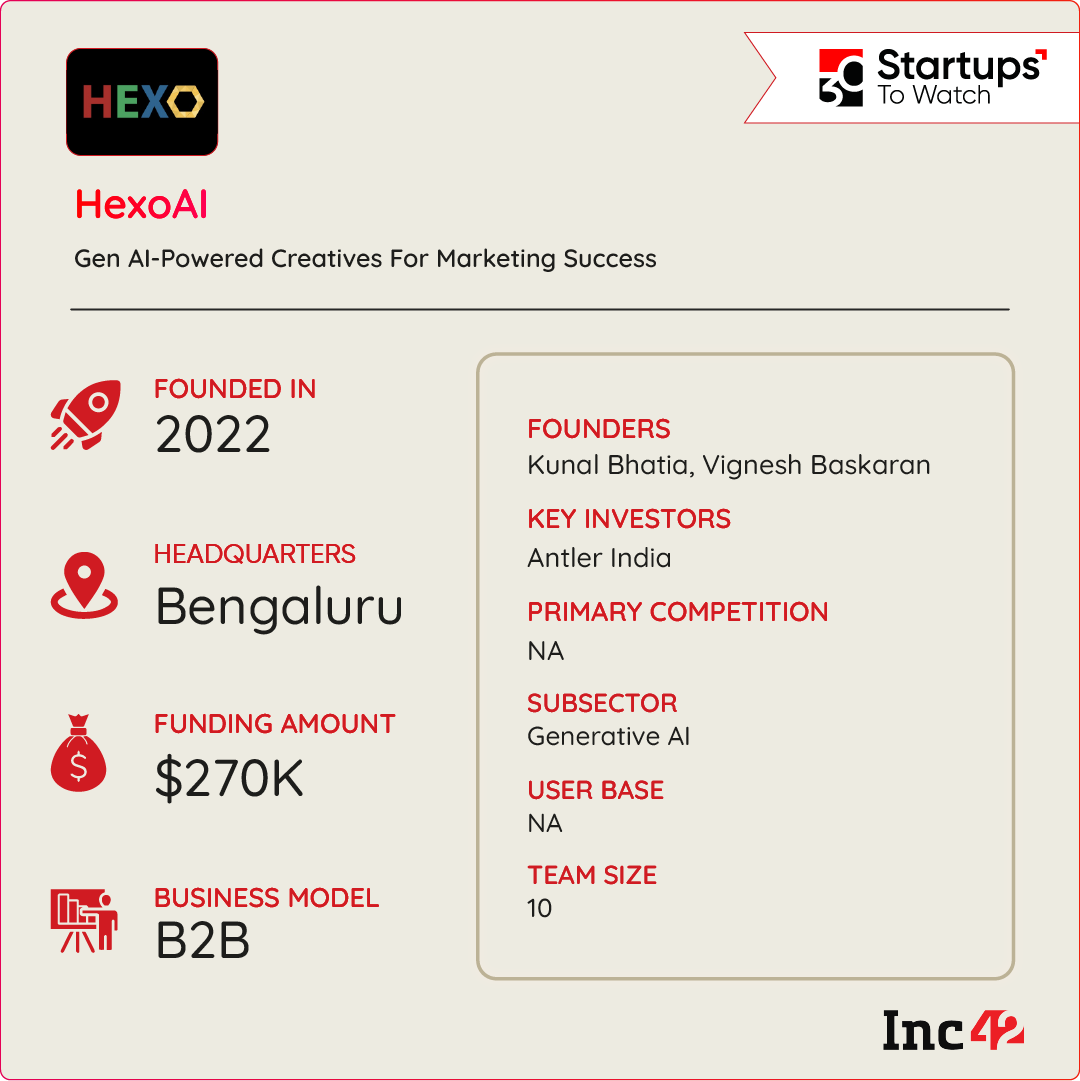

HexoAI

Generative AI-Powered Creatives For Marketing Success

Creating high-quality marketing content can be expensive, especially if it involves hiring professional photographers or designers. While the pricing differs across categories and can cost heavily with images edited as per the style guides of various ecommerce platforms.

Hexo.ai, founded by Kunal Bhatia and Vignesh Baskaran in 2022, uses a proprietary generative AI engine trained on a massive dataset of images, creatives, and marketing data to help businesses solve these challenges. The AI engine allows the startup to generate customised, high-quality, and realistic creatives.

The startup’s product suite includes a product photography generator, a creatives generator, a personalisation engine, an expenditure strategist and a variations generator for all visual needs of an ecommerce brand.

These tools can help businesses save time and money on marketing while also creating more effective and engaging content. Hexo.ai’s generative AI can also help companies track the effectiveness of their marketing campaigns and make necessary adjustments.

While Hexo.ai is in the pre-revenue stage, it plans to monetise its product suite through a subscription model. Users will be able to subscribe to Hexo.ai’s services on a monthly or annual basis.

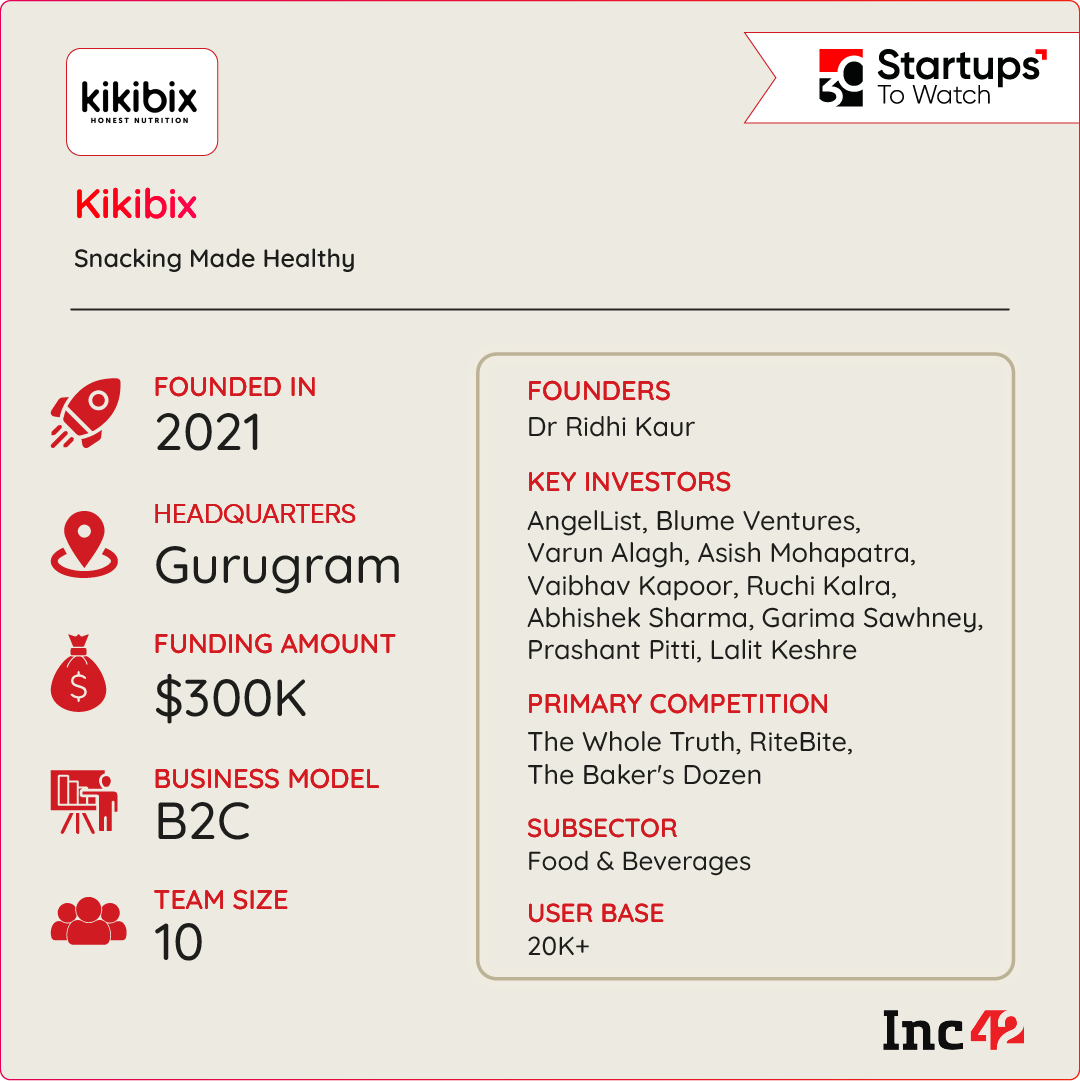

Kikibix

Seizing Growing Health Foods Market With Nutritious Snack Offerings

Over the past few years, Indian consumers have been increasingly incorporating healthier food options in their diets, given a steep rise in the cases of lifestyle-related diseases. That has helped the health foods market to expand at a CAGR of 20%, and according to a report by Avendus Capital, this sector will reach $30 Bn in size by 2026.

Increased demand for healthier snacking options enabled Dr Ridhi Kaur to launch Kikibix, a D2C brand offering healthy snacking options like cookies and peanut butter, in 2022. The Gurugram-based D2C startup has developed 12 types of cookies and three peanut butter flavours. Kikibix claims its cookies are baked using whole grains and don’t contain wheat, gluten, palm oil, refined sugar and artificial sweeteners.

So far, the D2C startup has served 20,000-plus customers, and its products are available on its website and major online channels, having recently boarded the quick commerce bus with Blinkit. With a team of 5-7 people, Kikibix claims to have grown 8X YoY.

The startup’s short-term plans include launching two new product lines – nuts and namkeens – and expanding the catalogue to 30-50 SKUs across five categories by 2024. In the long run, Kikibix aims to go omnichannel and onboard a brand ambassador by 2026.

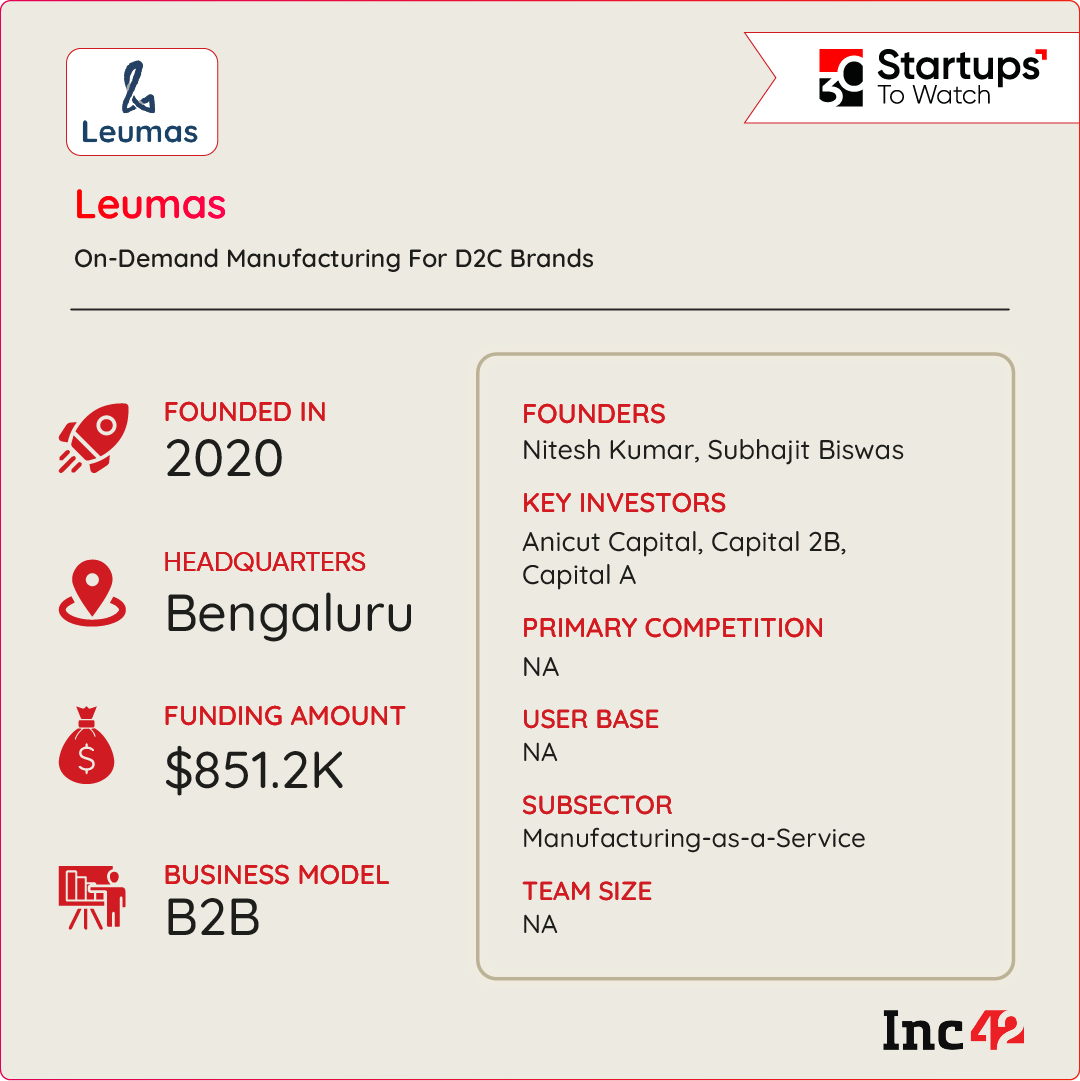

Leumas

On-Demand Manufacturing For D2C Brands

In the burgeoning landscape of Indian D2C brands, the majority outsource their production due to the high investment required for in-house manufacturing. However, Leumas has emerged as a game-changer for D2C brands in nutraceuticals, health supplements, skincare, hair care, oral care and healthy foods.

Founded by Nitesh Kumar and Subhajit Biswas in Bengaluru, Leumas offers a unique solution that allows D2C brands to manufacture goods as per their demand. By leveraging Leumas’ scalable production capacity, brands can access flexible batch sizes and efficiently produce multiple products.

Central to Leumas’ offering is its innovative tech stack, integrated with its manufacturing facilities. D2C brands can now upload their product recipes to the cloud, enabling Leumas to manufacture precisely according to each brand’s demand.

