[ad_1]

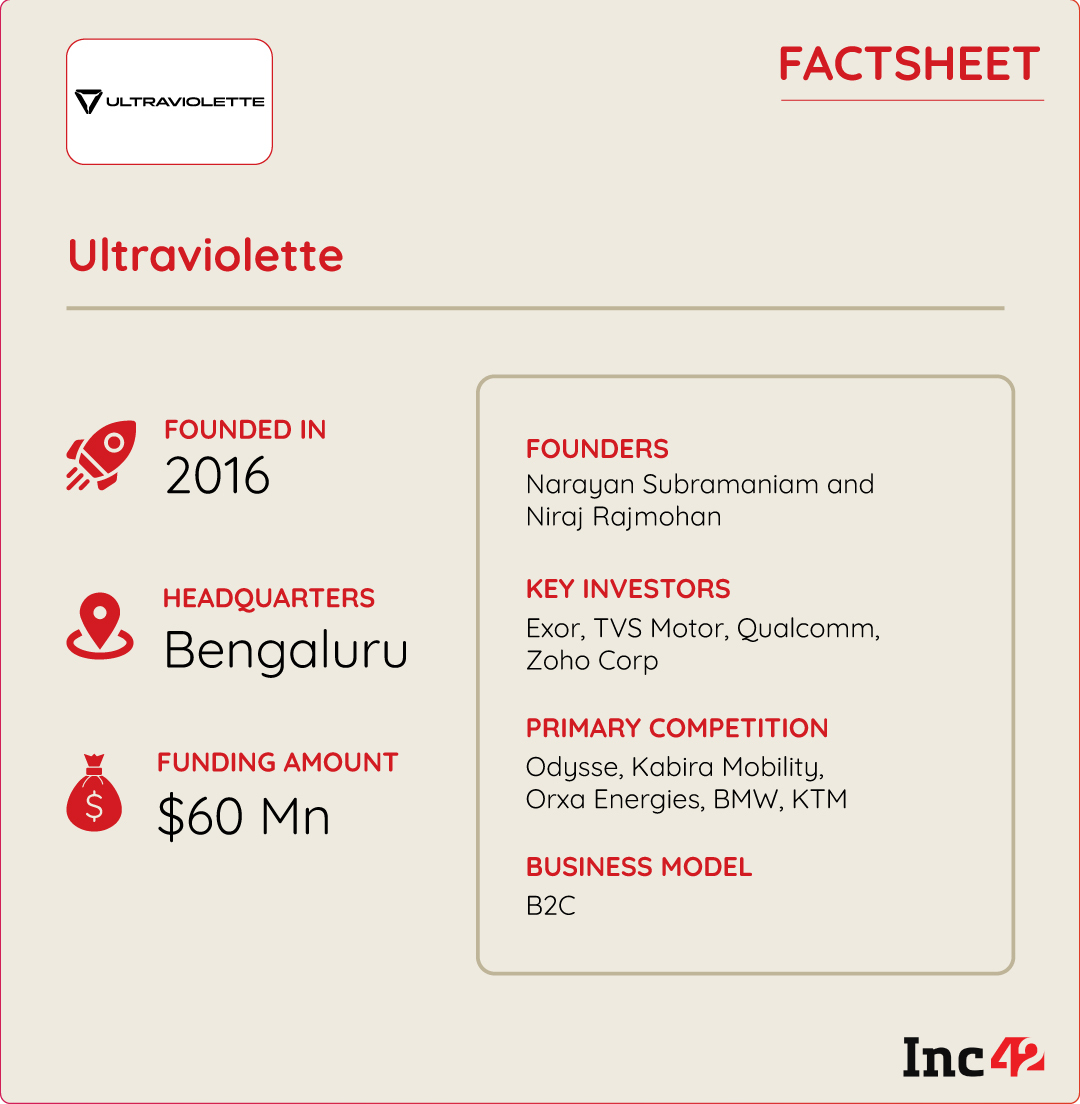

Founded in 2016 by Narayan Subramaniam and Niraj Rajmohan, Ultraviolette took six years to launch India’s first lineup of high-performance electric motorcycles

In the performance bike market, Ultraviolette bikes compete with quarter-litre or half-litre categories (300 to 500 CC) and counts players like Kawasaki, KTM, and BMW as its competitors

The global electric two-wheeler market is set to reach $121.08 Bn in 2030, with electric motorcycles expected to cherish almost half the market during this period

At a time when the adoption of electric cars and escooters has been well received in the realm of electric vehicles (EVs), electric motorcycles have yet to become a common spectacle – both on roads and race tracks.

