Startup Stories

How Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

The ‘Uber for trucks’ has eliminated the need for intermediaries and enables partner trucks to cover over 11,000+ km per month compared to the industry standard of 8,000 km

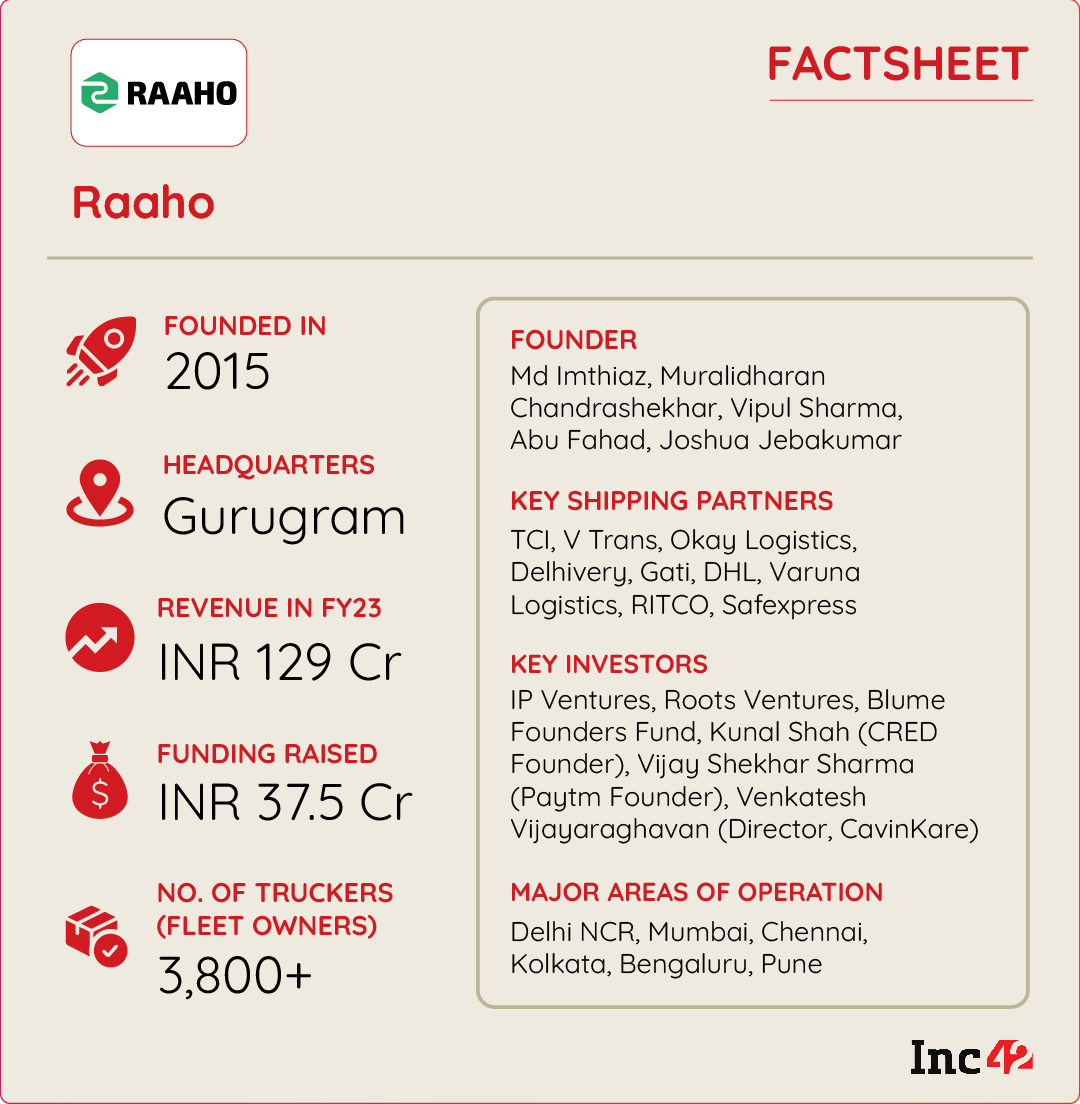

To date, Raaho has onboarded 3,800+ truck owners on its platform

It is currently present in 15 cities but aims to operate pan-India within three years

Think Azadpur Mandi, one of the biggest wholesale markets in India dealing in fruits and vegetables, and one can easily imagine huge gunny bags filled to capacity and a long row of pickup vehicles patiently waiting outside to deliver bulk orders.