At the heart of their services lies the flagship product, Leumasware, an on-cloud manufacturing suite that empowers D2C companies to design, develop, and manage new products. Additionally, it enables seamless production and quality control while maintaining a digital inventory that enhances supply chain visibility.

Not stopping there, Leumas goes the extra mile by offering expert assistance to D2C startups venturing into specific product classes, helping them bring their envisioned products to life.

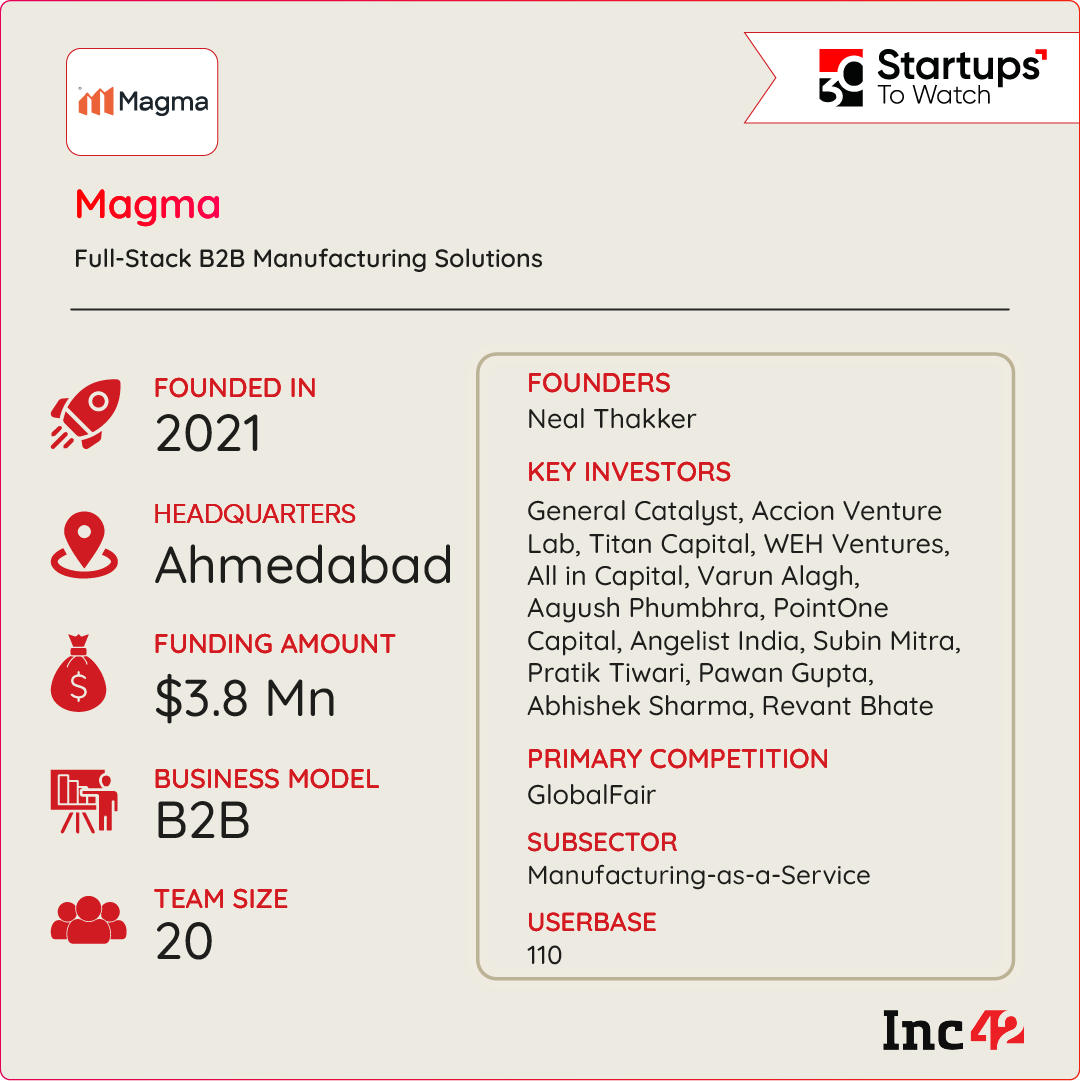

Magma

Bridging Gaps In Indian Manufacturing

After China, India is on its course to becoming one of the largest manufacturing hubs in the world. Per World Bank data, India’s manufacturing gross value add (GVA) stood at $450 Bn during 2022, compared to China’s $4.98 Tn and Japan’s $1.02 Tn.

Despite this, manufacturing units in India continue to face a slew of challenges in areas like capacity utilisation, quality control and supply chain management, leading to high customer churn and challenges in exporting their goods. To bridge this widening gap between Indian factories and global markets, Neal Thakkar founded Magma in 2021.

A B2B manufacturing platform in the building materials space, Magma helps factories with procurement, manufacturing and sales to compete with their global counterparts. By leveraging Magma’s mobile app and its web-based platform, factory owners can streamline their operations, connect with and manage suppliers, optimise and track logistics, and enable a consistent energy supply.

The startup operates on a commission-based business model, generating revenue through margins earned on the products sold via its platform. Magma claims to have onboarded 110-plus clients across 12 states in India, making an annualised gross merchandise value (GMV) of INR 200 Cr in the past three months.

Magma’s plans for 2024 include expanding its product offerings by increasing the number of SKUs available on its platform and serving more factories.

By 2026, the startup aims to expand into verticals beyond construction materials.

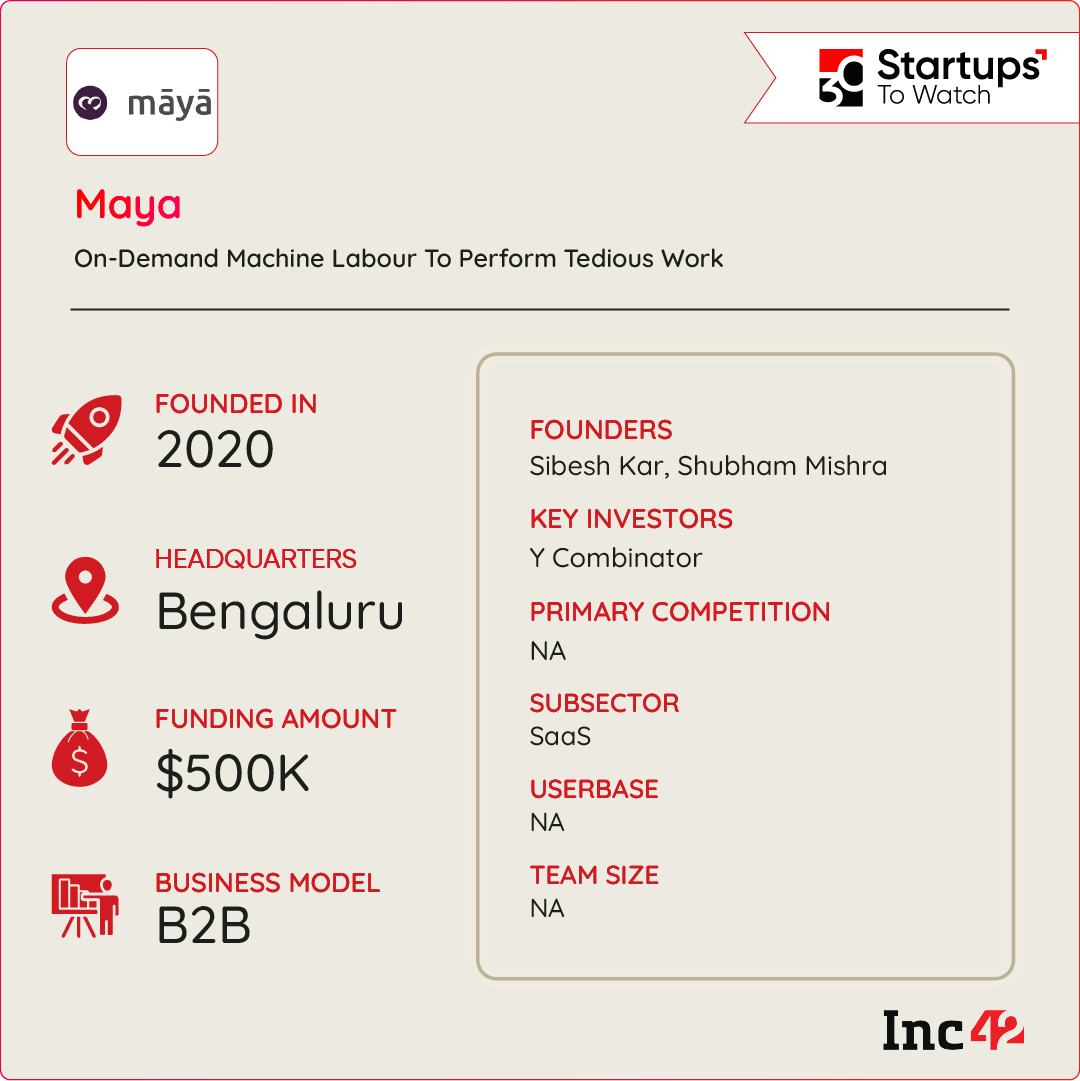

Maya

Programming Made Easy

Programming is a complex and time-consuming task, and many who lack technical know-how may find it difficult to learn.

Bengaluru-based Maya Labs, founded by Sibesh Kar and Shubham Mishra in 2020, is solving this problem by developing a program synthesis engine called PAC-1 that can convert natural language instructions into computer codes.

This allows users to instruct machines to perform tasks without having to write codes. At the enterprise level, Maya Labs’ PAC-1 helps software engineers focus on more complex tasks such as developing new features or fixing bugs.

Maya Labs plans to monetise its product through a subscription model. Users can subscribe to the startup’s service and use PAC-1. The startup also plans to offer enterprise-level pricing for businesses that need to automate large volumes of tasks.

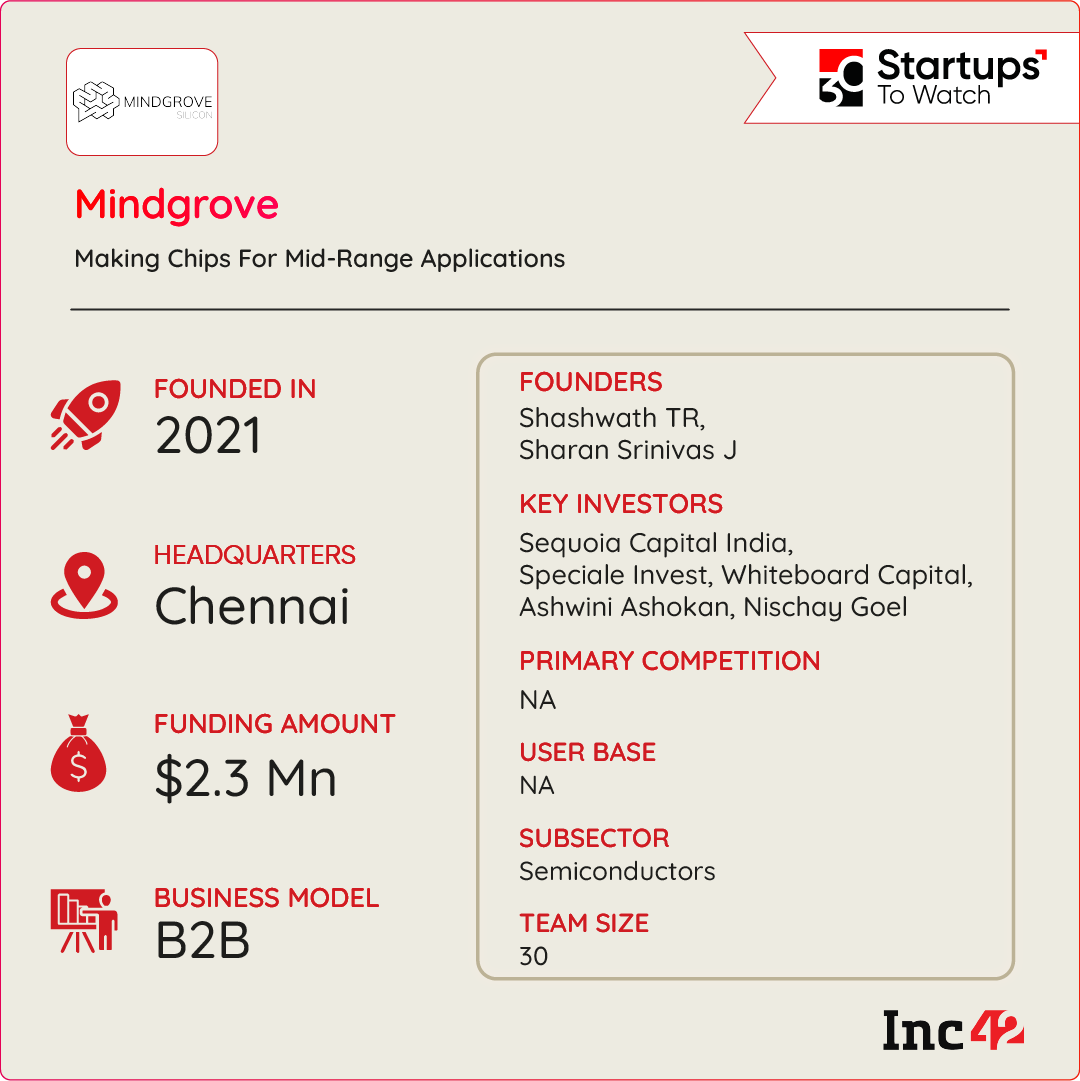

Mindgrove Technologies

Revolutionising Mid-Range Chip Market With Indigenous Systems On Chips

Throughout 2021 and 2022, the world witnessed a massive shortage of semiconductor chips, impacting industries across the globe. This came as a wake-up call for countries like India, which are heavily dependent on China and Taiwan for these chips. While the supply chain has stabilised in recent months, there is still a problem of overdesigned chips.

At a time when many global chip designers are looking to develop the next-fastest chip, there is a large section of engineers working on mid-range applications like IoT, computer vision and automobiles with outdated, inefficient and expensive tech.

