Startup Stories

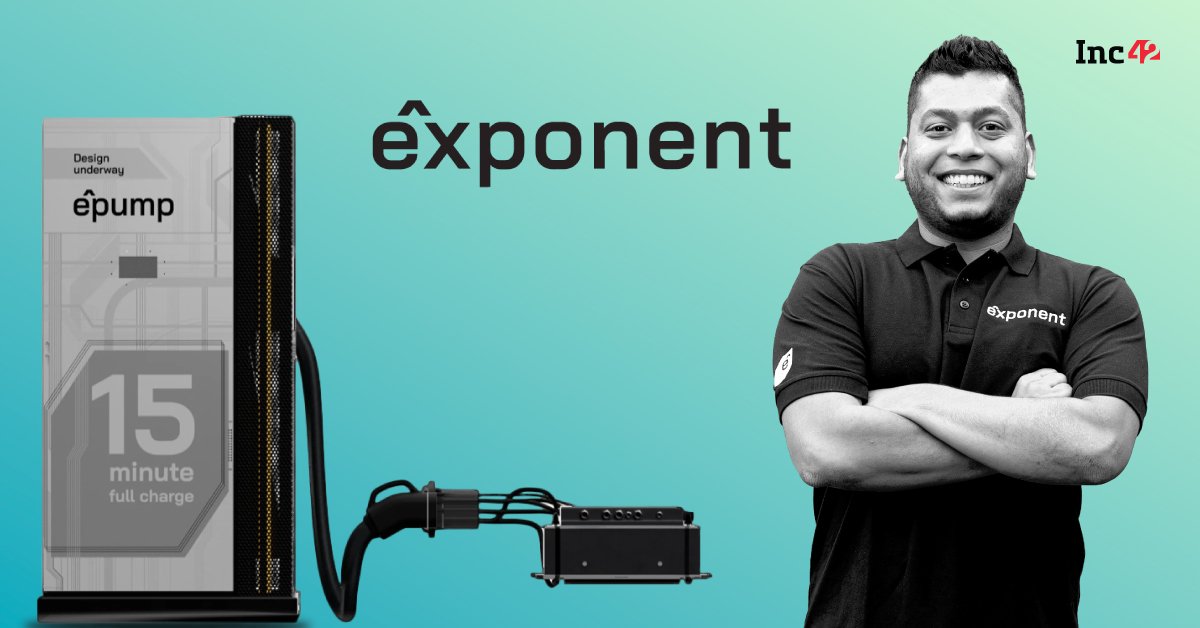

Locking Horns With Tesla? Here’s How Exponent Energy Has Made 15-Minute EV Charging A Reality

Former Ather Energy executives Arun Vinayak and Sanjay Byalal founded Exponent Energy in 2020 to enable OEMs across segments to go electric with unmatched agility

Exponent Energy’s tech stack not only reduces charging time but also enhances the life of EV batteries, thereby making them cost-effective in the long run

Overall, Exponent Energy’s secret sauce of efficient 15-minute rapid charging is engrained in its tech stack that comprises ‘e^packs’, ‘e^pumps’, and ‘e^plugs’

At a time when commercially viable battery charging technologies worldwide take a minimum of 30 minutes to a maximum of 10 hours to fully charge electric vehicles (EVs), depending on battery capacity and vehicle types, Bengaluru-based Exponent Energy claims to have broken all records with its 15-minute EV charging tech, with the vehicle category no bar.

The startup has made 15-minute rapid charging an on-road reality with its patented ‘water-based’ off-board thermal management system.

But before we delve deeper into the technology and Exponent Energy’s journey in building its tech stack, it is pertinent to understand why such a technology is groundbreaking.

In an attempt to make the usage of EVs more seamless, various players across the globe are working on curbing the EV charging time down to as low as 10 minutes.

However, so far, only a handful of players, including Tesla, California-based Enevate, and European tech giant ABB, have been successful in achieving this and that too for certain use cases, while many such technologies are still being championed in ultra hi-tech labs.

Amid this, India’s Exponent Energy’s tech innovation is applicable across use cases. The tech not only reduces charging time but also enhances the life of EV batteries, thereby making them cost-effective in the long run.

