[ad_1]

Within a mere three years of its existence, FlexiLoans found itself in a lurch in the backdrop of the demise of IL&FS, India’s one of the most ghastly financial disasters

After sustaining the IL&FS crisis somehow and stabilising their expenditures in FY20, the NBFC received another jolt in the form of the Covid-19 pandemic

Driven by the cofounders’ effective leadership and business acumen, the Mumbai-based digital NBFC has been making profits on a monthly basis since September 2022

Upon being cornered on multiple fronts due to market meltdowns, diminishing investor confidence, pandemic, falling business metrics and negative cash flows, among other things, what would a majority of business owners do? Well, while many may give in and start afresh, only a few are likely to show resilience to die another day, not literally though.

Similar is the story of FlexiLoans, a Mumbai-based digital NBFC incorporated in 2016 and run by cofounders Deepak Jain, Manish Lunia and Ritesh Jain, which is largely driven by its instincts to survive and determination to go down swinging if it had to, in the face of major headwinds.

Within three years of its existence, the digital NBFC found itself in a lurch in the backdrop of the IL&FS crisis, India’s one of the most ghastly financial disasters.

Not to mention, the country’s very own Lehman Brothers-like event created a snowball effect, and prominent Indian NBFCs were bewildered as they saw their market share plummeting to unanticipated lows as borrowing costs started setting new records.

It was in the aftermath of the IL&FS event that Dewan Housing Finance Corporation Ltd. (DHFL), one of the major Indian NBFCs, saw a sharp 60% drop in its stock price, as mutual funds dimmed their NBFC exposure by 20% YoY. Further, taking preventive measures to cull the occurrence of any such undesired events in the future, the RBI solidified licensing mandates, but the damage had already been done and investors were seen shying away from newly incorporated NBFCs.

Stuck between a rock and a hard place was FlexiLoans with a meagre asset under management (AUM) size of INR 150 Cr and a huge fixed cost. Nonetheless, the founders, Deepak Jain, Manish Lunia and Ritesh Jain decided to show resilience in driving the organisation through the turmoil with their effective leadership and business acumen.