Understanding the challenges faced by system engineers, Shashwath TR and Sharan Srinivas J founded Mindgrove Technologies in 2021 to provide SoCs (systems on chips) for mid-range use applications. The cofounders worked at IIT Madras’ Reconfigurable Intelligent Systems Engineering (RISE) Lab — while Shahwath was a systems engineer, Sharan was a PhD student at RISE Lab.

Mindgrove has been working on three primary SoCs – Secure IoT, Vision SoC and Edge Compute. While all of them are in the design phase, Secure IoT will enter production by late 2023 at fabs in the US and Taiwan.

These chips are powered by IIT Madras’ SHAKTI, an open-source initiative by the RISE Group, to develop state-of-the-art SoCs in India. Mindgrove also benefits from the Indian government’s push for self-sufficiency in chip design and manufacturing.

The startup claims its SoCs have several use cases across categories and segments, including IoT, edge computing, EVs, smart utility meters, and security equipment such as fingerprint locks and CCTVs.

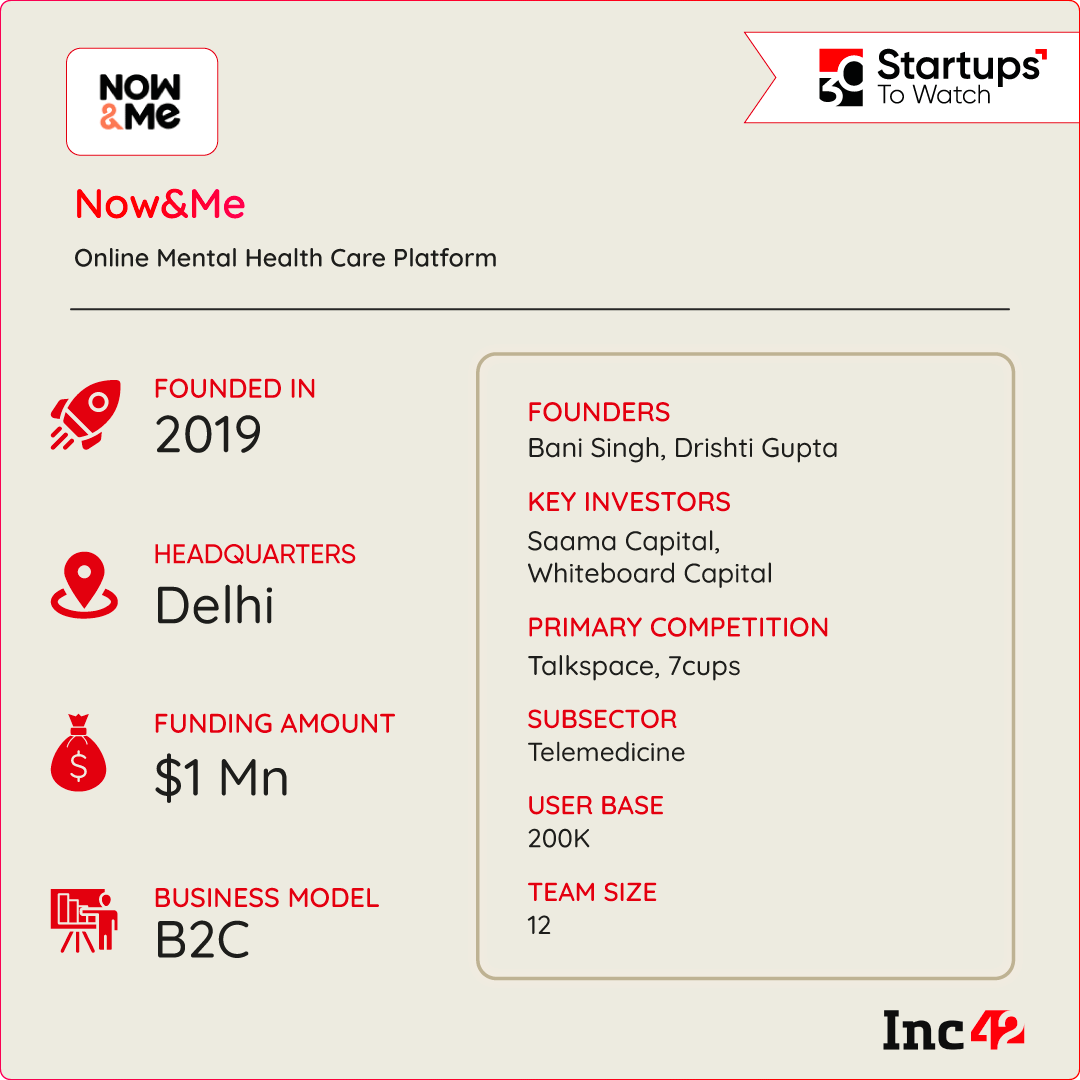

Now&Me

AI-Enabled Mental Health Platform For GenZ

According to an Indian Council of Medical Research (ICMR) research report, the Indian population is facing a severe mental health crisis, with depression, anxiety, and bipolar disorders constituting one-sixth of all health-related disorders.

Another research by the National Institute of Mental Health and Neurosciences (NIMHANS) finds that nearly 150 Mn Indians require mental health care services but fewer than 30 Mn are seeking care. Having witnessed this problem firsthand, Bani Singh and Drishti Gupta founded Now&Me, an AI-enabled startup focused on self-care for Gen Z.

Their flagship product is an expert chat panel, which helps users connect with mental health and self-improvement experts via text, calls, or video calls. Unlike traditional therapy sessions, the platform caters to individual needs, allowing flexible session durations at as low as INR 7 per minute. The expert panel, which comprises professionals fluent in multiple languages, offers both therapy and coaching.

Additionally, the startup provides a peer support community, enabling users to connect with like-minded individuals and express their feelings. The peer support community provides a safe space for users to share their stories openly, combating feelings of isolation.

Now&Me has adopted a freemium model, providing users with a free trial of therapy and expert services, followed by paid recurring sessions. The pay-per-minute approach allows users to pay for the duration of their sessions with experts.

In the last three months, Now&Me has assisted over 7,000 individuals. The startup now aims to expand its reach beyond individuals and provide enterprise-level support. The plan by 2024 is to offer an expert chat panel for both B2C and B2B needs, enabling more individuals and organisations to access the necessary guidance and support.

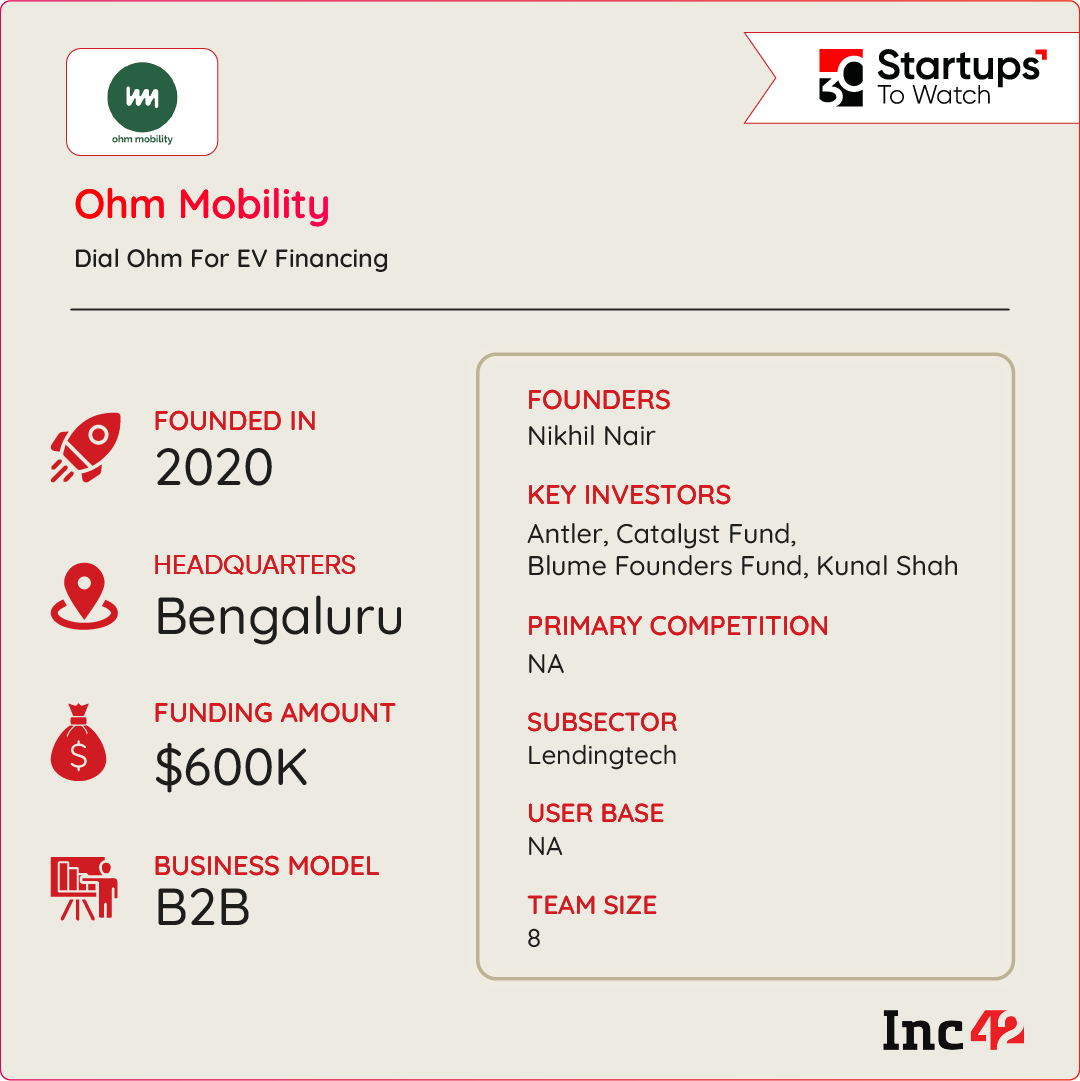

Ohm Mobility

Dial Ohm For EV Financing

India has a 100% electrification target to decarbonise its transportation by 2030, and the homegrown EV market is likely to become a $206 Bn opportunity by that time, according to a CEEW-Centre for Energy Finance report. But the country will require investments worth $180 Bn+ to reach its green mobility goals.

Despite the sector’s rapid growth and great potential, financing for EV startups has been sluggish at home. Nikhil Nair, who earlier worked with SELCO and M-COPA for solar financing in India and Nigeria, was aware of how a capital crunch can affect the mass transition to EVs. So, the cleantech veteran launched Ohm Mobility in 2020, an EV financing platform connecting startups with FIs.

The Bengaluru-based EV fintech collaborates with multiple FIs, including banks, NBFCs and EV leasing companies, to ensure hassle-free lending and speedy disbursals. It claims to have disbursed loans worth INR 35 Cr in the past three months and charges a platform fee from the EV startups.

Short term, Ohm Mobility aims to help finance 30% of Indian EV companies by 2024.

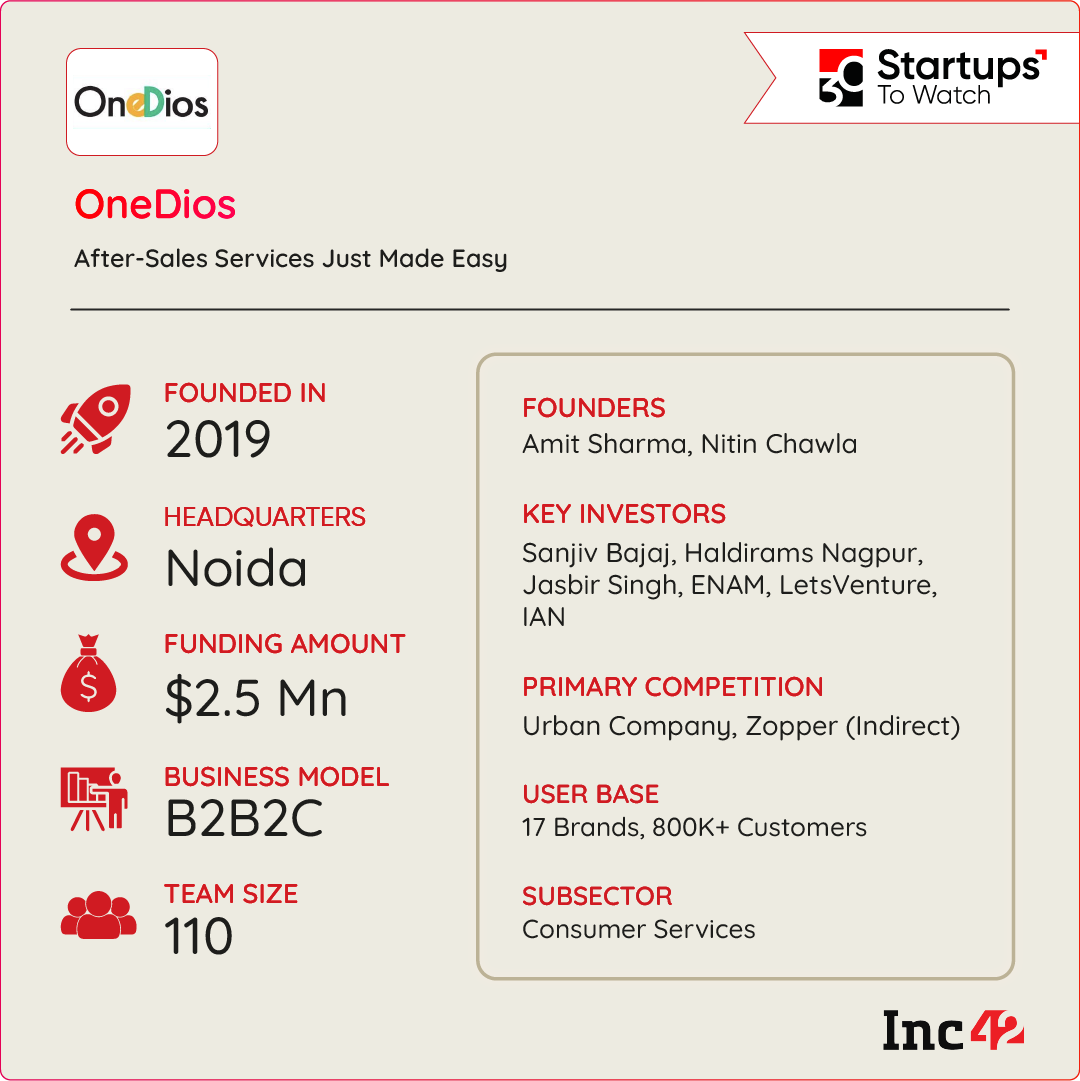

OneDios

After-Sales Services Just Made Easier

While buying products, especially electronic items, vehicles and consumer durables, is fun, they can become a headache over time, especially when they start to wear out, demanding servicing. Getting after-sales service of any kind, be it appliances or vehicles, is a long process and demands maintaining a long list of contacts. Further, customers often face long wait times, while companies incur high costs in just registering requests.