Spilling The 15-Minute Rapid Charging Beans

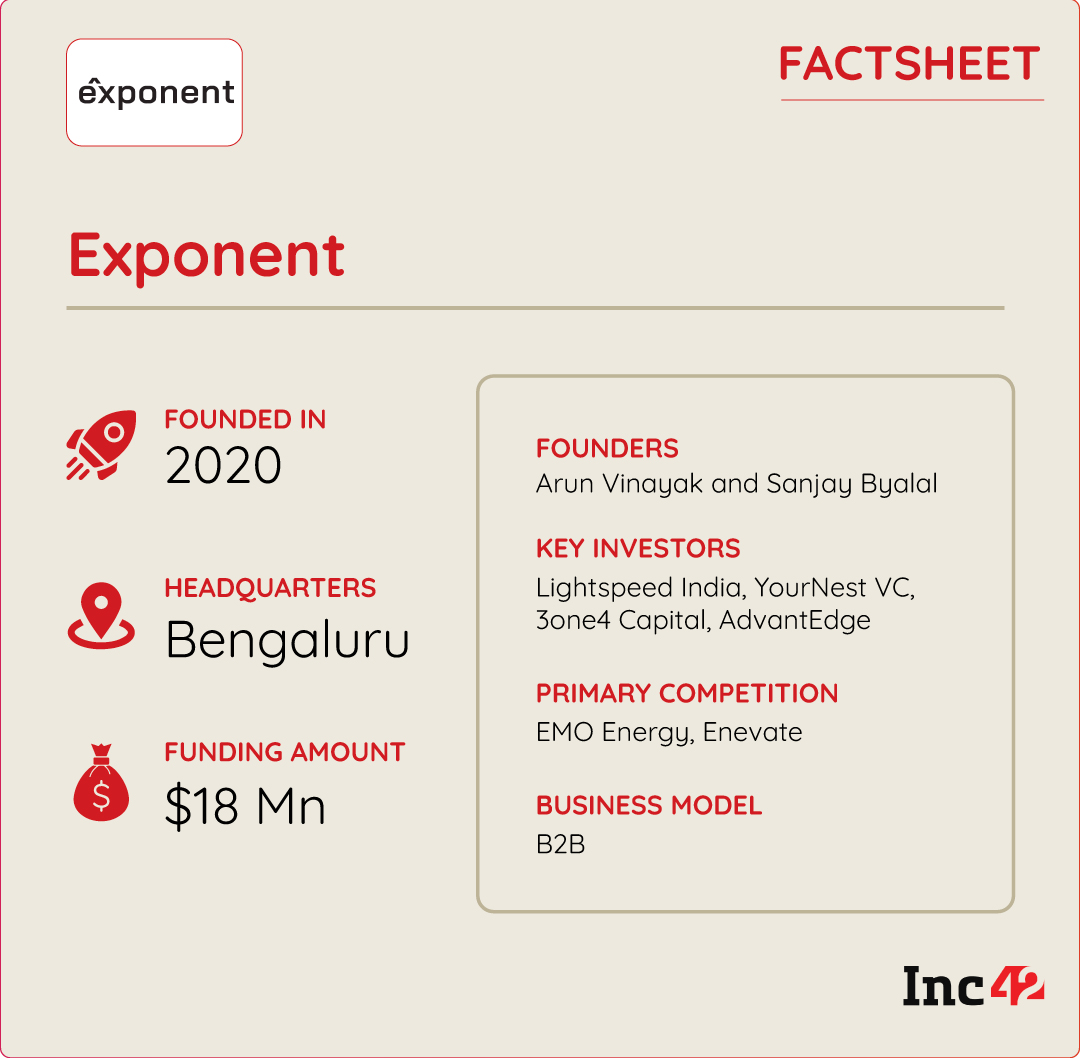

Former Ather Energy executives Arun Vinayak and Sanjay Byalal founded Exponent Energy in 2020, with the sole motive of building a tech enablement platform that can help original equipment manufacturers (OEMs) across segments to go electric with unmatched agility.

According to CEO and cofounder Vinayak, the only hurdle in the path of EV adoption in India is the efficiency of these vehicles, which can be improved multifold.

