[ad_1]

Startups in consumer services, ecommerce and fintech saw the most shutdowns from 2016 to 2018

These were also the sectors that attracted the most investment, acquisitions, and ventures

The reasons for shutdown include policy logjam, inability to perform, competition, a dearth of follow-on funding, etc

This article is part of Inc42’s special year-end series — 2018 In Review — in which we will refresh your memory on the major developments in the Indian startup ecosystem and their impact on various stakeholders — from entrepreneurs to investors. Find more stories from this series here.

“The value of an idea lies in the using of it.” — Thomas Edison

The cup of ideas runneth over in the Indian startup ecosystem. A good idea is the genesis for any successful startup, but sometimes just having a good idea is not enough.

According to the findings of a survey by the Institute for Business Value and Oxford Economics, 90% of India’s startups fail within the first five years. It added that the lack of pioneering innovation is the major reason for the failure of Indian startups — in essence, they are copycats of startup ideas of the West, the study said.

Turns out, almost half of the Indian startups are actually not needed at all.

It is the absence of scalable ideas that makes 9 out of 10 Indian startups sink like lead balloons, despite the best intentions of founders and investors. The lack of originality is clear from this caveat— Despite being the third largest startup ecosystem after US and China, the number of international patents India has applied for in 2015-16 was only 1,423 whereas Japan’s count stood at 44,235, China at 29,846 and South Korea at 14,626.

This shows the clear mismatch between the number of startups mushrooming and the extent of innovation in the country compared to others.

As per Inc42’s The State of The Indian Startup Ecosystem 2018 report, more than 10K Indian startups have shut their operations so far.

While failure is a hard pill to swallow, it is also a great teacher. For a startup founder, there is no bigger disappointment than seeing the product of their efforts come to nought. However there is also the flipside — if you’ve never failed, you’ll never know what works.

With 2019 just a couple of days away, we at Inc42 have compiled a list of the biggest failed Indian startups of the year. As late-night talk show host, Conan O’Brien said, “Through disappointment one gains clarity and with clarity comes conviction and true originality”