Understanding that the country’s after-sales services sector required a disruption when it comes to offering better customer experience, Nitin Chawla, a former IBM employee, founded OneDios in 2019, along with a fellow IBMer, Amit Sharma.

The startup runs a mobile app, OneDios, which allows users to search and register a service request within 60 seconds. Its flagship product, the OneDios Request Booking System (ORBS), works as a gateway to connect customers with brands.

Customers can also upload their invoices and warranty cards to tag their products in the app to schedule after-sales services and register requests faster.

The solution can be integrated with any CRM, enabling brands to deploy ORBS within two weeks. OneDios has partnered with 90-plus major brands, including Daikin, Hitachi and Voltas. Partnerships with brands and dealerships not only allow the startup to sell extended warranties and register service requests but also acquire customers at the point of sale.

The primary revenue stream for OneDios is the commissions that it earns from service requests raised via its app. It also makes money by working with brands to sell extended warranties.

OneDios estimates that at least 1.6 Bn service requests are routed through call centres across India per year, giving it a large TAM. This TAM has allowed OneDios to register more than 800K users and 60K service requests per month. The startup’s revenue during FY23 was INR 1.35 Cr, up 20X from FY22.

In FY24, OneDios aims to sell 50K extended warranties, deliver 10 Lakh service requests and onboard 500K new customers, with hopes to become profitable by FY26.

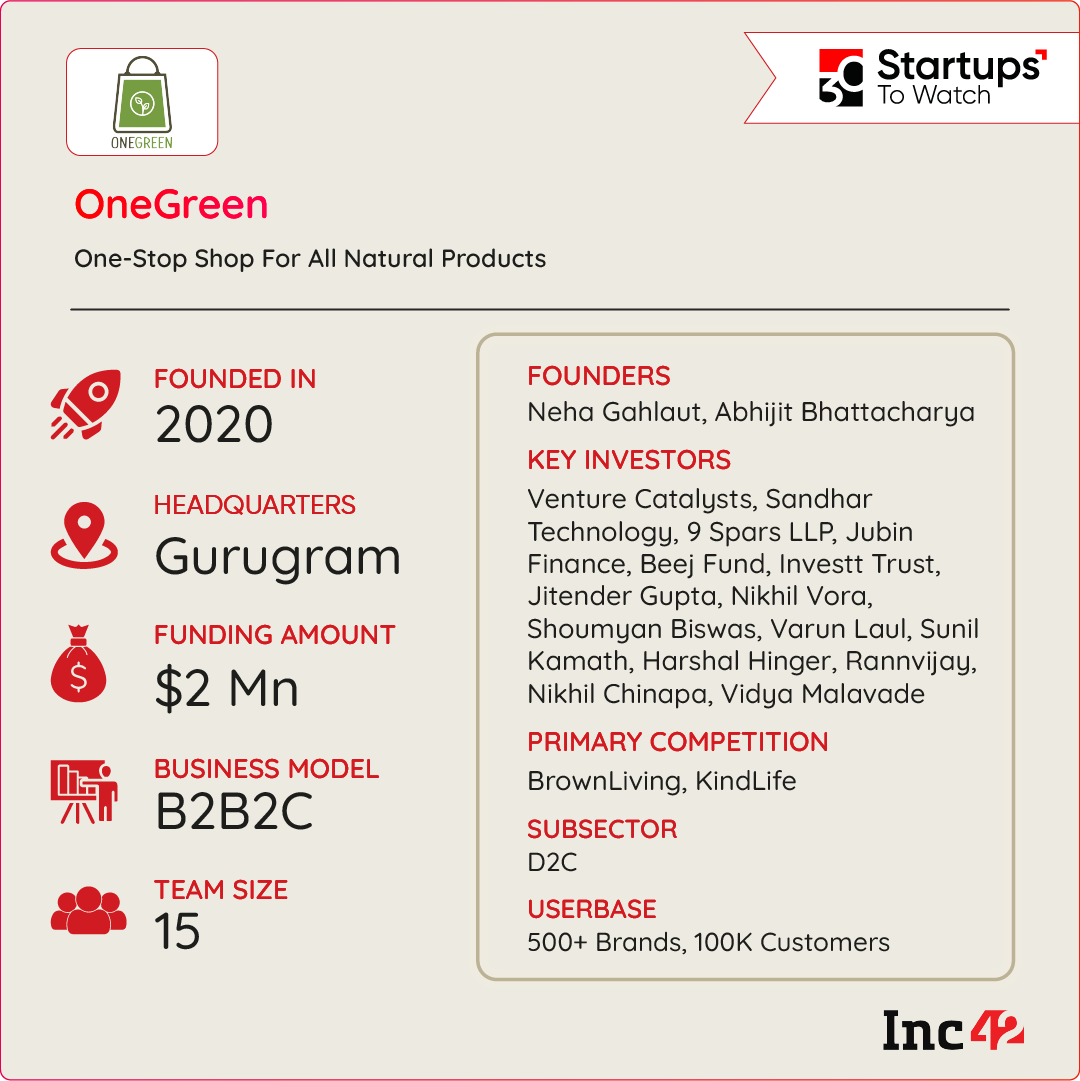

OneGreen

A One-Stop Shop For All Natural Products

While there are numerous brands in India claiming to offer ‘natural’ and ‘green’ products, determining the authenticity of these claims can be challenging. Additionally, many brands that offer genuine products often fail to grab consumers’ attention as they primarily sell through their websites.

Seeking to adopt a more mindful lifestyle, when they became parents for the second time, Abhijit Bhattacharya and Neha Gahlaut faced similar difficulties. They realised that finding genuine products, which are no green sheen, from various websites and platforms was quite a challenge.

This led Bhattacharya and Gahlaut to found OneGreen, a one-stop shop for all green and mindful products, in 2020. The platform offers products across categories such as baby care, food and beverages, home and dining, clothing, fashion and pet supplies, among others. In just three years, OneGreen has grown to become a horizontal ecommerce platform that offers over 20,000 products from 500-plus brands across more than 85 categories.

OneGreen has developed a three-step quality and credibility measurement model, OneGreen Index, to mitigate green-washing in the market. The algorithm validates and confirms claims made by a brand and testifies its presence and popularity, rating it on a scale of 1 to 10 — the higher the score, the better the product.

OneGreen operates on a commission-based revenue model. The startup has managed to reduce its burn rate by 90% in the past six months and grow its GMV by 10% MoM. The startup also claims to have a 20% repeat rate over 90 days.

By 2024, OneGreen plans to cut down its costs even further, increase repeat customers and improve average order value.

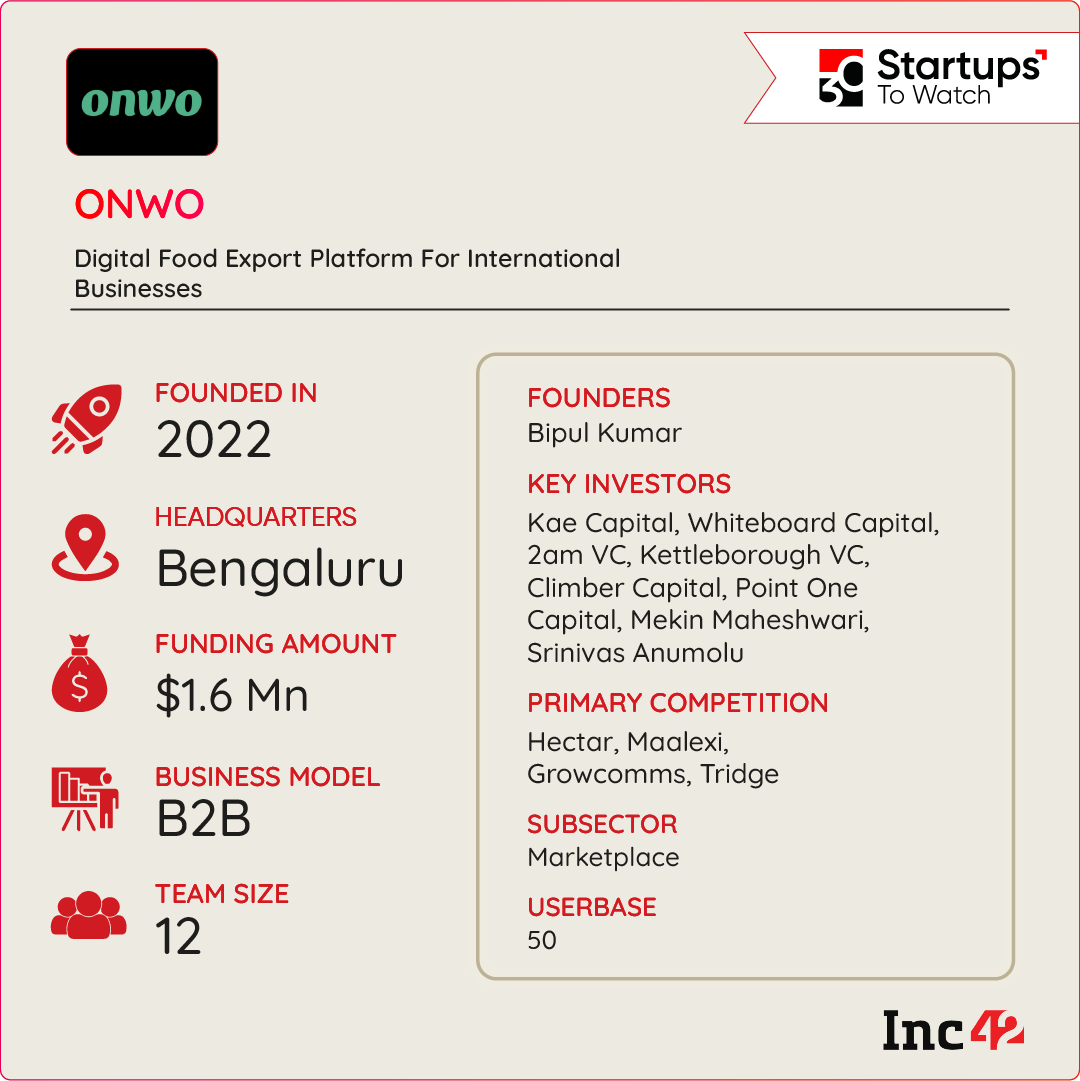

ONWO

Simplifying Cross-Border Food Trading For Indian SMEs

According to an IBEF report, India recorded $50.2 Bn in total agriculture exports during 2021-22, up 20% from $41.3 Bn in 2020-21. However, cross-border trade of food products faces several challenges, including complex ecosystems and middlemen, limited access for SME buyers and a lack of price transparency.

Having faced these challenges while working in the international sourcing division at Flipkart, Bipul Kumar founded ONWO in 2022 to ease the cross-border trading of food products.

ONWO is an exporter of rice and sugar. The startup’s curated platform offers overseas SME buyers a range of products from Indian producers, including multiple variants of rice as well as processed and raw sugar.

The platform simplifies the procurement process by offering quality-assured, low-touch pre and post-order experiences. ONWO provides its services across both online and offline channels, allowing customers to reach the platform via all avenues.

The platform also provides contract manufacturing and private label solutions, quality assurance and risk management and complete order fulfilment. ONWO has 15-plus partner mills located primarily in Maharashtra, Uttar Pradesh, Punjab, and Haryana. So far, the startup claims to have delivered more than 10,000 metric tonnes worth of produce to regions such as North America and the Middle East.

ONWO generates revenue through multiple streams. It charges a commission on the price of the products sold on its platform. Additionally, it earns fees for fulfilment services and value-added services provided to manufacturers and buyers.

Recently, the startup claimed to have achieved a 90% repeat order rate, turning EBITDA positive in the process. ONWO also claims to have $10 Mn in ARR in FY23 and plans to hit $1 Bn in revenue by 2026.