“Our problem statement in focus was battery life, battery charging times, the charging network… this is where the energy stack was really broken, and we needed to make energy much faster, simpler, accessible, and affordable,” Vinayak said.

When it comes to rapid charging, the biggest hurdle is overheating of batteries and battery life degradation. A 15-minute rapid charging generates almost 256X more heat than a 4-hour charging, which is the industry average.

Notably, lithium-ion (Li-ion) batteries are highly sensitive to extreme temperature conditions. Hence, battery thermal management systems are crucial for these battery packs as they help them function seamlessly even in extreme temperatures.

In most cases, various cooling systems such as air cooling, liquid cooling, and phase change material cooling are used worldwide to keep these batteries at their optimal temperature.

However, according to Vinayak, liquid cooling systems, which are the most common solution for thermal management in EVs today, hardly solve this problem, particularly in countries like India where the ambient temperature is normally 40 degrees Celsius or higher.

To resolve this, Exponent has built an advanced heating, ventilation, and air conditioning (HVAC) system, which is ‘off-boarded’ from the vehicle and is deployed at its charging stations, ‘e^pump’.

EV players like Tesla, Lucid, and Hyundai also have advanced HVAC systems, but the only issue is that these systems are an integral part of their vehicles and make them heavier and more expensive.

To resolve this pain point, the startup has built chargers and charging stations that come with this technology, reducing the burden on OEMs to incorporate such technology in EVs.

Its charging station, ‘e^pump’, transfers refrigerated water through its charging connector, ‘e^plug’, preventing Li-ion cells in its batteries from getting overheated while charging. The technology ensures that the temperature of its battery packs, ‘e^packs’, doesn’t exceed 35°C in any climatic condition.

Overall, Exponent Energy’s secret sauce of efficient 15-minute rapid charging is engrained in its tech stack that comprises ‘e^packs’, ‘e^pumps’, and ‘e^plugs’.

Making Batteries Last Longer

Besides reducing the charging time by controlling overheating, Exponent Energy has also been able to increase battery life by controlling lithium plating – the formation of metallic lithium around the anode of Li-ion batteries during charging.

Lithium plating is a phenomenon that degrades battery life and leads to battery malfunction.

While newer and more advanced cell chemistries are being developed to change the anode itself at a fundamental level, they are not mainstream yet.

“We are using the same material science and same anode but using a more software and electronics-based approach to smartly push the same anode to do more without actually damaging it,” Vinayak said. He added that the startup’s BMS and charging algorithms have been able to address the problem of lithium plating at the grassroots level, increasing the battery life.

Building The Business

Since its inception, Exponent Energy has raised $18 Mn in total funding from the likes of Lightspeed India, YourNest VC, 3one4 Capital, AdvantEdge VC, Hero MotoCorp’s chairman and CEO Dr Pawan Munjal’s family office, and Motherson Group.

Enabling efficient last-mile deliveries being the startup’s major focus area, it partnered with one of the leading OEMs in the three-wheeler commercial vehicle segment, Altigreen Propulsion Labs, in 2022. It claims that EVs powered by its tech stack have already covered over 10 Lakh kms with more than 25,000 rapid charging sessions.

However, the only catch here is that the startup sells its entire tech stack as a solution, and its ‘e^pumps’ can only charge ‘e^packs’. It has its ‘e^pumps’ at 30 locations in Bengaluru, which generate revenues on a subscription basis, based on the energy consumed per vehicle.

The startup’s ‘e^packs’ can be charged anywhere but they take at least an hour to fully charge. For maximum 15-minute efficiency, the battery packs need the company’s proprietary ‘e^plugs’ and ‘e^pumps’.

All of Exponent’s battery packs, which are also cell agnostic, come with a warranty of 3,000 cycle life, 3X the industry standard. They cost almost 30% less than other EV batteries in the market, as per the company.

Charging Ahead

After establishing its first set of charging networks in Bengaluru, Exponent Energy is planning to expand its operations to five more cities – Delhi NCR, Mumbai, Hyderabad, Chennai and Ahmedabad – by the end of the financial year 2023-24.