Indian Startups That Shut Shop In 2018

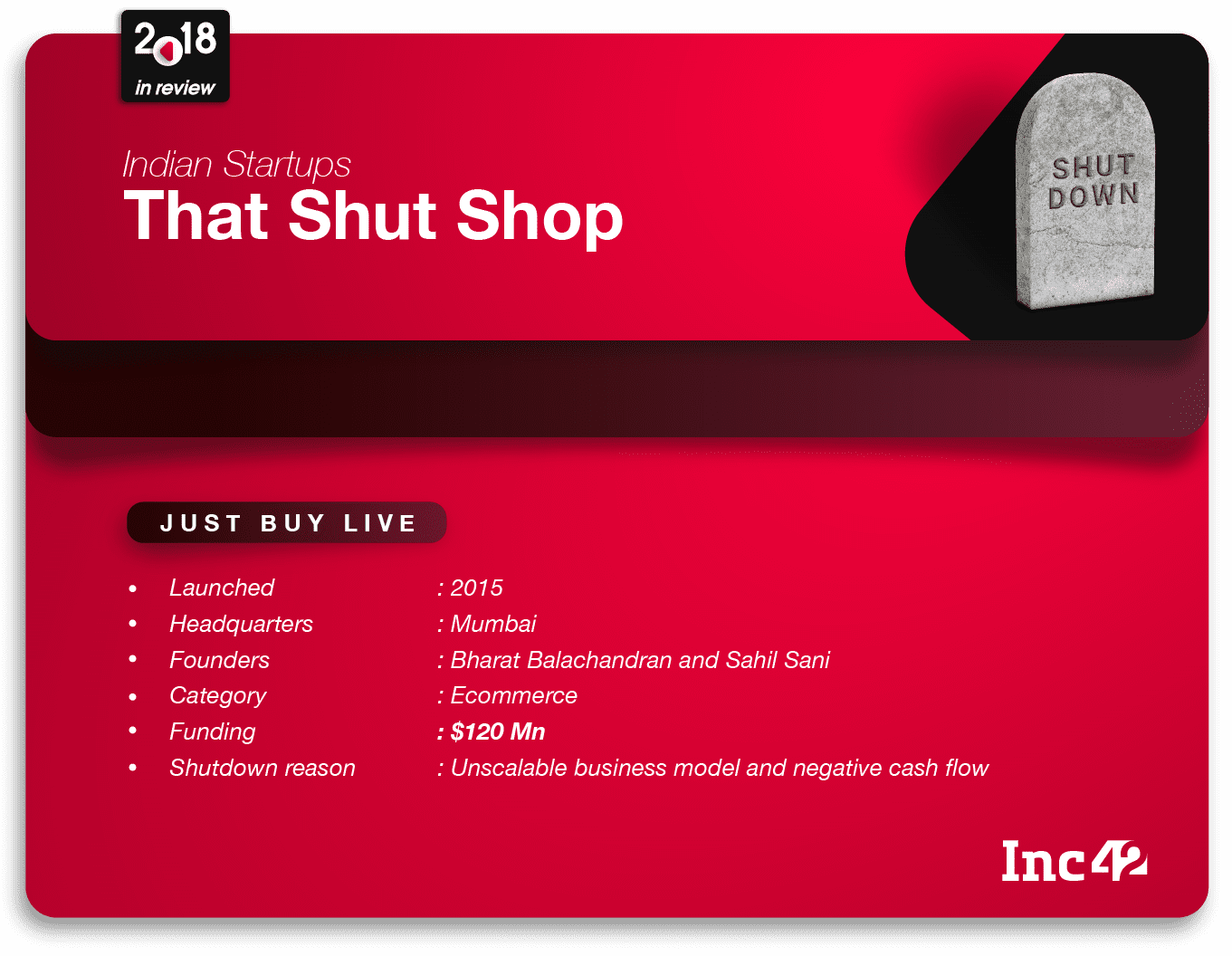

Just Buy Live: May Not Rise From Ashes After All

Overview

Just Buy Live connected retailers to buy goods directly from brands across multiple categories such as food, drinks, personal care, auto, smartphones, fashion, stationery, etc. The startup also offered an unsecured credit lending to small and medium enterprises (SMEs) to facilitate the transaction on its portal and provide working capital to small retailers. In August 2017, the startup raised $100 Mn (INR 699.25 Cr) Series B funding from a Dubai-based investment firm, Ali Cloud Investments.

Why it failed

Various reports claim that Just Buy Live may have shutdown due to an unscalable business model and negative cash flow. As per Entrackr’s report in March this year, Just Buy Live’s cofounder said that the company has temporarily been shut down and would resume operation after raising fresh funding. Its website is currently down.