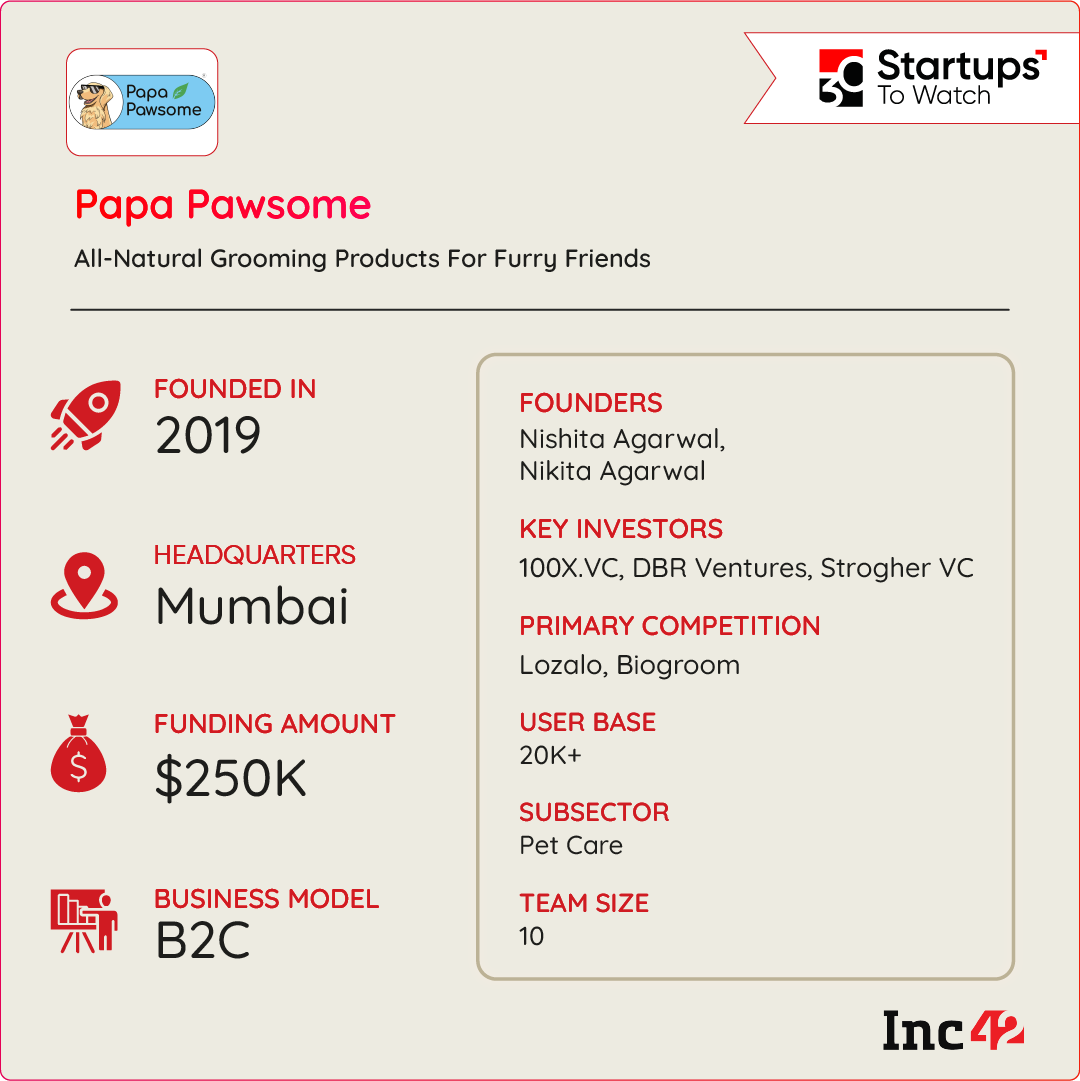

Papa Pawsome

All-Natural Grooming Products For Furry Friends

Keeping the four-legged, furry companions squeaky clean can be tricky. But more worrisome are the ingredients used in off-the-shelf grooming products that can be extremely harmful if licked or swallowed by dogs and cats. The market needed a Mamaearth for pet care – brimming with the goodness of natural products – and Mumbai-based Papa Pawsome has created that niche.

Nishita and Nikita Agarwal (unrelated), the digital-first D2C pet grooming brand offers a wide range of holistic wellness products which use plant extracts instead of harmful chemicals like sulphates, parabens, silicones and artificial fragrances. These include wet and dry shampoos, detanglers, itch creams and medicinal ointments for ticks, fleas and infections, paw and skin creams, spa kits and more. Pet parents can also choose products from dog breeds.

Papa Pawsome sells through its dedicated website, quick commerce platforms like Blinkit and Zepto, and marketplaces such as Amazon, Flipkart and BigBasket. It claims a user base of 20K+, a 60% rise in repeat customers and an ARR of INR 4 Cr in FY23, including month-on-month revenue growth of 20%.

The D2C brand plans to launch new products, including dog toothpaste, hemp oil and pet wipes in the short term.

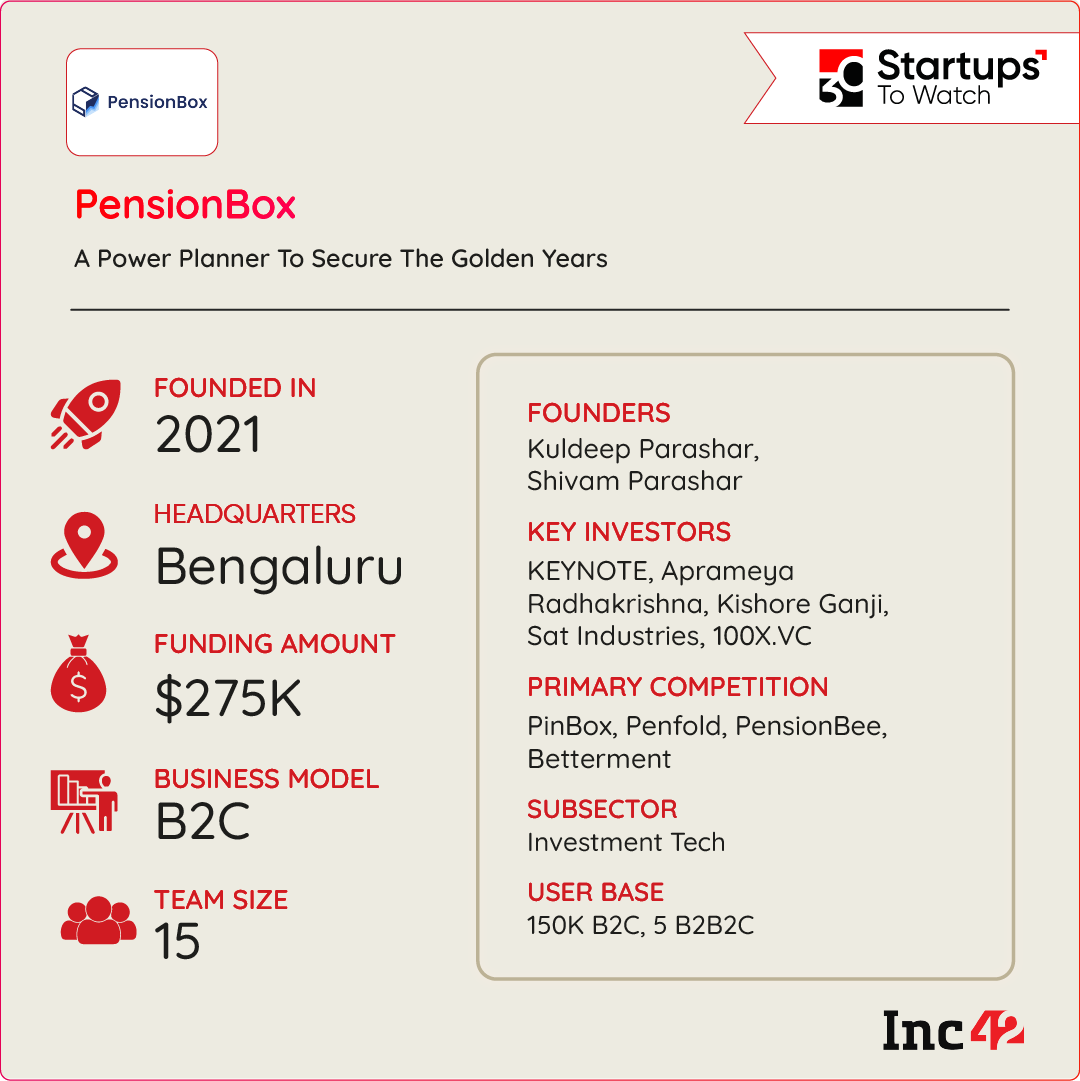

PensionBox

A Power Planner To Secure The Golden Years

Elderly poverty in India can be quite alarming in the next decade or two. As per the National Statistical Office, the country’s aged population will reach 194 Mn in 2031 from 138 Mn in 2021. And more than 90 Mn of them will not have financial security, according to a 2021 report by the Agewell Foundation.

Although the Vision India@2047 document considers (post-retirement) gainful engagement for the active and healthy, brothers Kuldeep and Shivam Parashar wanted to do more. They were alarmed by the inadequacy of the US retirement system when they worked there and planned for their parents’ golden years. The viability of the Indian pension system is also under the scanner. For instance, a 2022 report by The Print estimated that around 300 Mn would be without pension benefits by 2050. So, the Parashars launched the PensionBox app in 2021 to help people plan their retirement.

The Bengaluru-based fintech uses AI solutions to generate pension plans based on the contributions made to the National Pension Scheme (NPS). It further takes into consideration a person’s age, salary/monthly income, desired retirement age and place and whether they have a business plan for post-retirement years. The platform allows complete control over contribution schedules so that users can put the money in at their convenience.

In case there is no NPS contribution during the one-year period the user has for matching their contribution target, the app adjusts the goal within the selected retirement age accordingly.

It has also come up with a B2B2C vertical, partnering with private-sector companies to ensure pension benefits for their workforce. It has teamed up with five such companies so far. PensionBox claims to have onboarded more than 1.5 Lakh users, tracking INR 250 Cr in pension savings. The platform takes a 0.5% cut on every NPS investment as recurring revenue. In other words, PensionBox charges a small percentage on each transaction happening on its platform.

It also charges users a one-time fee for opening an account with the NPS.

PensionBox aims to onboard 2 Mn users and 100 B2B clients by 2024. It plans to bring in 10 Mn users and 2K companies by 2026 and wants to emerge as the country’s first pension tech unicorn. It will also apply to patent its AI-powered dynamic pension planning engine.

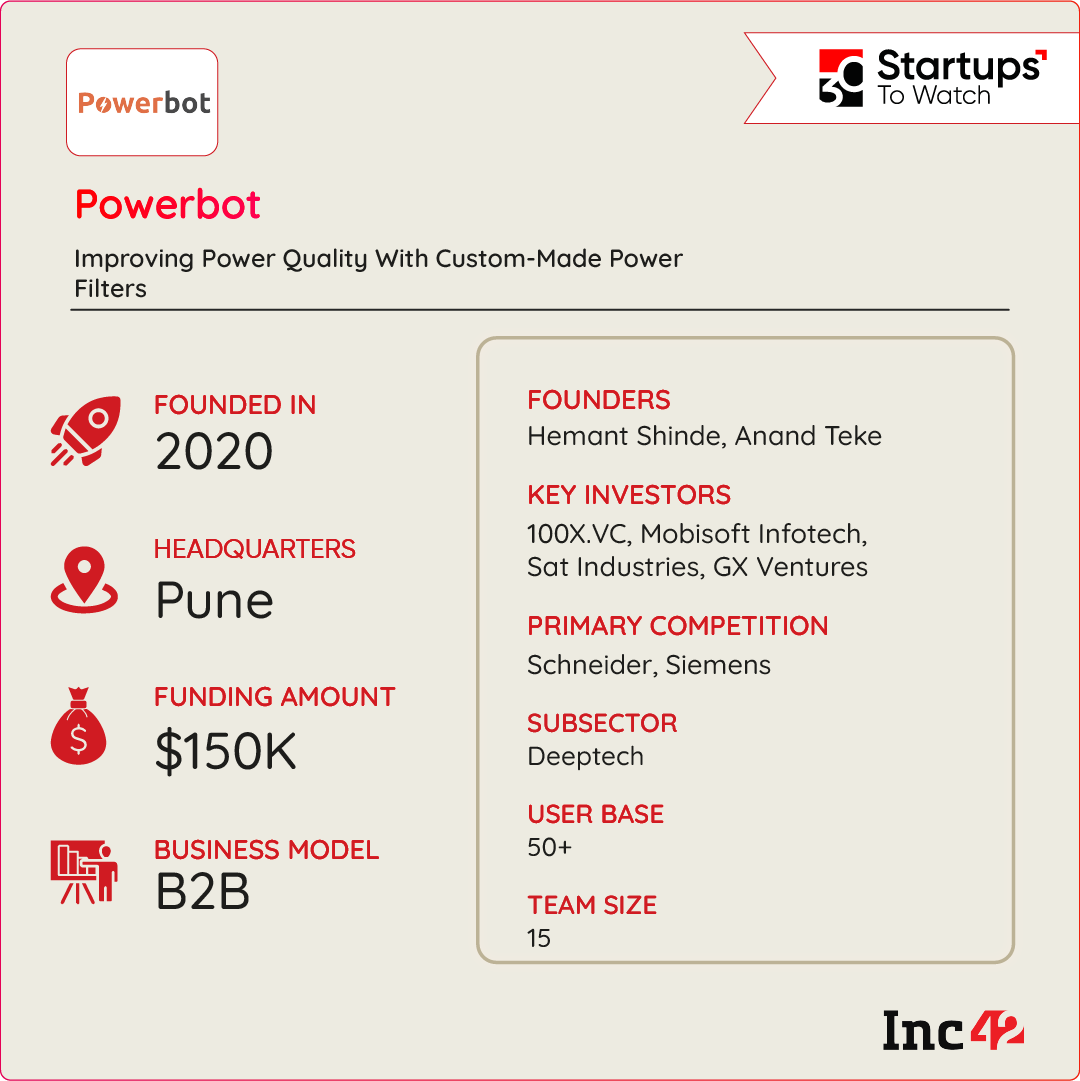

Powerbot

Improving Power Efficiency With Custom-Made Power Filters

Despite waves of technological advancements, a majority of Indian enterprises are still operating on low PF circuits, which results in a lot of electricity wastage. For the uninitiated, the PF or power factor expresses the ratio of actual power used in a circuit to the apparent power delivered.

Another challenge for Indian enterprises is that the ones that pay more than INR 50,000 in electricity bills are charged differently. This is because authorities believe that they induce disturbances in power lines. These were two of the major headwinds that Anand Teke faced during his previous stint as the founder of a rooftop solar startup, HelioKraft.

To address this, Teke joined hands with Hemant Shinde and founded Powerbot in 2020 to arrest runaway costs by improving efficiency. The startup examines the electricity data of enterprises through its proprietary smart analyser, which is designed to analyse power quality on 100-plus parameters.

Next, the analyser, installed at the premises of users, sends the data to Powerbot’s cloud. The data is then analysed by Powerbot’s proprietary algorithms to design filters aligned to the client’s power needs, which are then installed at their respective properties.

The smart meters and power filters are the primary revenue generators for Powerbot, which operates on a B2B business model. With 50-plus clients onboard, the startup claims to be on the course to generate 8X more revenues this year compared to last year.

The founders have plans to expand to 15-plus states by next year. It recently also struck a distribution deal with a well-known Indian brand.