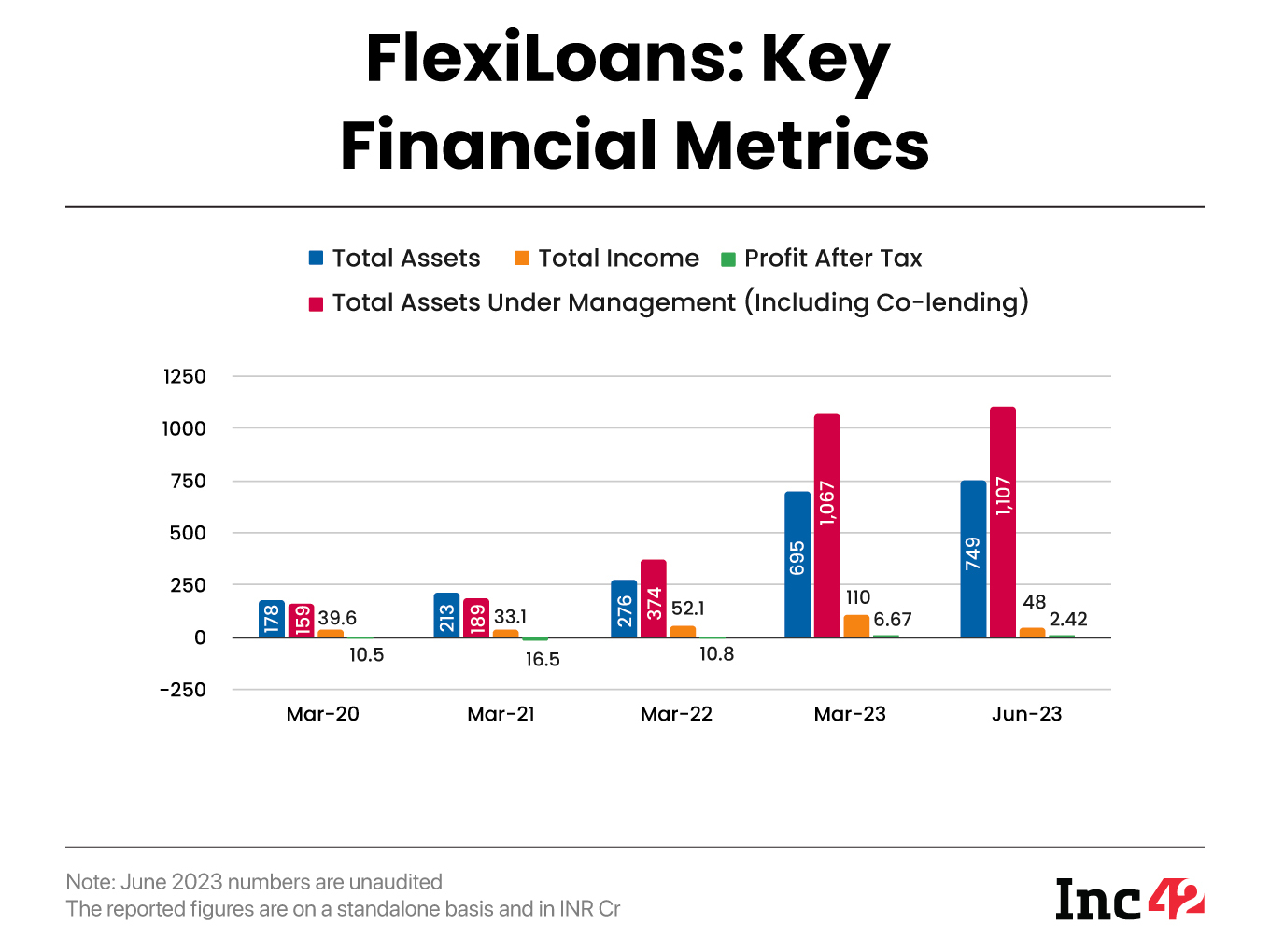

While they were engaged in an uphill battle, bogged down in losses, a silver lining appeared in terms of revenues, which rose to INR 24.36 Cr in FY19 and INR 39.69 Cr in FY20 from INR 9.9 Cr in the crisis-led FY18, as per company filings with MCA.

But When It Rains It Pours…

Much to everyone’s chagrin, the unfortunate events were far from over. After sustaining the IL&FS crisis somehow and stabilising their expenditures in FY20, FlexiLoans got another jolt. However, this time, the crisis was not man-made.

We are talking about the Covid-19 pandemic, which brought the world down to its knees. The mayhem called Covid-19 hit Indian micro, small and medium enterprises (MSMEs) the most as multiple lockdowns made their survival difficult. Many SMEs that had taken loans started defaulting, leading to an unprecedented surge in non-performing assets (NPAs) or bad loans.

Amid this, FlexiLoans continued to accumulate losses, while its revenues sank to INR 32.54 Cr in FY21.

“From early March to September 2020, our business came to a screeching halt, NPAs reached unprecedented levels, and we had to increase provisioning due to the RBI’s six-month moratorium on instalment payments,” Lunia said, reflecting on the challenging period.

However, the cofounders were determined and with a “this too shall pass” mindset, they once again braced themselves to fight yet another battle for survival.

Finally, their efforts to even out the odds proved fruitful, and in FY23, FlexiLoans was able to reignite its revenues and emerge as a dark horse by becoming profitable. During the year under review (FY23), the NBFC garnered INR 109.73 Cr in revenues with a net profit of INR 6.66 Cr, we were told.

According to the cofounders, FlexiLoans currently manages more than INR 1,000 Cr of AUM and has an annual disbursement run rate of over INR 4,000 Cr. It offers both term loans and supply chain business loans, with the former contributing 70% to its business. It also claims to have 100+ ecosystem partners who give them business leads. Some of these partners include Flipkart, Pine Labs and Paisabazaar.

“FlexiLoans has been profitable at a relatively early AUM compared to its peers due to its high operating leverage built on a frugal business model. We have been profitable since September 2022 month-on-month, and in FY24, we are all set to witness a healthy PAT number on the back of a significant build-up in AUM,” Lunia said.

FlexiLoans’ Balancing Act

According to Lunia, FlexiLoans ensured its survival by offering the lowest credit costs in the entire country. This helped them bring their loan write-off costs down dramatically.

“During the pandemic period, one of our major competitors wrote off over INR 300 Cr, while our total write-offs stood at only INR 8 Cr. Our credit costs and NPAs accounted for less than 5% of our revenue. Even banks couldn’t boast such ratios. Furthermore, while we restructured fees for only 7% of our customers, many other NBFCs had to go beyond the 40-50% mark,” a satisfied Lunia gloated.

The prudent financial management of the cofounders, fuelled by a strict control on costs, not only helped the company remain stable in 2020 but also enabled it to secure a debt and equity round of INR 150 Cr ($18 Mn) led by Falguni and Sanjay Nayar’s Family Office. Sanjay Nayar is the CEO of KKR India, while Falguni Nayar is the founder of Nykaa.