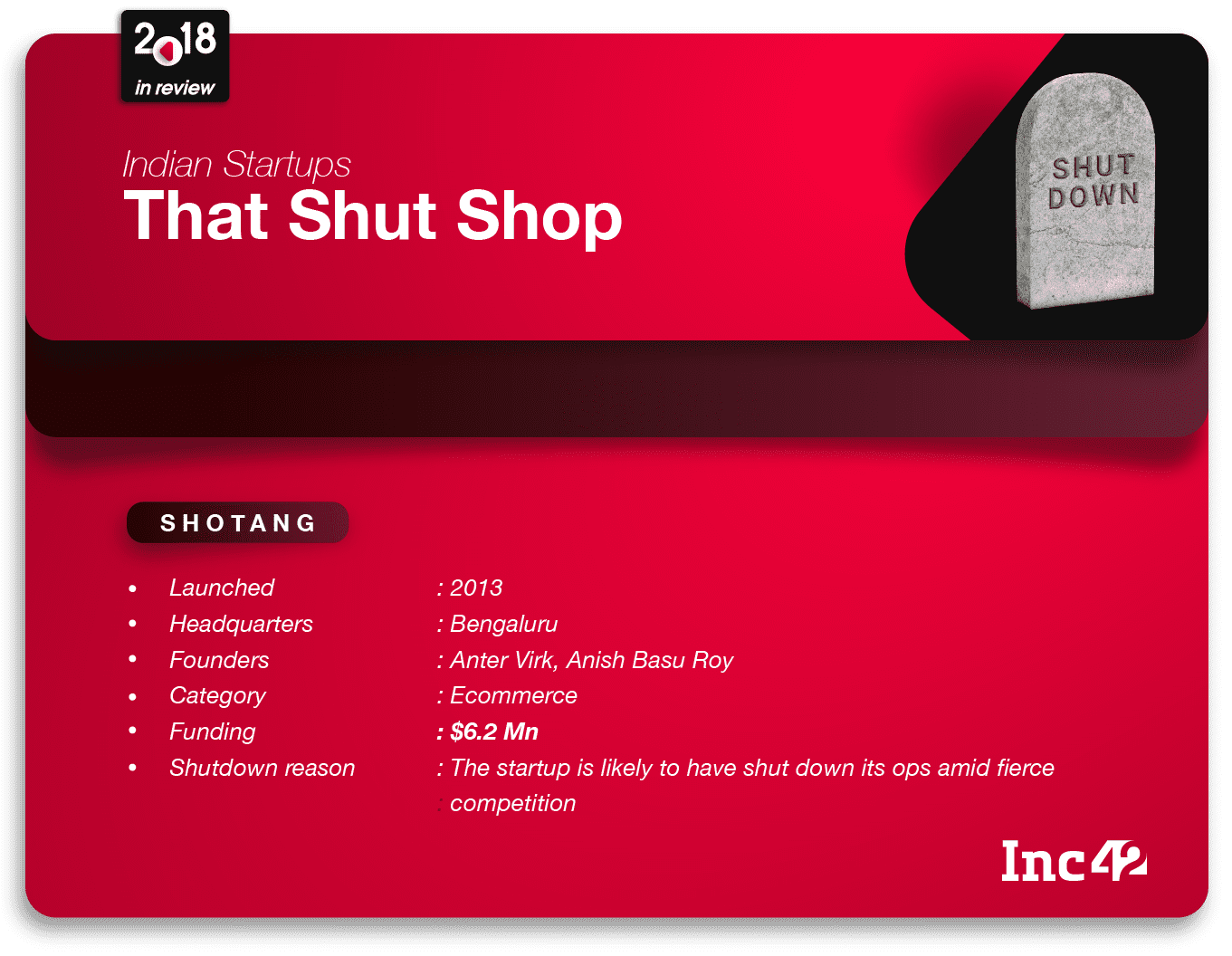

Shotang: It Tried But Failed

Overview

Shotang was a business-to-business (B2B) online marketplace that connected retailers, distributors and manufacturers to discover, transact and manage their business online using their platform. Its main products were mobiles and apparel. It earned revenue through commissions paid by distributors per transaction.

Why it failed

At its peak Shotang had a $40 Mn (INR 279.7 Cr) market valuation. It had last raised $864K (INR 6.8 Cr) from Patamar Capital in February this year, and $5 Mn (INR 35.94 Cr) from Exfinity Venture Partners in December 2015. Techcircle cited an anonymous person saying that the money it last raised was “primarily meant to pay off creditors, employees, partners. It tried but failed.”

It is likely that the business was forced to scale down its operation amid fierce competition from the likes of Flipkart, Amazon and Paytm Mall.