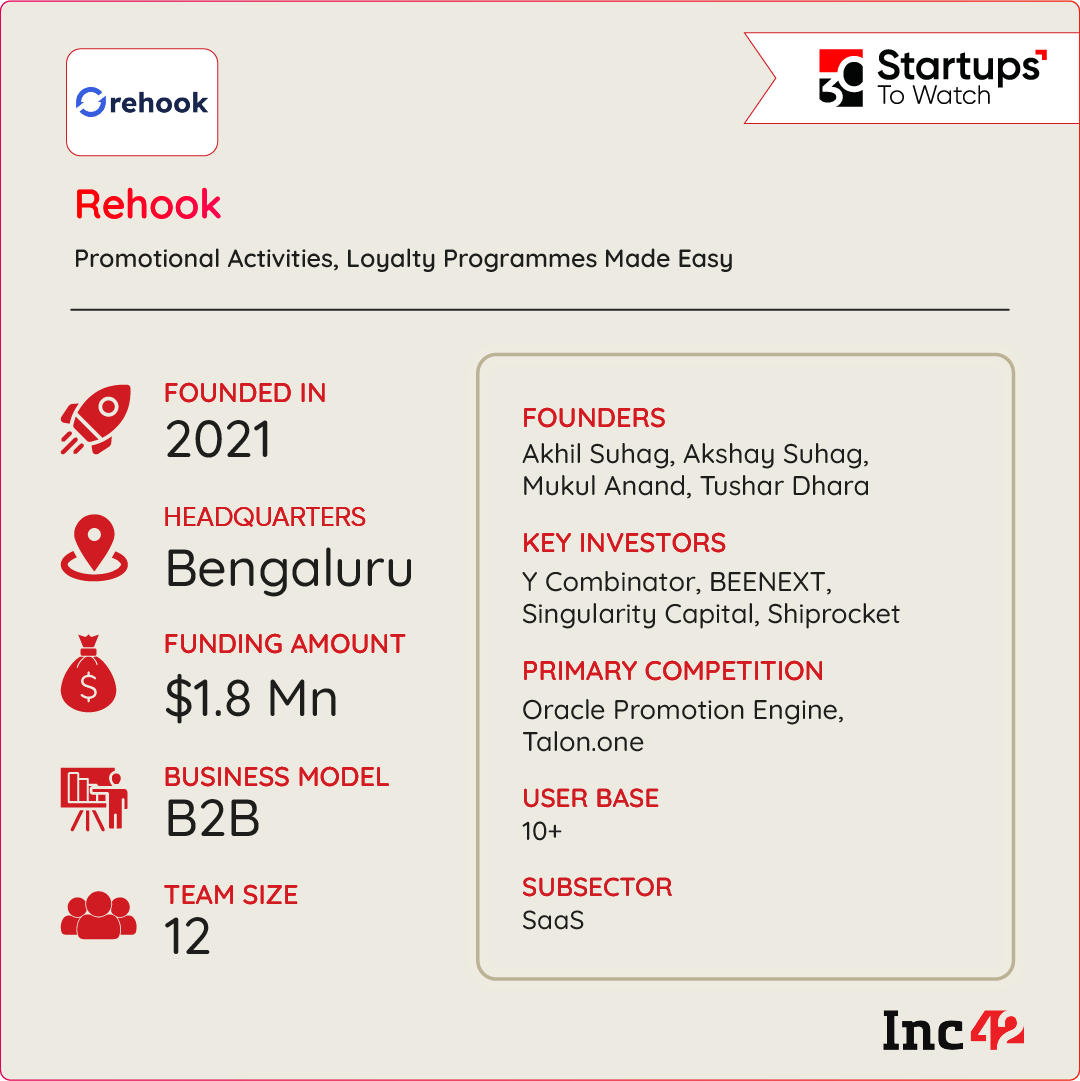

Rehook.ai

Automating Customer Promotions And Loyalty Programmes For B2C Companies

Every customer-facing company, especially B2C companies, have several promotions and loyalty programs in place to drive customer retention and improve sales metrics. However, this process is complex, expensive, time-consuming, and disrupts internal workflows.

To resolve this complex web of problems, Akhil Suhag, Akshay Suhag, Mukul Anand and Tushar Dhara founded Rehook.ai in 2023.

The startup offers a full-stack platform that automates the entire user promotion stack and saves time, money and resources required to build promotional strategies and loyalty programmes, including coupons, bonuses, leaderboards, action-based rewards, referrals, streaks, gift cards and more.

It has developed an in-house rule engine, which enables companies to create rules and tailor promotional campaigns based on user actions. This approach also allows for high-impact and personalised campaigns that can be optimised and targeted for maximum impact.

One of Rehook.ai’s unique selling propositions is its platform-independent, API-first, and event-driven architecture, which ensures scalability and eliminates any tech dependency post-integration.

This allows brands to build hyper-personalised promotions at scale while having complete control. Clients can edit, pause or modify any campaign at any time and set conditions for budget, time frame, reward validity, and recurrence.

Rehook.ai operates on a SaaS subscription and pay-as-you-go revenue model. Having onboarded its first 10 customers, the startup aims to achieve $1 Mn in Annual Recurring Revenue (ARR) by 2024 and targets $5 Mn ARR by 2026.

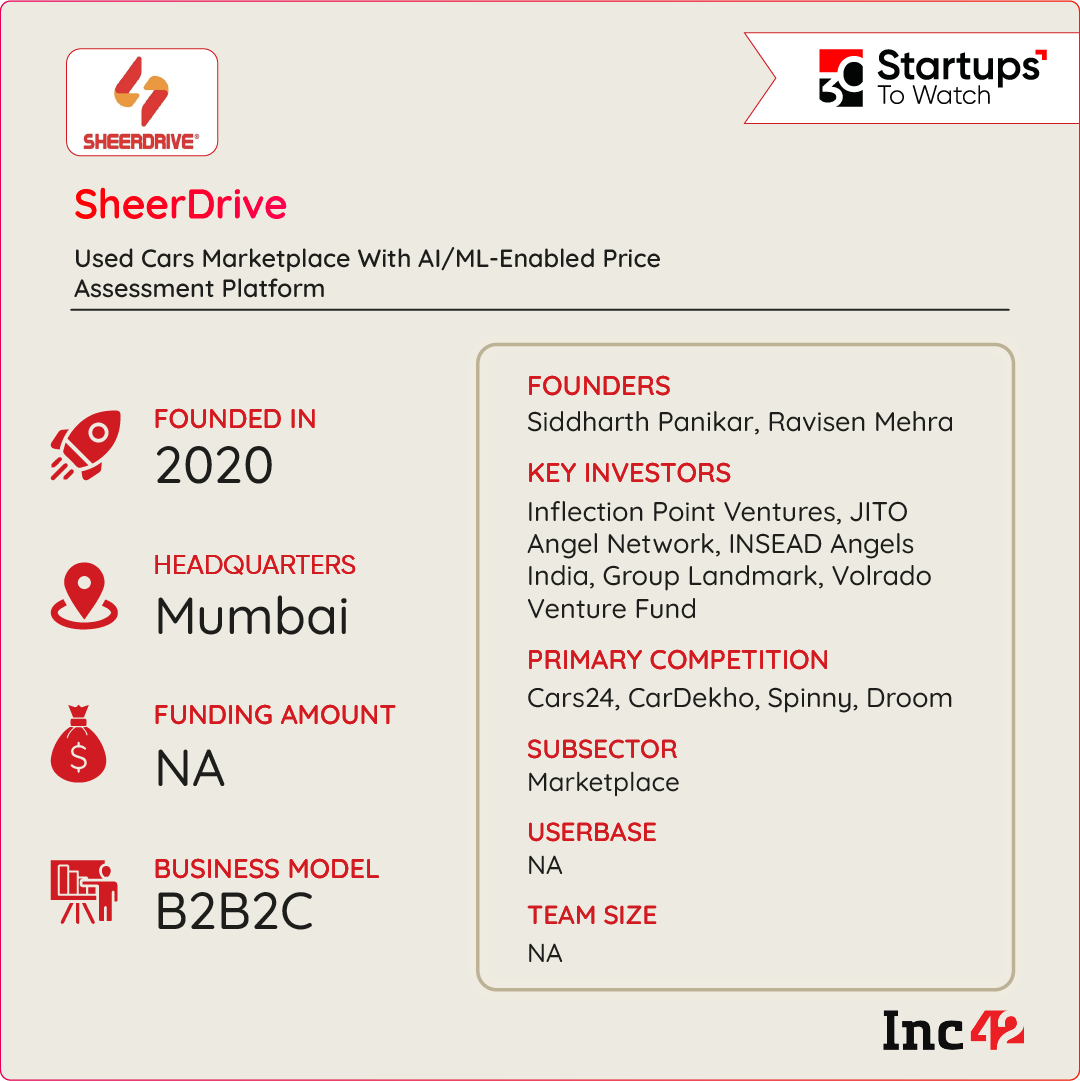

SheerDrive

Using AI/ML To Unleash True Potential Of Used Cars

The used car market is known for its complexity and fragmentation, leading dealers to invest significant time and resources in sourcing, grading, and pricing pre-owned vehicles. While various startups, such as Cars24, CarDekho, Droom, and Spinny, have entered the segment, persistent challenges remain.

One notable newcomer is SheerDrive, a digital platform cofounded in 2020 by Siddharth Panikar and Ravisen Mehra. The primary goal of SheerDrive is to assist both new and used car dealers in efficiently procuring and remarketing used vehicles.

The platform boasts a range of AI and ML-enabled features designed to streamline the car evaluation and pricing process. Among these is the Vehicle Scan tool, which utilises AI and ML algorithms to analyse a vehicle’s condition based on a photograph, identifying any potential damage or issues.

Another noteworthy feature is Intelligent Computation, a web dashboard that allows dealers to review and grade various vehicle parts, thereby gaining valuable insights into the car’s overall condition. Armed with this information, dealers can proactively address any damages or necessary repairs before putting the car up for sale.

Assured Pricing is yet another critical component of SheerDrive, offering an algorithm that generates fair market values for used cars. By considering factors such as the vehicle’s condition, mileage, and location, the algorithm provides dealers with an accurate and guaranteed fair market value for each car.

Lastly, the Robust Remarketing platform serves as a valuable intermediary between car retailers and web aggregators. By connecting used cars with potential buyers, this platform also offers insights into the optimal timing and location for marketing a particular used car.

SheerDrive operates on a subscription-based revenue model, with dealers paying a monthly fee to access the platform’s robust features. The fee structure is determined based on the number of vehicles each dealer sells, ensuring a fair and scalable pricing system.

Shipturtle

Transforming Marketplaces Into Asset-Light Digital Bazaars

Marketplaces are one of the most popular ecommerce formats nowadays. But traditional platforms still struggle with vendor onboarding, inventory cataloguing, order processing and fulfilment, resulting in longer processing times and hindered growth. Sharad Kabra, a second-time entrepreneur, faced similar issues when he built myBageecha, a multi-vendor online marketplace offering garden products.

To make life easy for online sellers from every nook and cranny, Kabra set up Shipturtle in 2021. The ecommerce SaaS suite can transform any run-of-the-mill marketplace into an asset-light digital bazaar where shoppers can search through a huge catalogue or directory of brands, and businesses can sell their offerings to a much larger user base.

Its plugin can be easily integrated with the store formats of Shopify (WooCommerce and Magento frameworks are also getting developed) for vendor syncing, cataloguing, order automation, fulfilment, tracking, commission generation and reconciliation.

The Ahmedabad-based startup recently launched a host of website and app-building tools to create vertical markets and extend digital commerce scope beyond Amazon and Flipkart. It has also partnered with logistics players, such as Shiprocket, Amazon Shipping and Delhivery, to provide various delivery options.

The ecommerce enabler has multiple revenue streams in place, including subscription fees for its website and app-building toolkits, customisation fees and a one-time logistics carrier integration charge. It has onboarded 30 B2B clients so far.

By 2024, Shipturtle will build a directory for D2C brands to help them cross-sell to similar companies without third-party intervention, with plans to hit $1 Mn ARR by 2025. It also plans to roll out a social commerce arm by 2026, where content creators will boost brand credibility and drive their sales.

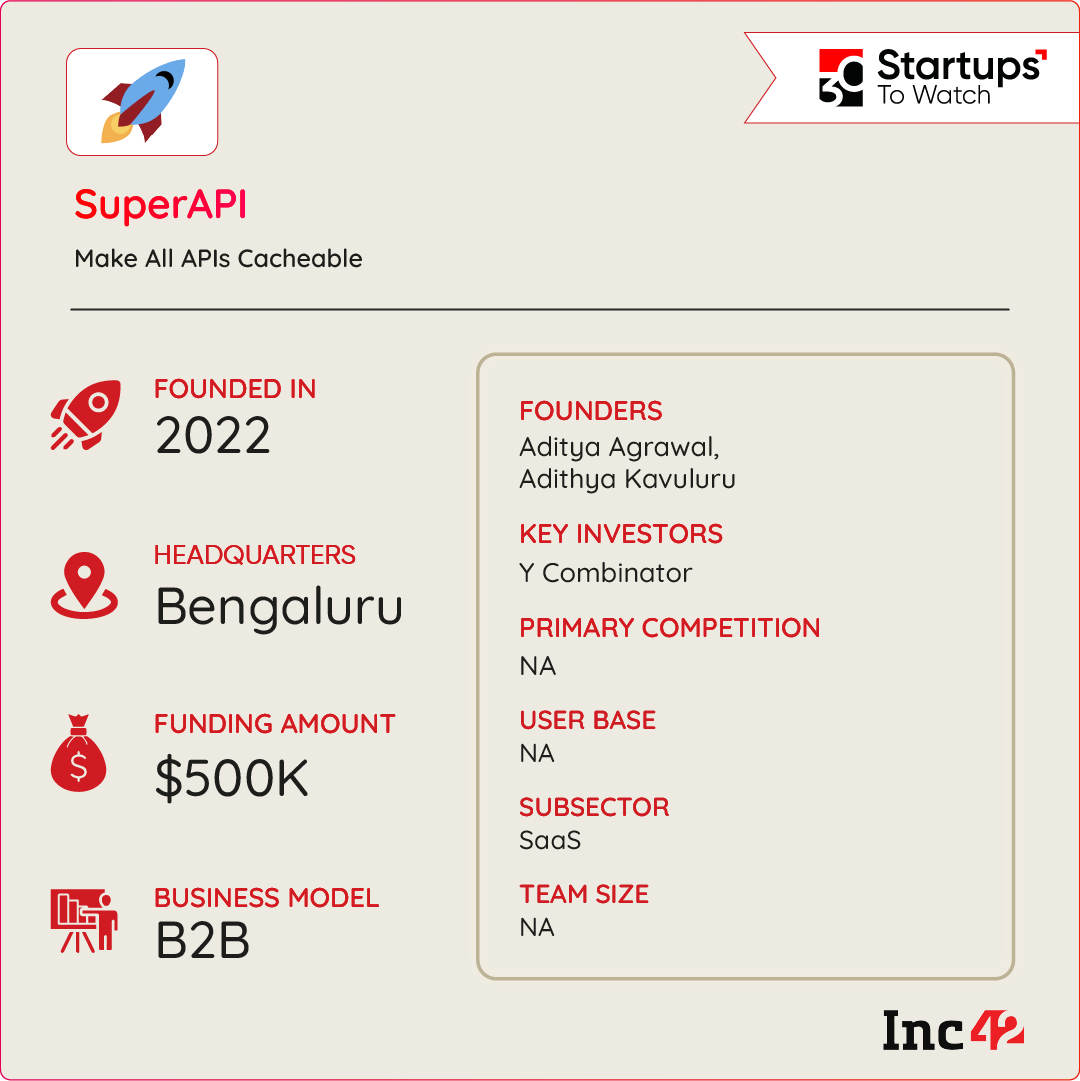

SuperAPI

Supercharging APIs For Efficient Coding

When a request is made to an API, it can take a few seconds to fetch responses. This can be a problem when developing a web or mobile app that needs to make frequent API requests. As such, slow and unreliable APIs can cause poor user experience, increased bounce rate and loss of revenue.