Subsequently, in 2021, as liquidity and enthusiasm returned to the market, the company’s growth metrics improved, stabilising it further. During this period, FlexiLoans successfully secured another $90 Mn in a Series B debt and equity funding round.

“So, starting from INR 150 Cr, we achieved 100% growth in our AUM, reaching INR 350 Cr by the end of FY22. The credit costs for FY22 remained under 2.5%, once again below the industry average of 5%, even though we experienced marginal losses due to increased investments, provisions and the recruitment of senior management for the initial four months of FY23. However, since September 2022, we have consistently been profitable every month,” the cofounder added.

Crafting An Effective Acquisition Funnel

The cofounders deployed three key customer acquisition strategies to expand its reach among SMEs and boost loan disbursals.

Firstly, they forged partnerships with platforms that boast extensive SME networks. These platforms include ecommerce giants like Flipkart and Amazon, along with PoS players such as Pine Labs and Mswipe and neobanks like Open. When these partners onboarded their clients, they presented FlexiLoans’ offerings as an option, thereby fortifying SMEs’ trust in the NBFC.

Secondly, during the pandemic, when many lending players scaled back their operations, FlexiLoans seized the opportunity to collaborate with them and extend their offerings through their platforms. Consequently, FlexiLoans emerged as one of the top three lenders on the Paisabazaar platform.

Finally, between FY20 and FY23, the NBFC concentrated heavily on expanding its organic reach through digital marketing initiatives. The team initiated blog writing, leveraged vernacular content, and joined hands with Instagram influencers to promote the user-friendly onboarding process and standardised interest rates of the NBFC, thereby increasing its brand visibility.

By the time they entered FY23, they had already doubled their marketing budgets to stay competitive amid rising competition from firms like Axio, Lendingkart, and Kinara Capital.

“As a result, by the end of FY23, our website was attracting over 3 Lakh visitors monthly. Nevertheless, we remained committed to controlling our customer acquisition costs while investing in digital marketing,” he observed.

Today, FlexiLoans caters to an array of industries, including fashion and apparel, FMCG, groceries, pharmaceuticals, and electronics. Further, online sellers collectively constitute more than 50% of the company’s loan book.

This strategic diversity within their customer segment has allowed FlexiLoans to mitigate risks and capitalise on opportunities, ensuring robust growth and a stable lending portfolio.

The NBFC’s 73% customers are from Tier II cities and beyond, and the top states served by the organisation are Maharashtra (20%), Delhi (14%), Uttar Pradesh (12%), Gujarat (11%), and Karnataka (10%).