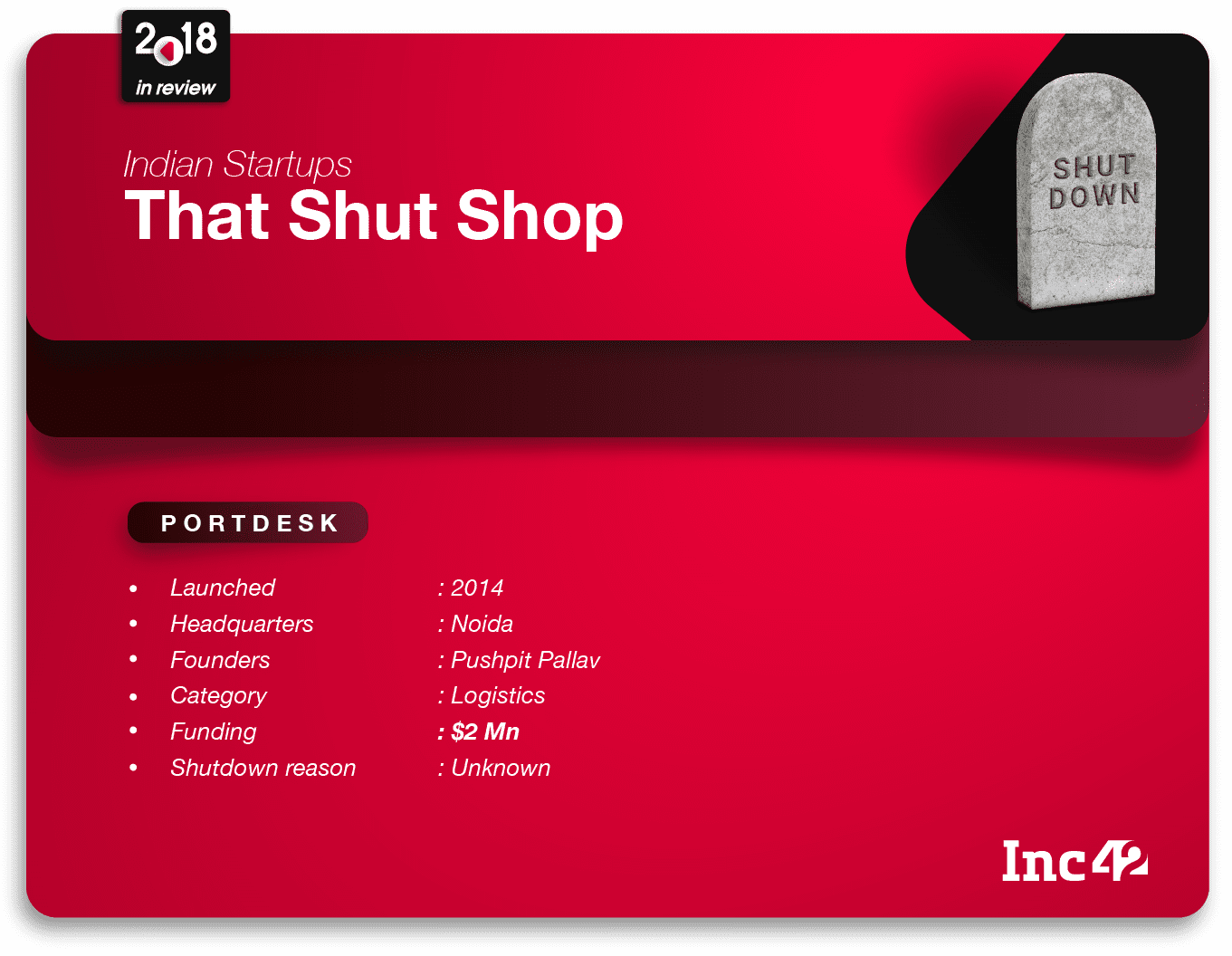

PortDesk: Cause Of Death Unknown

Overview

PortDesk provided an e-procurement software solution for logistics management for port-related operations such as accounting, cash management, ports DA estimate and voyage, layout and contract management.

Why it failed

In June this year, it was reported that PortDesk has shutdown its business, however, the reason is still unknown. Only a year earlier, the startup had raised $2 Mn (INR 13.98 Cr) in a seed funding round from a Singapore-based maritime services company, Alphard Maritime Group. The startup’s founder Pushpit Pallav was not reachable for comments.