While the earliest reference to electric motorcycles can be traced back to the late 1800s, internal combustion engine (ICE) motorcycles manufactured by Suzuki, Honda, Yamaha, Royal Enfield, Hero, BMW, Harley Davidson, and Ducati have continued to rule roads worldwide.

The situation is no different In India, where the EV market is more nascent than some of its peers like China, the US, and Europe.

Though India’s electric two-wheeler adoption has jumped by almost 4-5X year-on-year since 2020, helped by hundreds of escooter OEM players entering the market, electric motorcycles have yet to receive this boost. This is because there are fewer players in the market that want to entertain the intricacies, complexities and costs associated with building top-notch products to rival traditional ICE motorcycles.

Amid this, Bengaluru-based Ultraviolette Automotive has emerged as one of the pioneering startups to begin the production of high-performance electric motorcycles in India.

Founded in 2016 by Narayan Subramaniam and Niraj Rajmohan, Ultraviolette took six years to launch their first flagship vehicle, F77.

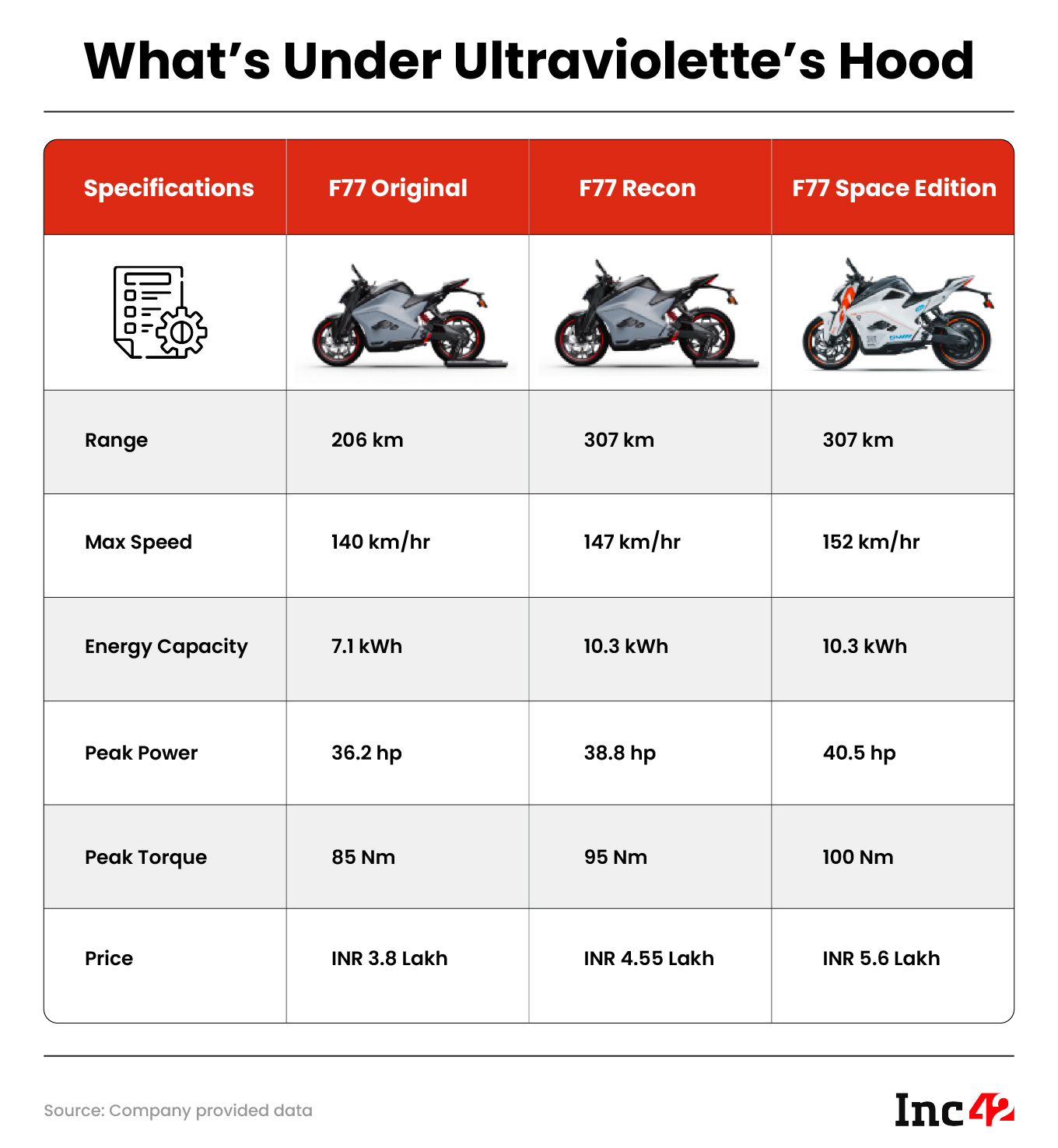

Before embarking on their entrepreneurial journey, Subramaniam and Rajmohan served the automotive sector for almost a decade, working with global tech companies. Their tech backgrounds have played a crucial role in paving the way for Ultraviolette, which today boasts India’s first lineup of high-performance electric motorcycles — F77 Original and two special editions, F77 Recon and F77 Space Edition.

Ultraviolette’s Race Has Just Begun

From building the core IPs for most technologies used in F77, including the battery tech, drivetrain, and software to establishing a well-integrated servicing network, Ultraviolette’s vision since its inception has been to create ‘top-of-the-line mobility solutions driven by progressive design and energy efficient technology’.

“Our focus has always been on innovation,” said Subramaniam, the cofounder and CEO of Ultraviolette.

We were told that Ultraviolette draws inspiration from the aviation and aerospace sectors, which is evident in the design philosophy of its bikes. All the standard and special edition bikes under its F series showcase jet-inspired design.

As per the founders, what sets Ultraviolette’s approach apart is its application of principles from aircraft engineering, encompassing mechanics, electronics, and architecture, in building emotorcycles.

Further, the F77 lineup has been built keeping the future needs of the users in mind — as they are expected to use the product for at least 7 to 10 years. Given that the EV technology is growing and changing at an unprecedented scale, the founders told Inc42 that they have tried to make their motorcycles future-proof by selecting components that are durable and deploying technology that doesn’t become obsolete soon.