Ask ‘cargo owners’ if fast and efficient transportation is a huge challenge and they will agree en masse. Things are so chaotic that business owners seek the services of brokers/agents (read intermediaries) to arrange deliveries. Worse still, owners of small fleets have to wait long and negotiate the fares, often making losses due to delayed load availability, payments and random deductions.

But the scenario has changed to a large extent after Gurugram-based Raaho started operating as the ‘Uber for trucks’ in India. It connects shippers (third-party logistics/3PL players) with truck/fleet owners in about 15-20 minutes, focussing on efficiency and operational transparency in a largely unorganised inter-city trucking sector.

Raaho was founded in 2015 by serial entrepreneur Md Imthiaz, Muralidharan Chandrashekhar, Vipul Sharma, Abu Fahad and Joshua Jebakumar. Operational since 2017, it is an online truck aggregator and on-demand inter-city truck-hailing platform that eliminates the need for intermediaries. The startup uses machine learning and data science for freight matching and route optimisation, thus slashing extra miles and emissions and guaranteeing higher incomes for the trucking community.

In 2014, Imthiaz exited hyperlocal reward and discovery platform. The serial entrepreneur began searching for his next project and wanted to venture into the grocery space.

But before starting up, the founders frequently visited Azadpur Mandi for a deeper understanding of the supply chain dynamics. During these visits, they witnessed for the first time the difficulties faced by truckers.

“They depend on brokers for the freight,” recalled Imthiaz. Moreover, the freight matching is done completely manually using a register that contains all essential data such as the driver’s name, licence number of the vehicle and vehicle type with information on the origin & destination (called ODVT in the industry parlance). This manual method was time-consuming and quite inefficient. Truck owners used to report to those brokers early in the day and waited until the evening/ next day for their freight.

Besides the chaotic demand-supply scenario, the founders noticed yet another problem. “Small truckers owning fewer than 10 trucks dominate this fragmented market,” said Imthiaz. So, optimised asset utilisation is critical for these truckers for a steady revenue flow, which means they require quick and consistent freight orders.

Aware that the segment was ripe for disruption, the five set up Raaho. Its key clientele includes the prominent transporters and 3PL players such as Delhivery, Gati, RITCO, Safexpress, Om Logistics, TCI (Transport Corporation of India), V Trans, Okay Logistics among others.

The startup has onboarded 3,800+ fleet owners and now covers as many as 15 cities, including Delhi, Chennai, Mumbai, Bengaluru, Kolkata, Pune, Ahmedabad, Hyderabad, Coimbatore, Patna and more.

In March 2023, the startup raised INR 20 Cr from Inflection Point Ventures (IPV), Roots Ventures, Blume Founders Fund and marquee angels like Vijay Shekhar Sharma, Kunal Shah and more as part of its extended Pre-Series A round. It clocked INR 129 Cr in revenue in FY23, a 3x jump from the previous financial year, claimed Imthiaz.

Raaho’s Inclusive Solutions For Key Stakeholders

In a bid to change how logistics operations are carried out, Raaho has developed a B2B model, keeping in mind all three stakeholders. These include businesses/shippers needing to deliver bulk orders efficiently; fleet owners, mostly small players, offering transportation services, and drivers on the ground responsible for transporting goods within states and across state lines. Despite their codependence, there is a clear lack of convergence among these stakeholders, the critical challenge the platform aims to address.

To that end, the startup has developed three separate apps on Google Playstore for shippers, truck owners and drivers – each tailored to meet the specific requirements of respective stakeholders.

To begin with, a shipper can raise a booking request via the shipper app by specifying the pickup and delivery locations, type of freight and desired delivery date. On the trucker app, fleet owners can bid on the request by setting the price they will accept for the load. Next, Raaho uses its algorithms to list the highest bids and nearest locations matching the freight request. Raaho provides real-time shipment tracking when a job is accepted.

The platform streamlines the entire process, including easy onboarding of truck owners and drivers, document uploading and managing the same through shared access.