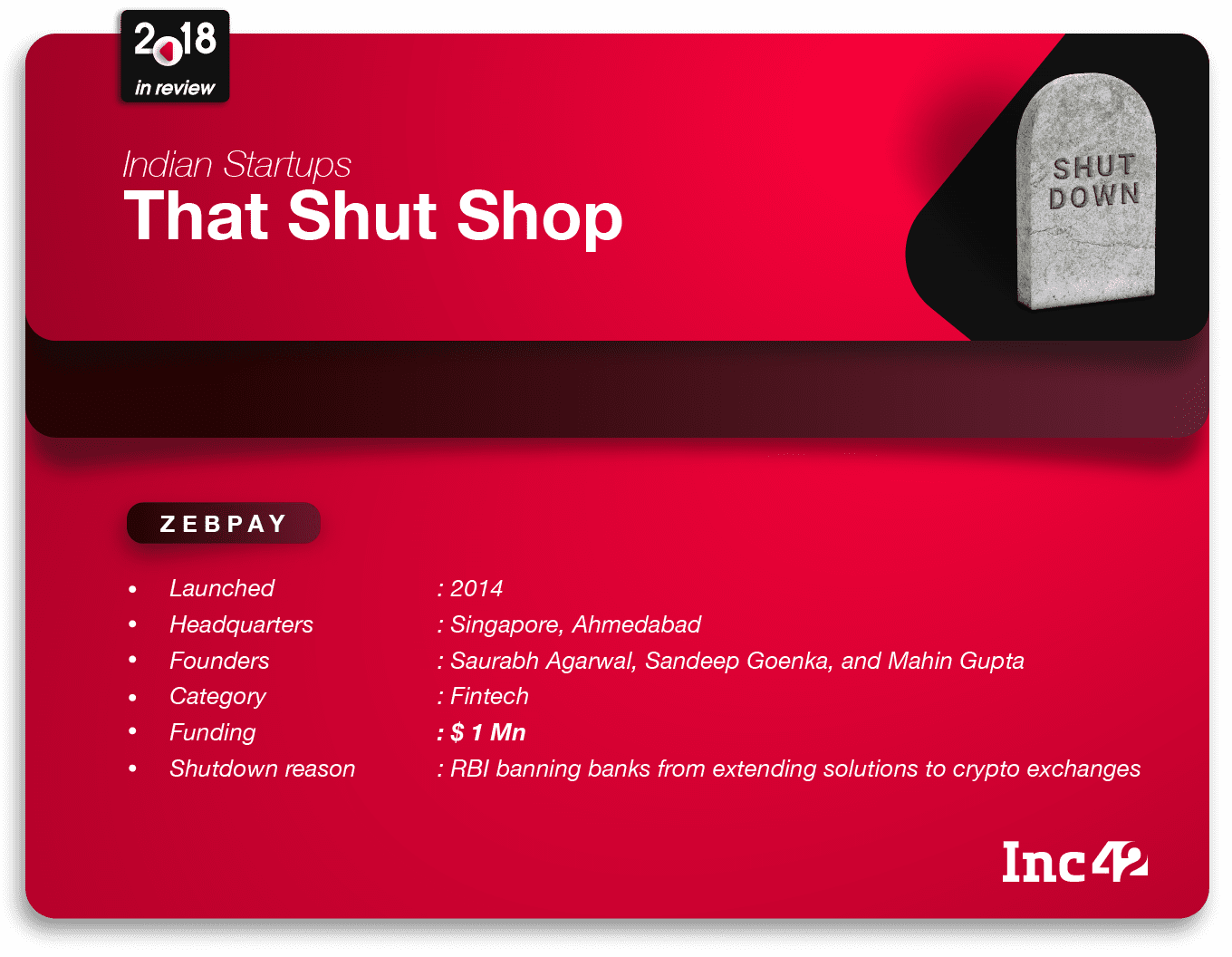

Zebpay India: Shut Down Over Policy Stalemate

Overview

Undoubtedly India’s largest crypto exchange, Zebpay (till its closure) enabled users to buy and sell Bitcoin and other cryptocurrencies such as Bitcoin Cash, Ripple, Ethereum, and Litecoin, or to purchase airtime and gift cards. According to its website, it had over 3 Mn users.

Why it failed

Zebpay decided to down its shutters in the aftermath of the circular issued by the Reserve Bank of India (RBI) on 6 April 2018, restricting banks and regulated payments companies from extending any services to crypto exchanges and wallets.

Many Indian cryptocurrency exchanges, as well as crypto groups, soon knocked the doors of the Supreme Court which, after multiple hearings, has listed the matter for further hearing in January next year.

However, amid the lack of crypto rules and regulations in India, Zebpay, on September 28, 2018 announced its closure. In a statement, it said, “At this point, we are unable to find a reasonable way to conduct the cryptocurrency exchange business.” The crypto exchange, however, continues to allow users to deposit and withdraw coins/tokens into their wallet.

Since then, the situation has only worsened — the founders of Unocoin, another leading crypto exchange, were arrested on October 23 by Bengaluru Police over a Bitcoin ATM installation.

Not only Zebpay, a slew of exchanges including Coinsecure, BTCXIndia, MoneyTrade, Bitconnect and more shut down for various reasons this past year.