Betting Big On Tech And Bigger On Colending

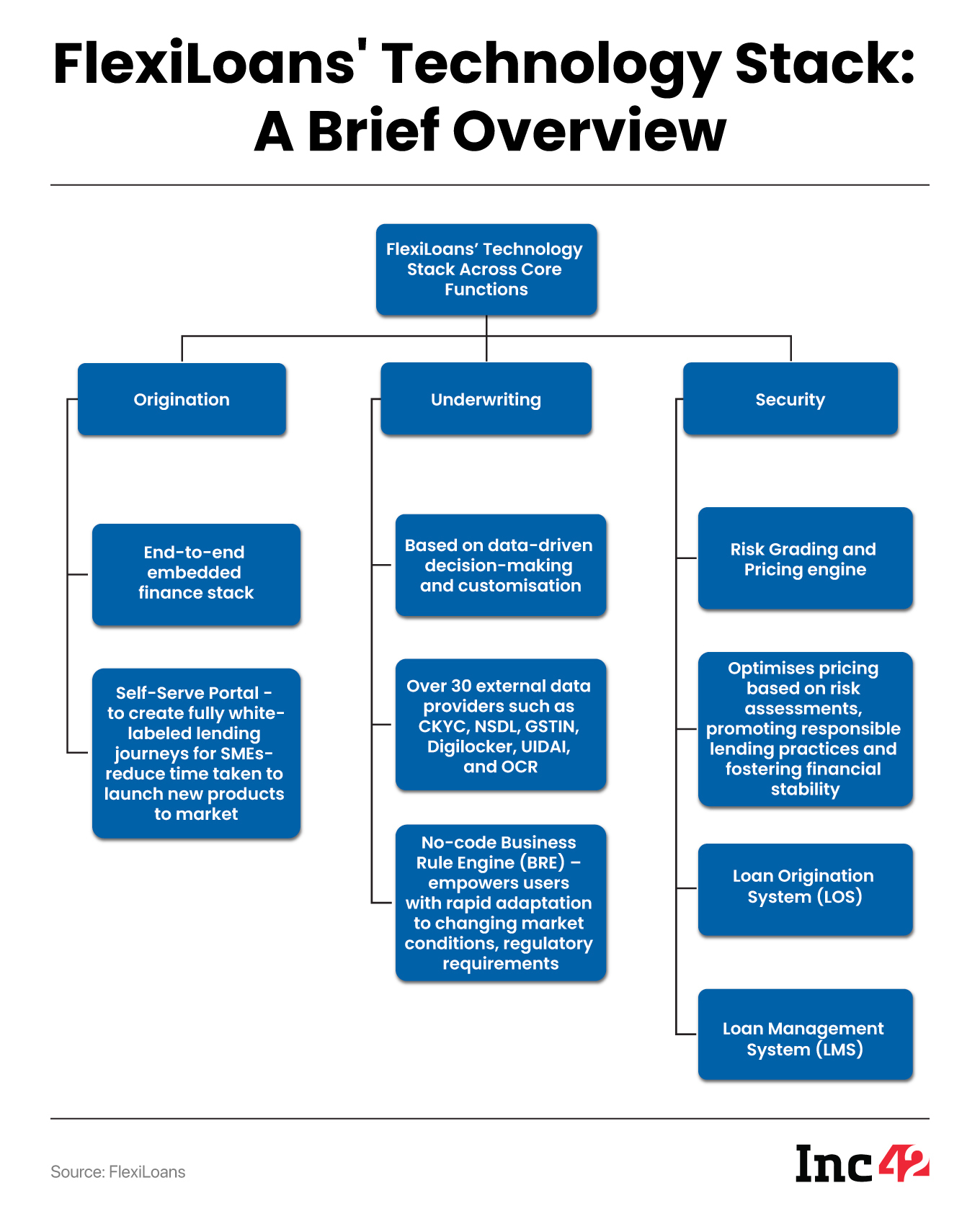

At the core of FlexiLoans, technology plays a pivotal role in covering most of its operational processes — from onboarding of clients to underwriting and from data protection to data analysis. New-age technologies such as AI, ML, and Big Data are seamlessly integrated into every aspect of the company’s operations.

According to Lunia, the company’s ace up the sleeve is its risk models, which are meticulously trained to accurately assess and price unsecured MSME loans in India.

Not just this, FlexiLoans boasts a dedicated team of 100 experts who have helped it excel in complex areas like image processing, scoring, digital extraction, credit analysis, and financial analysis through AI/ML technologies.

Customer-uploaded documents are efficiently categorised and tagged by their in-house ML engine. Their in-house ML technologies can process hundreds of diverse documents within seconds, and their credit analytics tool provides real-time credit decisions.

FlexiLoans also possesses over 20 proprietary data science assets and five algorithms (yet to receive patents) that span the entire loan lifecycle. The technology platform allows the company to increase transparency and reduce bad debts.

“Today, we are 90-95% digital, but in certain cases, around 5%, we do require face-to-face interactions with customers. We have agency partners and a dedicated team spread across India to meet customers. Nonetheless, technology enables us to reach a wider audience and the need for physical meetings decreases accordingly,” Lunia said.

Meanwhile, recognising the role of collaborations in the digital lending space, FlexiLoans introduced Bi-Frost, an end-to-end API solution, which expedites integration with various lending institutions in a matter of weeks.

This initiative has empowered the company to facilitate working capital loans within 48 hours, boasting an impressive 98% approval rate from lending partners. Currently, FlexiLoans’ colending platform is being leveraged by over eight financial institutions.

What’s Next?

Beyond expediting lending processes, FlexiLoans’ colending platform widens the pool of available capital for small businesses. It fosters new lending partnerships, promoting a more diverse and inclusive lending environment.

“Approximately 70% of our AUM growth is seamlessly supported by our partner lenders through our colending platform. Leading players like Fullerton, RBL Bank, and Karur Vysya Bank are already on board. Furthermore, we scaled our supply chain solutions eightfold in FY23, helped by the unique blend of vendor financing and BNPL solutions,” Lunia adds.

As of now, the cofounders are confident that FlexiLoans will surpass an AUM of INR 2,000 Cr this year. They envision an even stronger FY25 with INR 2,500 Cr in AUM, of course, with all eyes set on profitability.

Not just this, the cofounders are fixated on building a future-proof organisation by refining its product offerings and streamlining SME processes for SMEs. Additionally, the startup plans to expand its co-lending activities and forge partnerships with more PSU banks.

However, one of the major challenges for the company, and the sector, is getting access to longer-term, cost-effective capital. The availability of quality funds, on par with recognised banks, will go a long way in mitigating many NPA-related risks and creating a collaborative ecosystem to ensure win-win for all stakeholders.

[ad_2]

Source link