Often, using a caching solution is the only way out, which helps store the responses from APIs for faster response rates. Integrating the best of both worlds, Aditya Agrawal and Adithya Kavuluru founded SuperAPI in 2022, making APIs instantly cacheable with their solution.

Under the hood, SuperAPI does everything an app developer does to make APIs cacheable. The startup offers HTTP caching, in-memory caching, database caching and stale-while-revalidate caching. SuperAPI also offers API monitoring, validation and compression, allowing data transfer to remain manageable within a limited bandwidth and keep API data up-to-date.

These features ensure a better user experience with improved responsiveness and reliability. Since the startup does everything in one place, it helps save a lot of money, which developers would have spent buying solutions to make their APIs cacheable.

SuperAPI is free to use for up to 100 requests per month and hits a subscription paywall after that. The subscription fee starts at $10 per month for 1,000 requests and goes up to $100 per month for 1,00,000 requests.

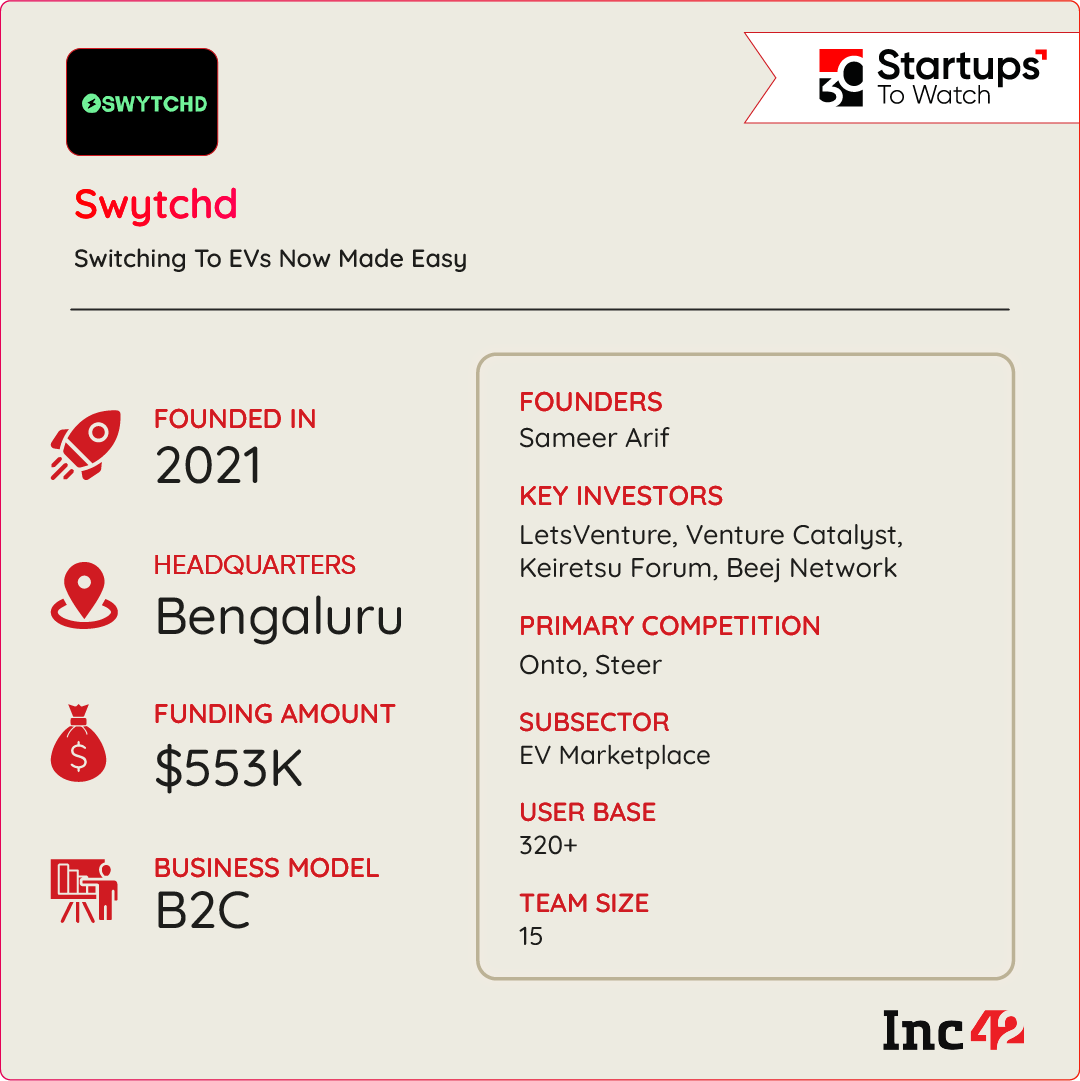

Swytchd

Switching To EVs Now Made Easy

Between June 2022 and June 2023, India registered nearly 8.27 Lakh two-wheeler electric vehicles (EVs), according to data from the government’s Vahan portal. Despite this, the price of a two-wheeler EV could burn a hole in the pockets of a large chunk of the Indian population, which can lead to stagnation in EV demand.

Having worked in the vehicle leasing department of Jaguar Land Rover, Sameer Arif came up with the idea of launching a similar product for EVs, which led to the inception of Swytched in 2021, which offers two-wheeler EVs on a monthly subscription.

Like popular subscription models, the startup provides customers with a complete package, covering everything from vehicle to servicing. Customers can choose from Swytched’s diverse range of brands such as Ather, Ola and Revolt. Once subscribed, the startup takes care of all the necessary support and services.

At the end of each month, customers can decide whether to renew the vehicle subscription, switch to another model, or discontinue the service. Swytched’s pricing structure accounts for the vehicle, insurance, servicing, breakdown support and charging refunds. Over the past three months, Swytched has gained more than 300 active monthly subscribers.

Swytched’s short-term plan for 2024 is to double its fleet size. By 2026, the startup aims to expand its operations beyond Bengaluru and establish a presence in multiple geographies with a fleet of over 2,000 vehicles on the road.

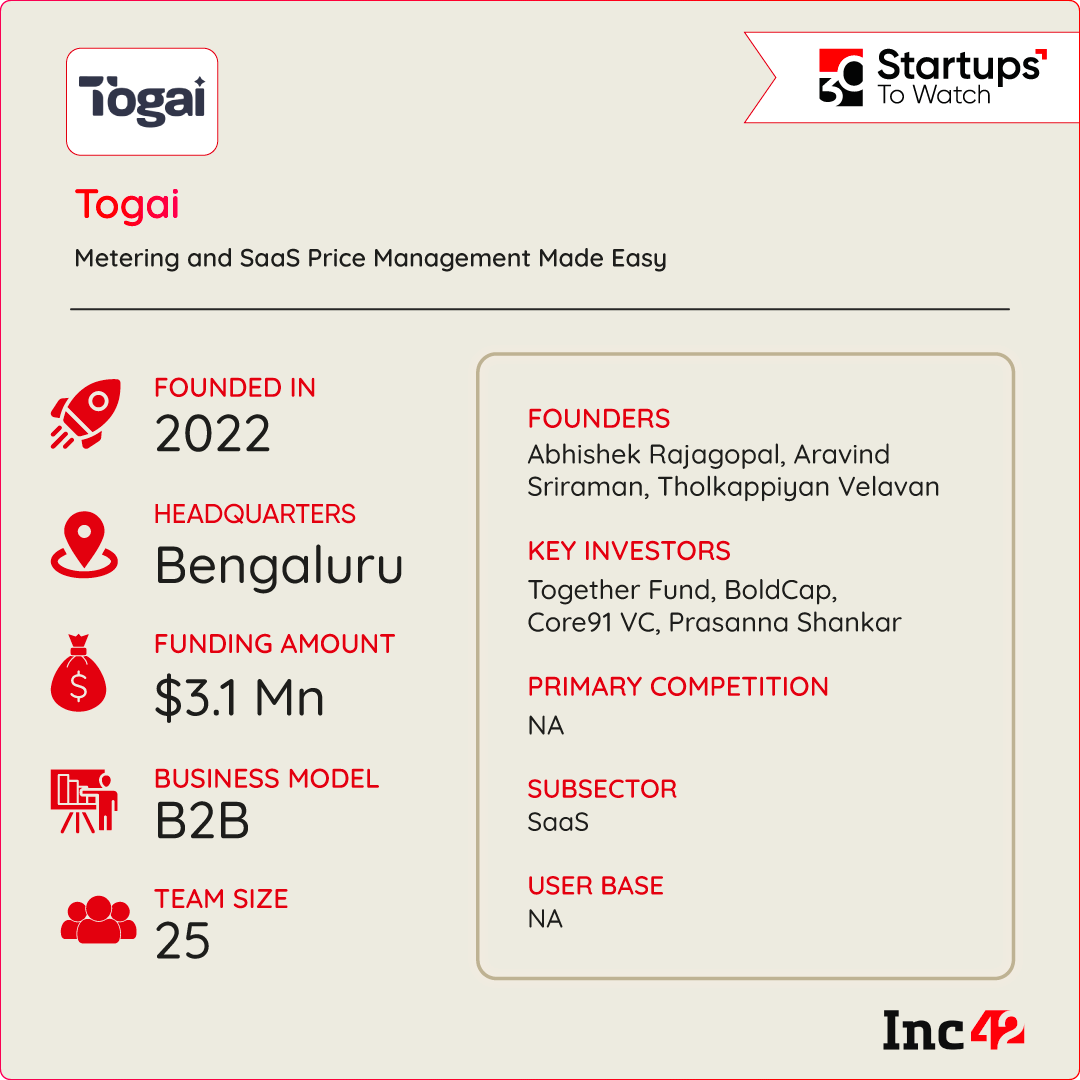

Togai

Simplifying Pricing And Billing Processes For B2B SaaS Companies

India has become the world’s SaaS hub, with companies like Zoho and Freshworks building for the world. However, almost all B2B software companies face challenges with pricing and billing in their operational workflows.

SaaS products are typically billed as per usage, along with other billing models such as subscriptions. However, managing large-scale data in real-time for usage-based pricing can be challenging. Similarly, offering tailored pricing strategies can also be a roadblock, when businesses rely on traditional subscription billing platforms that may not provide the flexibility required.

To uncomplicate complex billing processes in the enterprisetech space, Abhishek Rajagopal, Aravind Sriraman and Tholkappiyan Velavan founded Togai in 2022.

Togai’s flagship product is a billing platform that focuses on addressing the limitations of traditional subscription billing platforms. The platform excels in handling metered billing, allowing businesses to price their products based on customer usage, though it also offers SaaS companies to design subscription models, be it usage-based, subscription or hybrid pricing.

Togai’s event-based architecture enables SaaS companies to create and adjust pricing models quickly, catering to the specific needs of their customers. The platform also integrates with existing tools such as CPQ, CRM, billing systems, usage analytics and revenue recognition, ensuring smooth and efficient pricing updates across all systems.

Enterprises can avail of Togai’s solution for free, up to the first $50K in billing per month. After a company crosses the free limit threshold, it can choose from either its growth plan (with 100/1,000 invoices worth $25K/$250K) or its custom-made enterprise plan.