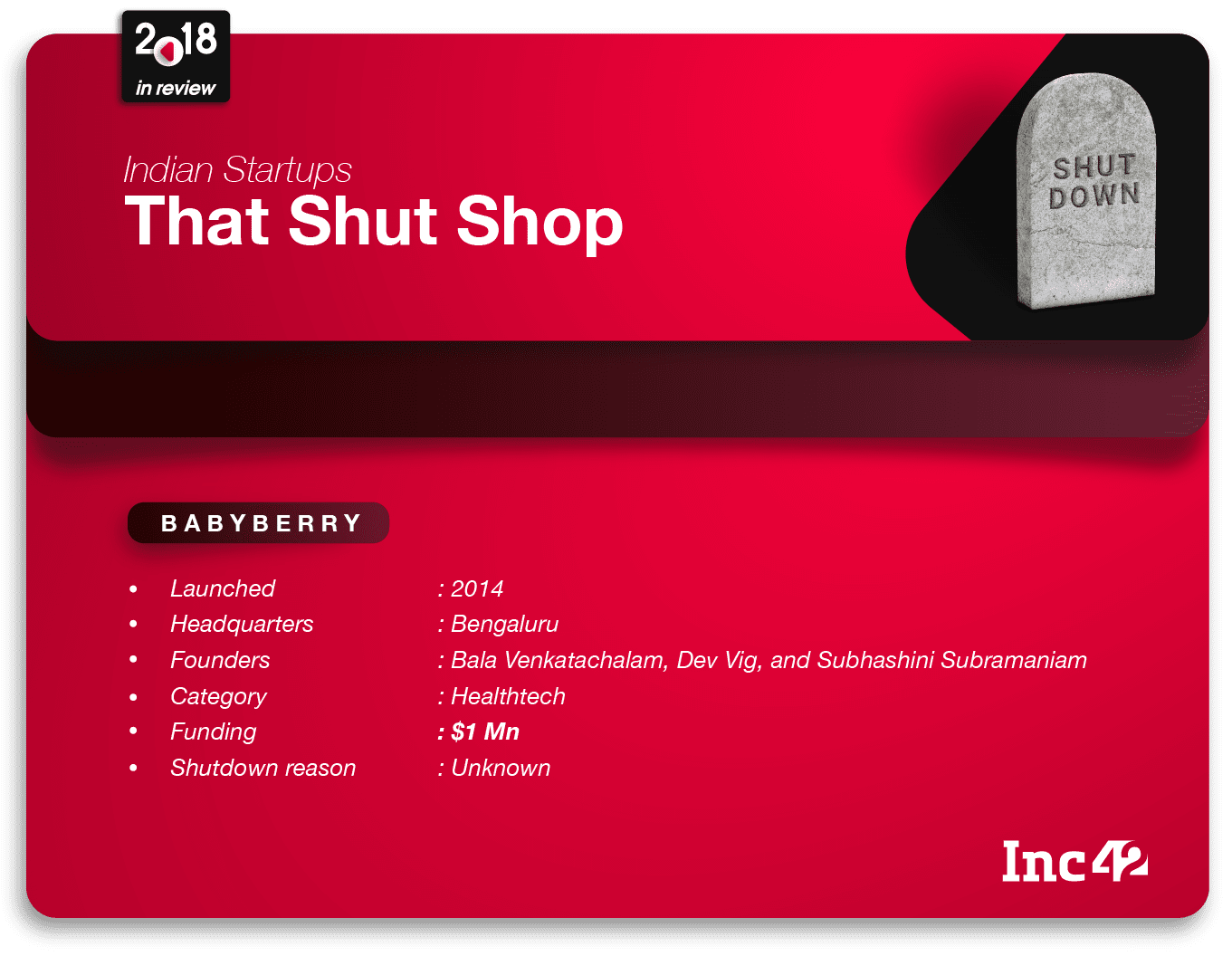

BabyBerry: Missing In Action

Overview

Online parenting app Babyberry helped parents of a newborn baby to provide the best possible care for their child’s holistic growth and development from physical, cognitive, social to emotional growth. The app included features such as digital vaccination chart and reminders, health records management and access to the nearest doctors based on geolocation.

Why it failed

It is uncertain as to what lead BabyBerry to shutdown its operations. Its website is pulled down, it hasn’t posted any feeds on its social media since October last year, nor any queries to the founders could elicit any response. In August this year, a report had cited its founder saying that the startup is currently looking to solve technical errors on the platform after many of its customers reported the glitches. Notwithstanding, the startup had raised $1 Mn (INR 6.99 Cr) in 2016 meant for product development and marketing.

