Startup Stories

How D2C Brand T.A.C Grew Its Customer Base 10X In Just 2 Years

Launched in 2021 by Shreedha Singh and Param Bhargava, Gurugram-based D2C brand T.A.C is looking at ruling the beauty and personal care space and emerge profitable by FY25

The company claims to have witnessed 4X growth in FY23 to INR 45 Cr from INR 12 Cr in FY22. The founders aim to generate revenues to the tune of INR 150 Cr in FY24

With plans to break even in the current financial year, the founders have also set their eyes on entering the health and wellness markets

With consumer preferences experiencing a significant shift, the popularity of ayurvedic products has been steadily rising, particularly in the beauty and personal care industry. The Indian herbal cosmetics market is expected to reach $4.7 Bn by 2026. Launched in 2021 by Shreedha Singh and Param Bhargava, a Gurugram-based D2C brand, The Ayurveda Co. (T.A.C) is looking at ruling this space and emerging profitable by the next financial year.

However, the journey of this D2C beauty and personal care brand has not been without twists and turns. Suffering severe skin allergies in 2014, Singh started looking for remedies and her search led her to Ayurveda, which healed her within six months. It was then the idea of floating an Ayurvedic brand first flickered in her head.

After years of research, the founders, Singh and Bhargava, started building The Ayurveda Co. However, much to their chagrin, the husband-wife duo witnessed a lot of scepticism along the way. Despite this, the couple remained hell-bent on changing the perception around Ayurveda as a remedy that takes time to show effects and is now old and obsolete.

To change people’s perception around the 5,000 years old science of healing, the couple made it a mission to make their brand appealing and affordable for all age groups. Thus, The Ayurveda Co. was born, giving Ayurveda direct entry into the lives of people who have now largely separated themselves from its benefits.

Presently, the D2C brand offers a diverse range of natural and ayurvedic beauty and personal care products such as face washes, cleansers, serums, moisturisers, hair care products, and makeup. All products are made from ayurvedic ingredients, which are clinically proven and derma tested for being free from sulphates, parabens, and other harmful chemicals.