The startup also helps drivers working for fleet owners. On the Raaho driver app, they can easily indicate their readiness for a load and receive round-the-clock customer support They also gain by finding instant loads, optimised routes and quick payments. In contrast, offline brokers can seldom suggest shortest routes and the traditional payment cycles are usually longer. According to Imthiaz, Raaho’s partner trucks cover about 11,000 km per month, significantly higher than the industry standard of 8,000 km.

“There is a substantial boost in income for our partner truck owners and drivers due to this increased efficiency. Their earnings have seen a remarkable surge of approximately 35%,” said Imthiaz.

Raaho also handles payments seamlessly and ensures truckers get 90% in advance via a secure digital payment solution on the app. The remaining amount is paid within 24 hours of the submission of proof of delivery, revealed the founder.

Raaho’s revenue model is pretty straightforward. It earns a margin on every trip made through its platform. The margin is the difference between what a shipper pays and what Raaho pays to the truck owner undertaking the delivery. In the marketplace parlance, this is often called the ‘take rate’.

Will Customer Support, Tech-Managed Trucking Drive Growth?

Raaho’s inclusive business model and tech-driven capabilities have brought much-needed operational transparency to commercial trucking. The rising digital awareness across India is another boon for the platform, which plans to double the number of truck owners and drivers from 3,800+ to 8,000+ by the end of FY24. It also aims to reach every pin code in the next three to five years.

That is easier said than done, as the logistics space in India is still fraught with many challenges. Consider this. When Raaho began its operations six years ago, digital awareness was low and convincing the trucking community to switch from the age-old agent system to a fully digitalised platform was daunting. More importantly, digital payments, which form the backbone of the platform’s business model, were not widely adopted at the time. In brief, the concept of a ‘digital Bharat’ was taking shape, but early adopters were few and far between.

Still, those very challenges helped build a stellar customer support team, always ready to assist shippers, fleet owners and drivers via its digital channels. The team conducted onboarding campaigns in locations with high road freight demand. The goal was to build trust among these players, get them comfortable with digital processes and onboard them seamlessly.

Incidentally, Imthiaz and other founders had gone the extra mile to ensure they understood the trucker problem. They invested their own money, approximately INR 2 Cr, to buy 10 trucks and drove them around the country to understand the life of truck drivers and what hindered smooth operations. Their first-hand experience helped build what Raaho is today.

Even the Covid-19 pandemic proved to be a game-changer due to the surge in digital awareness and mass adoption of digital tech, including online payments. Add to that proactive policy initiatives, improved infrastructure and the focus on sustainable logistics, which amply explain why India has climbed up six places in the World Bank’s Logistics Performance Index in 2023.

This does not mean Raaho can grow exponentially without tapping into the latest technology. For starters, a handful of startups like BlackBuck and Vahak use deeptech applications to transform India’s trucking sector, as 66% of the cargo (in tonne-km) movement in the country is done via road transportation. This logistics trend has unleashed a mammoth opportunity for young logistics companies, and Raaho, too, is keen to leverage it.

“Raaho will introduce the National Digital Freight Index, showcasing daily vehicle and lane-wise pricing. This nationwide launch is set for 2024,” said Imthiaz.

Finally, trucking startups like Raaho are trying to tackle one of the toughest challenges of inter-city trucking: The deadhead miles. They refer to the extra distance that empty trucks must travel to pick up the next shipment after unloading their cargo.

But this issue is not limited to India alone. Even developed economies like the US face the same challenge. According to a report by Convoy, a trucking software company, up to 35% of U.S. truck miles may be empty. In India, the situation can be worse due to the fragmented nature of the industry.

Deadhead miles result in massive losses for truck owners because they are not paid for the time and the fuel. A report by ICICI Lombard suggests that the Indian logistics sector incurred an annual loss of $21.3 Bn in 2022 due to order delays and extra fuel consumption.

Nothing short of tech-driven load matching, smart routing and real-time monitoring and communications can do away with these hurdles and drive growth across India’s deeply fragmented logistics sector that costs between 13-14% of GDP. Can Raaho and its ilk put things right with the help of a multimodal digital infrastructure and sustainable strategies?

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency10 months ago

Crptocurrency10 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016