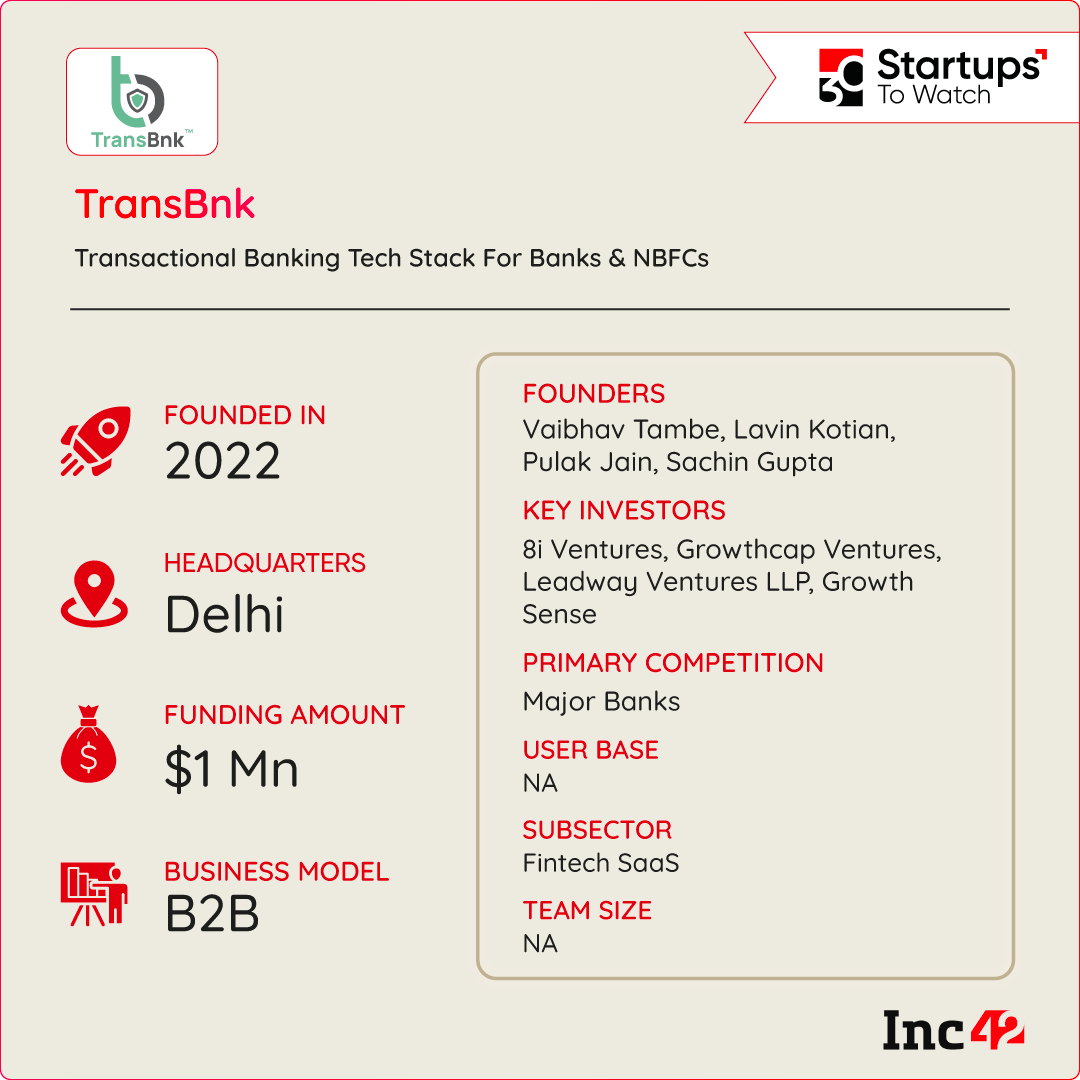

TransBnk

Transactional Banking Tech Stack For Banks & NBFCs

According to a 2019 McKinsey report, global transaction banking pulls generate nearly $1 Tn in annual revenue across segments such as trade finance, cash management and working capital products, including overdrafts and deposits. However, much of this work happens manually, which slows down the entire value chain.

Having worked in the banking sector, Vaibhav Tambe, Lavin Kotian, Pulak Jain and Sachin Gupta witnessed the tech and functionality challenges in setting up transaction banking infrastructure. As such, the quartet built TransBnk, a plug-and-play solution which digitises the escrow process for banks, NBFCs and other companies that engage in lending and supply-chain financing.

The startup has digitised the onboarding process and the post-onboarding transactions via its TrustHub platform, reducing the time it takes to onboard users to an escrow account from 45 days to hours. Further, it also offers banks pre-onboarded anchors (companies offering lending solutions via banks) via the DEBS platform, simplifying the escrow journey.

TransBnk also offers a plug-and-play co-lending solution for banks and startups looking to set up lending operations. The startup’s APIs provide access to multiple banks and manage the entire process, from escrow opening to transaction management. The startup has also developed a tech stack to handle recurring payments.

The startup monetises its tech stack by taking a small percentage of the value of transactions that happen via its platforms. In the short term, TransBnk is looking to expand its tech and product teams and product line to triple its clientele by 2024.

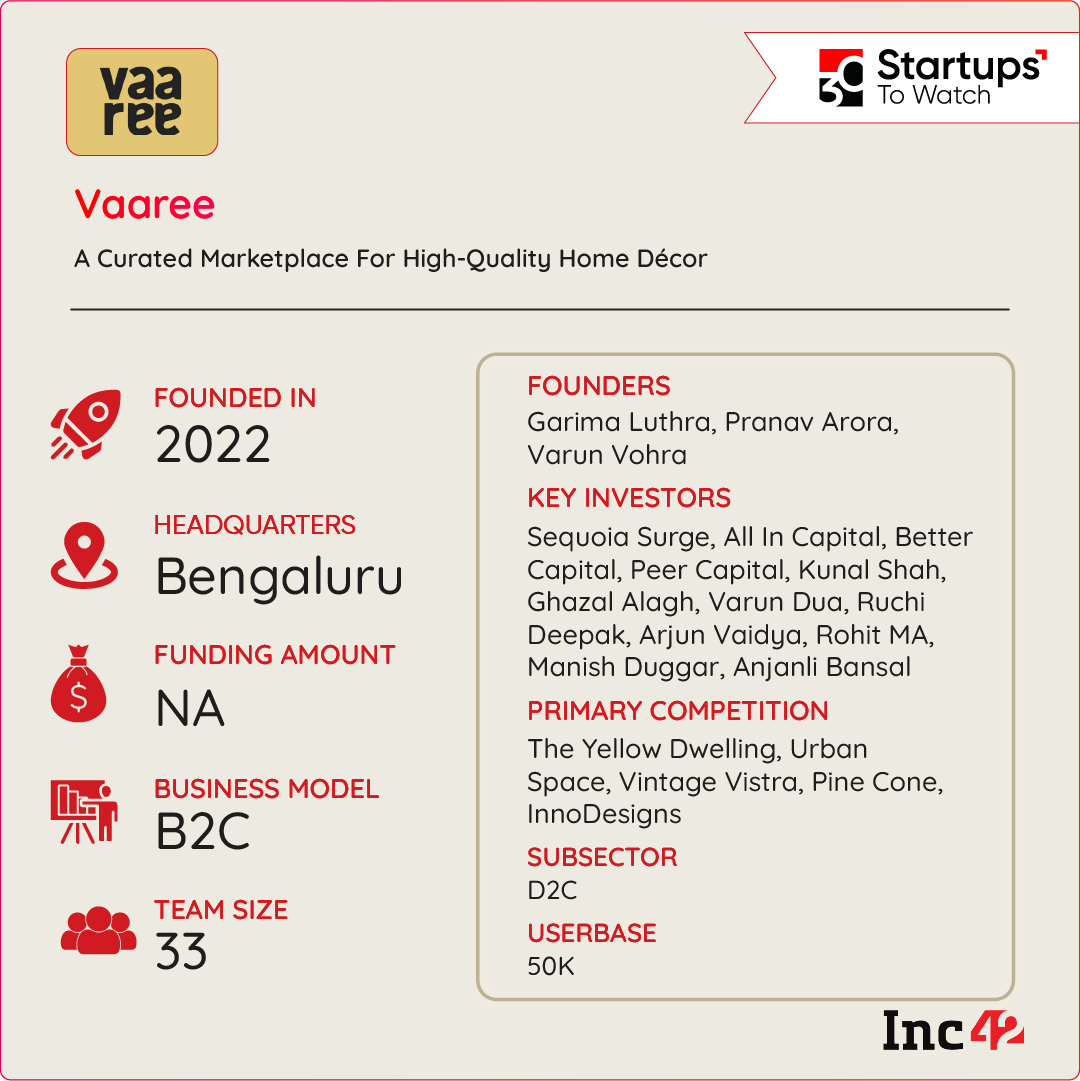

Vaaree

A Curated Marketplace For High-Quality Home Décor

India is rich in arts and crafts, weaves, colours and designs. And the creative minds from every niche bring forth their offerings through multiple home décor platforms. But these are either too expensive or the affordable ones often lack the quality. Also, most of these premium products are exported directly and similar products are unavailable in the domestic market to retain ‘product exclusivity’.

When setting up a new home shortly after their marriage, Varun Vohra and Garima Luthra also started searching for exquisite home décor at pocket-friendly pricing. Although digital commerce has effectively done away with all borders, creative or otherwise, they were unable to find their choice of products, and the prices were not to their liking.

Eventually, the duo, along with Garima’s cousin Pranav Arora, launched a B2C curated marketplace, Vaaree, in 2022 to cater to the connoisseurs at home.

The Bengaluru-based ecommerce startup has developed a curated marketplace and operates on a manufacturer-to-consumer business model where quality remains the soul of creation. Before onboarding, manufacturers have to undergo a 32-step quality control checklist put together by Vaaree to assess quality and process control. Surprise monthly checks are also carried out at production units for maintaining and improving quality standards.

The platform has tied up with 100 Indian manufacturers and has listed 20K+ SKUs across 75 categories, including bedding, furnishings, kitchen, dining, décor, bath and garden. Additionally, its team of experts offers personalised curation services for free to cater to shoppers’ requirements. Vaaree’s platform has an ‘Inspiration’ section, where users can talk with the startup’s team to select designs and colours best suited to their tastes and budget.

The marketplace earns commissions from manufacturers on products delivered.

Vaaree claims 40% month-on-month growth in GMV and says it shipped more than 50K products in the first year.

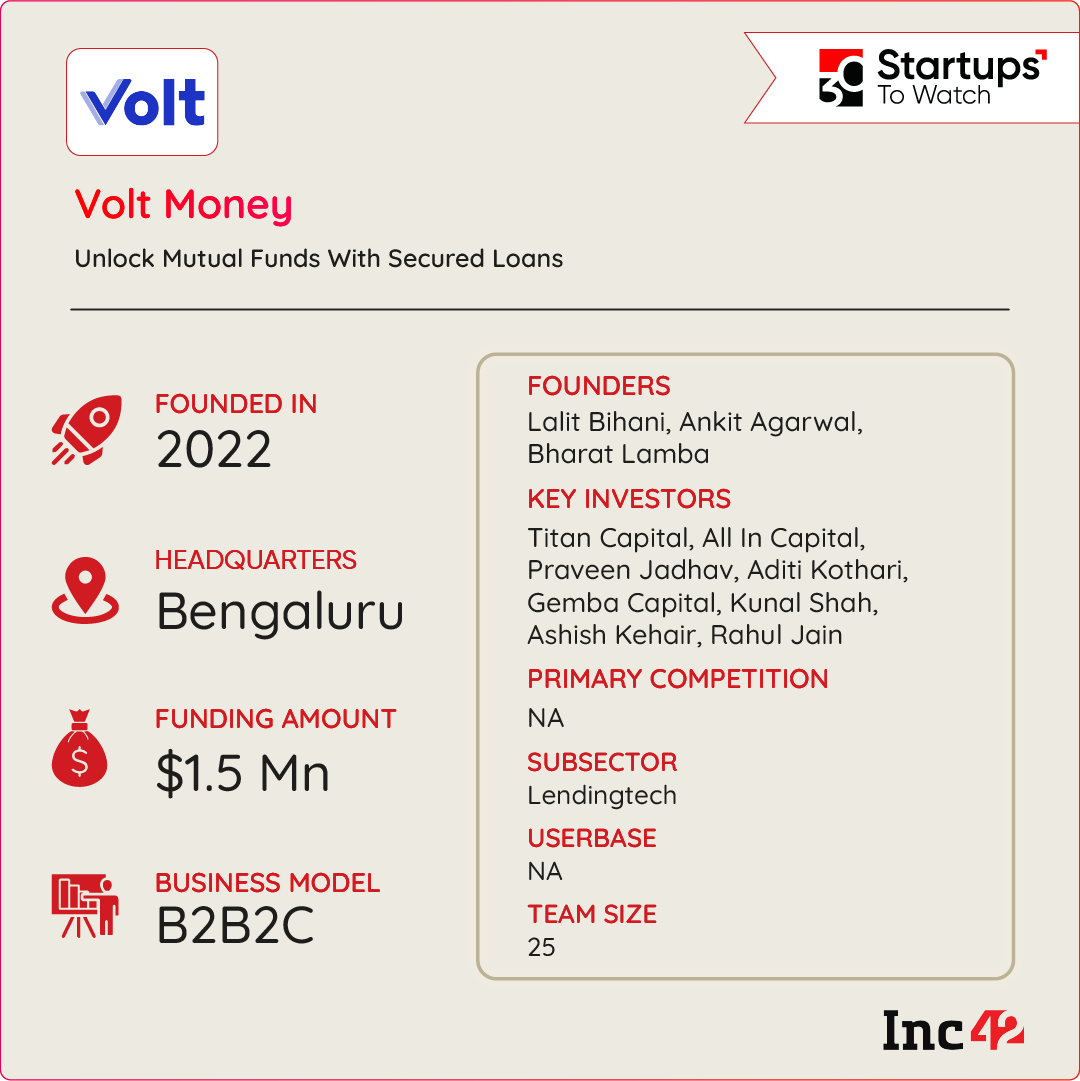

Volt Money

Unlock Secured Loans With Mutual Funds

According to a report by the Association of Mutual Funds in India, the average assets under management for the Indian mutual fund industry for June 2023 stood at INR 44.82 Lakh Cr. Most of this value is locked away in long-term investments, and redeeming mutual funds means closing the account and losing returns.

To address the emergency demands of customers and their unwillingness to withdraw from mutual funds, Bharat Lamba, Lalit Bihani, and Ankit Agrawal launched Volt Money in 2022, offering secured loans against mutual funds. Customers can avail loans from INR 25,000 to INR 2 Cr, depending on the size of their mutual funds.

The fintech startup’s interest rate starts at 9.95%, much lower than personal loans. With flexible lending terms compared to the rest of the industry, Volt claimed it is yet to see a default.

The startup earns revenue by charging a commission from the interest paid by the borrower and through direct processing fees. Since Volt operates in the B2B2C business model, Lamba claims it has nearly zero customer acquisition cost (CAC).

The startup is working on expanding its loan book and hiring resources to improve its tech stack. However, the long-term vision for Volt Money remains to diversify beyond mutual funds and leverage all financial assets for secured lending.

[Edited by Shishir Parashar and Sanghamitra Mandal. With inputs from Chetan Thathoo]

[ad_2]

Source link