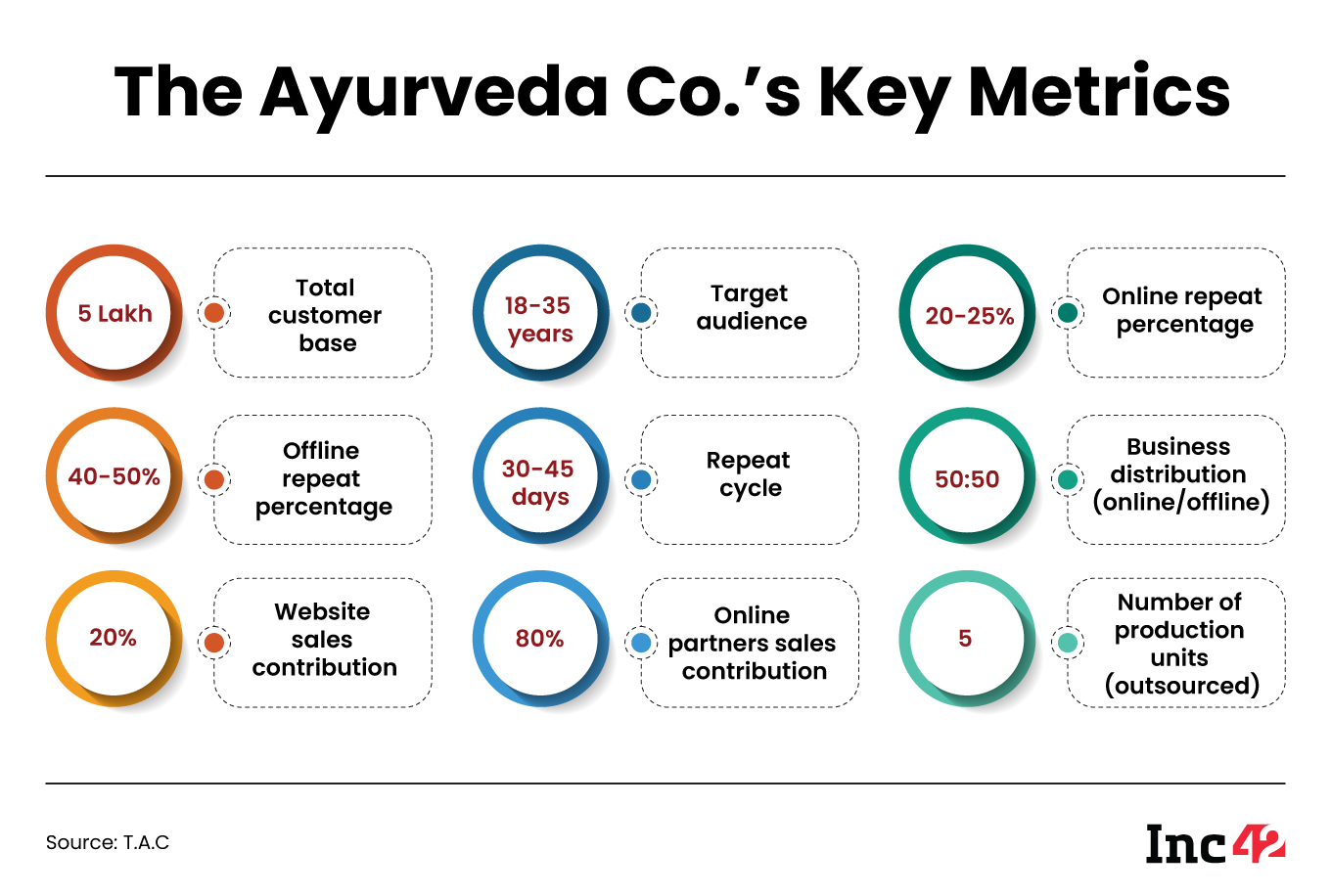

T.A.C sells its products through its website and its kiosks, along with select retailers and online marketplaces like Nykaa and Amazon. The startup displays and sells its products at 30 departmental stores in Dubai, which it plans to scale up to 300 this year.

In India, The Ayurveda Co. has 20 exclusive outlets, while its products are available across 3,000-plus multibrand outlets across the country.

In terms of its financial performance, the D2C brand claims to have witnessed 4X revenue growth in FY23 to INR 45 Cr from INR 12 Cr in FY22. This growth can be attributed to the significant expansion of their customer base, which has grown 10X over the last two years, from just a few thousand individuals to an impressive 5 Lakh customers.

In FY24, the founders aim to generate revenues to the tune of INR 150 Cr. To fuel this, the D2C brand recently raised INR 100 Cr in a Series A round.

Brand Positioning Is Most Critical In The Early Days

For T.A.C, establishing trust and fostering brand recall with customers was paramount. As a D2C brand centred around traditional Ayurveda, it was crucial to align with the preferences of millennials and GenZ. To achieve this, Singh personally oversaw surveys and managed customer care, as the sole point of contact, during the initial 15-18 months.

The founders also realised that for T.A.C to truly disrupt the market, a shift in perception around using ayurvedic products was essential, and the young generation must spearhead this transformation.

“Listening to the customers helped us understand the core proposition we can offer. While Ayurveda is traditional, we positioned ourselves as a young and modern brand,” Singh added.

Unlocking The Omnichannel Route With Beauty Advisors (The ‘Snipers’)

T.A.C targets individuals between 18 and 35 years of age. Among them, customers in the age group of 18 to 25 years buy mostly from online channels. This is why the brand was only selling online in 2021 and 2022 via its website and marketplaces such as Amazon, Nykaa, Flipkart, and Blinkit, and with the help of influencers on Instagram.

However, the founders soon realised that the TAM they were targeting was too small. As a result, in May 2022, the T.A.C team embarked on their offline journey to expand their market share. However, there were quite a few unforeseen challenges.

“To go offline, we first went to stores like Nykaa and Shoppers Stop, however, they demanded a 50% margin on our products and a monthly display rental of INR 20,000. It was a huge cost to bear,” Bhargava said.