The startup has also set an ambitious target of deploying 1,000 ‘e^pumps’ and 25,000 Exponent-powered EVs by 2025 in the aforementioned cities, eyeing a revenue of around INR 600 Cr during the year.

Currently, more than 200 EVs powered by the startup are running on Bengaluru roads.

Vinayak says that as an energy company, Exponent is more focussed on high-energy value products, hence the startup is not looking to enable two-wheelers right now. After three-wheeler commercial vehicles, it would target the three-wheeler passenger vehicle market.

Besides, Exponent is all set to soon launch 15-minute rapid charging capabilities for intercity ebuses as well as etrucks by next year.

It must be noted that the ebuses market is slowly getting more mature in the country, with existing and new players launching intercity bus services with well-established charging networks. Currently, FreshBus and NueGo are the two main players in this market, with the likes of ZingBus expected to enter the market soon.

While Exponent currently faces minimal competition in India, more players could emerge with advanced cell chemistries and battery tech as the EV industry keeps growing. To substantiate this fact, Bengaluru-based EMO Energy has also launched 30-minute chargeable portable battery packs for various vehicle categories.

Meanwhile, big players like Ola Electric are working on building their own cell and battery technology, though it remains to be seen if, and to what degree, the upcoming technologies would prove to be pathbreaking in the near future.

Startup Stories

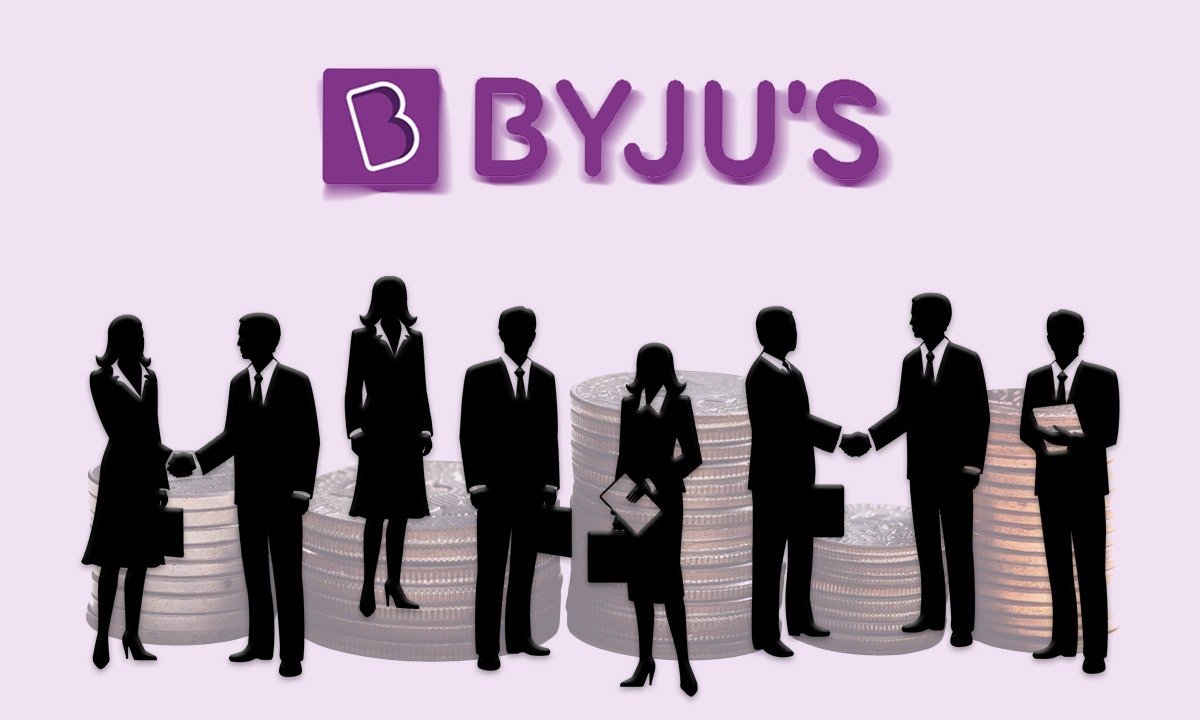

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency9 months ago

Crptocurrency9 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016