In addition, to ensure quality control and affordability once rolled out, the startup has built the entire vertical integration, including battery technology, drivetrain electronics, the cloud-connected system, the architecture, vehicle chassis, and charging system over the years.

Ultravoilette’s F77s Get Ready To Race

The pivotal moment arrived in late 2019 when Ultraviolette introduced its F77 model with a range of 150 km. However, with the emergence of the pandemic in 2020, the company halted production and directed all its efforts towards enhancing battery technology.

Between 2019 and 2022, F77 underwent a whole revamp to achieve a range of 200 km for its Original model and later touched the 300 km mark for its F77 RECON limited edition. This transformation encompassed both architectural changes and the adoption of a new cell format to enhance the battery performance.

In November 2022, Ultraviolette finally launched its motorcycles in Bengaluru.

But why did the startup choose the high-performance emotorcycle segment?

“In a diverse country like India, the first challenge is to make people excited about EVs. People still hold many misconceptions about this technology. So, we understood that if we had to change their mindset, it would be better to start with a segment that is exciting, engaging, and nuanced,” said Subramaniam, adding that it was a very calculated decision to start with the aspirational segment.

In the performance bike market, Ultraviolette bikes compete with quarter-litre or half-litre categories (300 to 500 CC) – a segment that alone witnesses sales of 1-2 Lakh ICE motorcycles per month in India.

So far, the startup has raised around $60 Mn in multiple rounds from Exor, TVS Motor Company, Qualcomm Ventures, Lingotto, and Zoho Corporation, among others.

This financial support extends beyond capital infusion as many of these investors are actively engaged in augmenting Ultraviolette’s technological capabilities and expanding its market presence that would soon transcend beyond India.

Today, the startup’s emotorcycles run in six Indian cities — Bengaluru, Chennai, Mumbai, Pune, Kochi, and Hyderabad.

The startup believes that the pure D2C approach cannot work for motorcycles. Hence, the first step to expanding into these markets was establishing after-sales servicing facilities in each of these cities. These servicing stations are directly managed by Ultraviolette.

Taking On Global Players With Competent Price Point

Ultraviolette does not compete with players that offer commuter bikes in the range of INR 1 Lakh to INR 2 Lakh, but rather the players that offer high-performance ICE motorcycles. In its segment, the company counts players like Kawasaki, KTM, and BMW as its competitors.