This paved the way for three key strategies that the founders adopted:

Setting Up An Experienced Team

The founders appointed a team of sales executives from companies such as L’Oreal, HUL, ColorBar, Biotene, and Lotus, Colgate, and Palmer. The new team was experienced in offline strategies like sachet-size products, smaller price points, and larger distribution, giving the brand a much-needed penetration boost.

Exclusive Stores

Instead of putting the products directly on the shelves of retailers, the founders focussed on opening their exclusive stores in areas with heavy footfall. This not only created a buzz in the market but also helped them negotiate better deals with retailers as the brand name was already built.

Training ‘Snipers’ In-House

The founders also decided to appoint beauty advisors (BAs) and gave them training to help customers choose the right products according to their skin type and requirements.

“It’s a very sniper kind of approach. And for our teams to become proper ayurvedic snipers, we kept on brushing up their skills. Today, we have 20-plus T.A.C exclusive stores and 3,000-plus offline retail touch points across India, along with more than 600 beauty advisors building brand awareness and trust among consumers,” Singh added.

Quality Conscious Super Supply Chains

Speaking with Inc42, Bhargava highlighted the importance of supply chains for global expansion. He also cautioned founders against compromising product quality during business growth.

“T.A.C’s success can be attributed to three key strategies — Maintaining an in-house R&D team of doctors and experts; sourcing high-quality ingredients from the Himalayan region through partnerships with key retailers; and investing in machinery and quality checks at outsourced manufacturing units to ensure product excellence,” the cofounder said.

Although The Ayurveda Co. outsources its manufacturing, the founders are laser-focussed on investing in machines and quality-control processes at regular intervals. This allows them to stay abreast of new technologies. Also, the D2C brand’s quality-control teams make sure that their vendors are committed to maintaining high quality.

“Also, we are the first of the few brands that have been able to enter the Middle East in less than six months after completing all formalities. We were able to get the products approved and on the shelves in Dubai because we have been focussed on building a super supply chain that is quality conscious and scalable,” Bhargava added.

Is Profitability A Distant Dream?

In the financial year 2021-22, the D2C brand’s total expenses amounted to INR 16.6 Cr, resulting in a net loss of INR 2.7 Cr. Although the founders didn’t disclose the total expenses incurred in FY23, they could increase significantly due to a 4X rise in revenues and a strong focus on marketing and brand promotion. It is pertinent to mention here that T.A.C also serves as the title sponsor for reality shows like MTV Roadies and Splitsvilla.

However, according to Bhargava, these expenses are important for the growth of the company. He claims that the company maintains a positive contribution margin.

“We are investing in promotion and marketing and not incurring losses here. The losses primarily stem from our distribution and operations side as we work with an in-house team of 600+ beauty advisors engaged in direct selling with attached incentives. So, the losses are not on the selling side and we expect to recover with scale,” he added.

Interestingly, even though the primary goal of the founders is to thoroughly explore the beauty and personal care market by adding more products and categories to their portfolio, they have no plans to set up a manufacturing unit.

Meanwhile, the husband-wife duo are planning to make inroads into the health and wellness markets. The founders are looking to break even by the end of FY24 and turn profitable by FY25.

However, the segment which The Ayurveda Co. aims to become the leader in requires high cash burn and is crowded with deep-pocketed players. According to Inc42 data, there are approximately 130+ beauty, personal care, cosmetics and men’s grooming D2C brands in India.

Some of the notable names in this segment are Mamaearth, The Moms Co., mCaffeine, Biotique Nykaa, Sugar, Mamaearth, Wow Skin Science, JustHerbs, The ManCompany, MyGlamm, Skinkraft, Plum, and Beardo, among others.

While Nykaa has already become a listed beauty marketplace, others like Mamaearth, Wow Skin Science, Bombay Shaving Company, mCaffeine, MyGlamm have already established presence in many international markets. Therefore, it would be interesting to witness how The Ayurveda Co. cracks the profitability code by FY25 with its ayurvedic playbook and well-trained beauty ‘snipers’.

[Edited by Shishir Parasher]

A Message From Simpl:

Low consumer trust, sluggish checkout and a broken post-checkout experience leads to low conversions, high CoD share and high RTOs for D2C ecommerce. See how Simpl can help..

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency10 months ago

Crptocurrency10 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016