Ultraviolette F77 starts from INR 3.8 Lakh onwards, ex-showroom. According to Subramaniam, Ultraviolette’s ebike may seem more expensive in comparison to its ICE counterparts, however, it costs quite less in the long run since it is an EV.

“Also, if compared with the other high-end aspirational electric motorcycles in the global market, our bikes are at least 3-4X less expensive,” the CEO said.

However, when it comes to staying abreast of international players, the startup’s price point looks quite lucrative.

For example, US-based Zero Motorcycles, which is currently one of the global leaders in the electric motorcycles market, charges a minimum of $12,000 (INR 9.9 Lakh) for its ZERO FX dual sports variant that offers a range of approximately 145 km on a single charge and has a peak power of 46 HP with 106 NM torque.

In contrast, Ultraviolette’s F77 Original offers a range of over 200 km with a peak power of 36 hp and 85 NM of torque — not much difference in power but a huge variation in range and pricing.

(Note: While the two segments of bikes (ZERO FX and F77 Original) cannot be compared, we have picked the lowest-priced models of both companies)

Moving on, another example is Harley Davidson’s electric motorcycle LiveWire S2 Del Mar, which offers a 200 km range, 84 horses and a massive 260 NM of torque, is priced at around $15,499 (manufacturer’s suggested retail price), which translates to around INR 13 Lakh.

According to Ultraviolette’s cofounder and CTO Rajmohan, it is due to the company’s proprietary tech stack that they have been able to keep the pricing of their F77 lineup competent.

“There is always an additional cost associated when working with third parties because every player wants to keep their margins.

It is pertinent to note that players like Revolt, Oben Electric, Kabira Mobility, and Odysse, too, operate in the electric motorcycle segment, but they largely offer commuter vehicles.

Ultraviolette also unveiled its F99 Factory racing platform earlier this year at Auto Expo 2023, which comes with a peak power output of 65 horses and offers a top speed of over 200 km per hour. The startup plans to develop this technology further only for race tracks.

Ultraviolette’s In The Speed Lane

According to the cofounders, Ultraviolette is gross margin positive. The startup has a total headcount of around 350 employees with 200 of them dedicated solely to the R&D unit.

Ultraviolette recently launched a Space Edition of its flagship F77 as a tribute to India’s Chandraayan-3 mission and specetech development. The limited edition bike comes with aluminium, paints, and other materials used in spacecraft. It is available for only 10 bookings.

While Ultraviolette did not reveal the plans pertaining to its upcoming bike launches, the startup is expected to roll out a fast-charging network in various parts of the country soon.

Currently, the startup offers two chargers – a standard charger that takes around 8-9 hours to fully charge a vehicle and a boost charger that takes about 4 hours to fully charge an ebike. The startup is also coming up with a fast charger, which would take less than 2 hours to fully charge its ebikes.

As per Vahan portal data, Ultraviolette has seen the registrations of over 195 vehicles this year. The founders claimed that they project at least 1,000 Ultraviolette motorcycles to be on the road by the end of this year.

In the next 12 months, the startup plans to extend its footprint to 12-15 cities. Besides, it plans to jump the Indian borders starting next year, with eyes set on countries like Italy, Germany, Spain, the US, Mexico, Colombia, and Brazil, along with Southeast Asian countries.

Meanwhile, in India, the enthusiasm of EV players to enter the electric motorcycle market is growing. Recently, Ola Electric announced that it will launch four electric bikes next year.

Bengaluru-based Orxa Energies is also preparing for the launch of its flagship all-electric high-performance motorcycle, the Mantis.

As per a report, the global electric two-wheeler market is set to grow at a CAGR of 19.1% between 2022 and 2030, reaching $121.08 Bn in 2030 with electric motorcycles expected to cherish almost half the market during this period.

Even though the pace of adoption of electric motorcycles has been slow in India, the entire domestic two-wheeler electric market is set to reach $6.2 Bn in size by 2030.

Nonetheless, for Indian EV players like Ultraviolette, who have also set their eyes on foreign lands too, these are some of the most exciting times.

However, as more established players will enter the high-performance motorcycle market with global collaboration, the road ahead could get a bit patchy for smaller players. While this is just an anticipation, it would be interesting to see how Ultraviolette’s high-performance playbook inspires other Indian EV OEMs to make a paradigm shift in a bid to stay abreast of their western counterparts.

[ad_2]

Source link