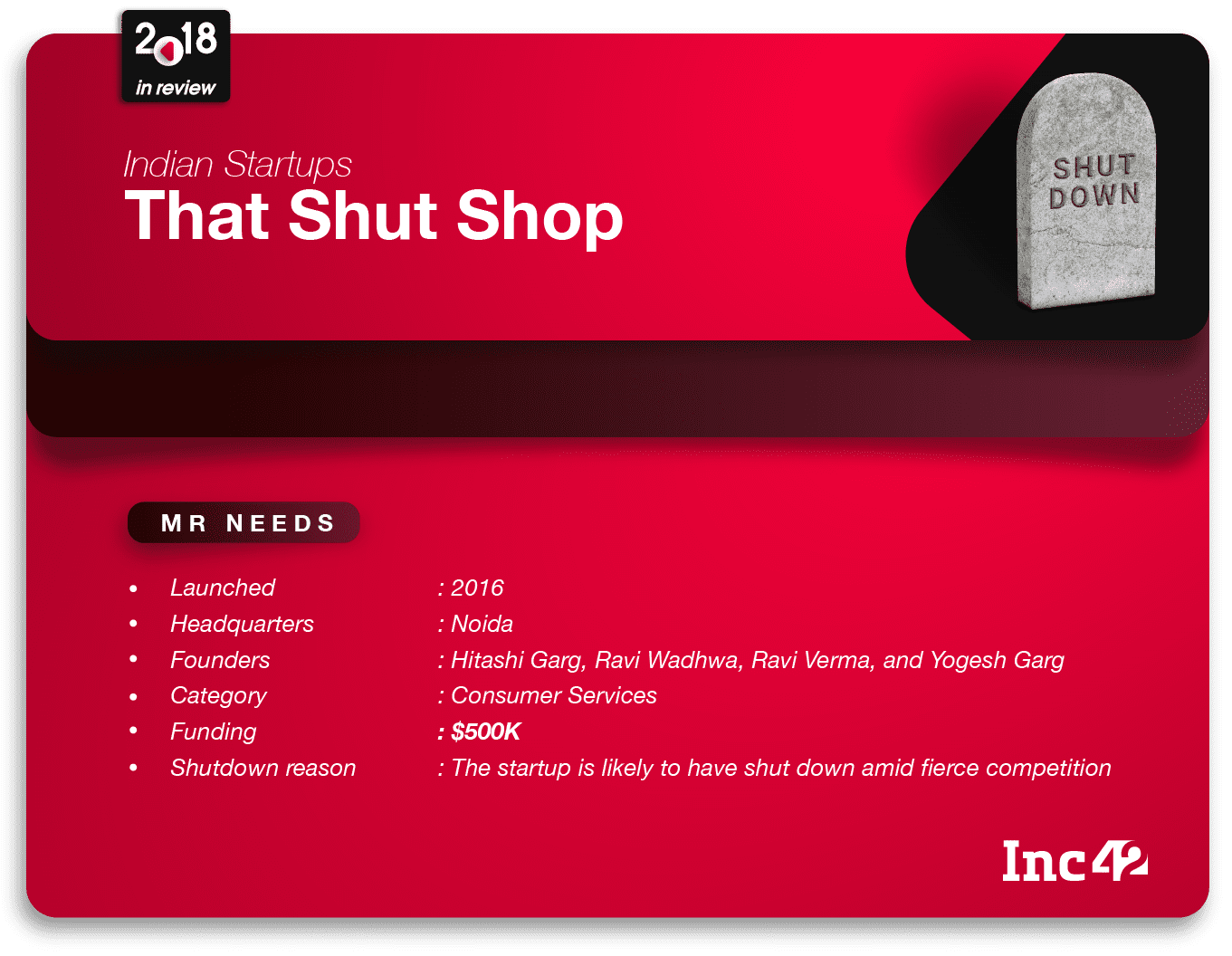

Mr Needs: Has Anybody Seen MrNeeds?

Overview

MrNeeds offered consumers an online subscription-based service for the delivery of products such as milk, bread, eggs, and other grocery items. In June 2017, ET had cited Wadhwa saying that its “per delivery costs are 50% to 70% lower than the industry standard,” and was serving 36K monthly orders for 9K families across Noida.

Why it Failed

The startup has pulled down its website, and is mobile application is not found anymore on Google’s play store. It is, however, not clear as to what lead the startup to shut its operations. It is likely that the startup closed down its shutters amid fierce competition from the likes of BigBasket, DailyNinja, and others. Inc42’s efforts to reach out to the founders have gone unanswered.

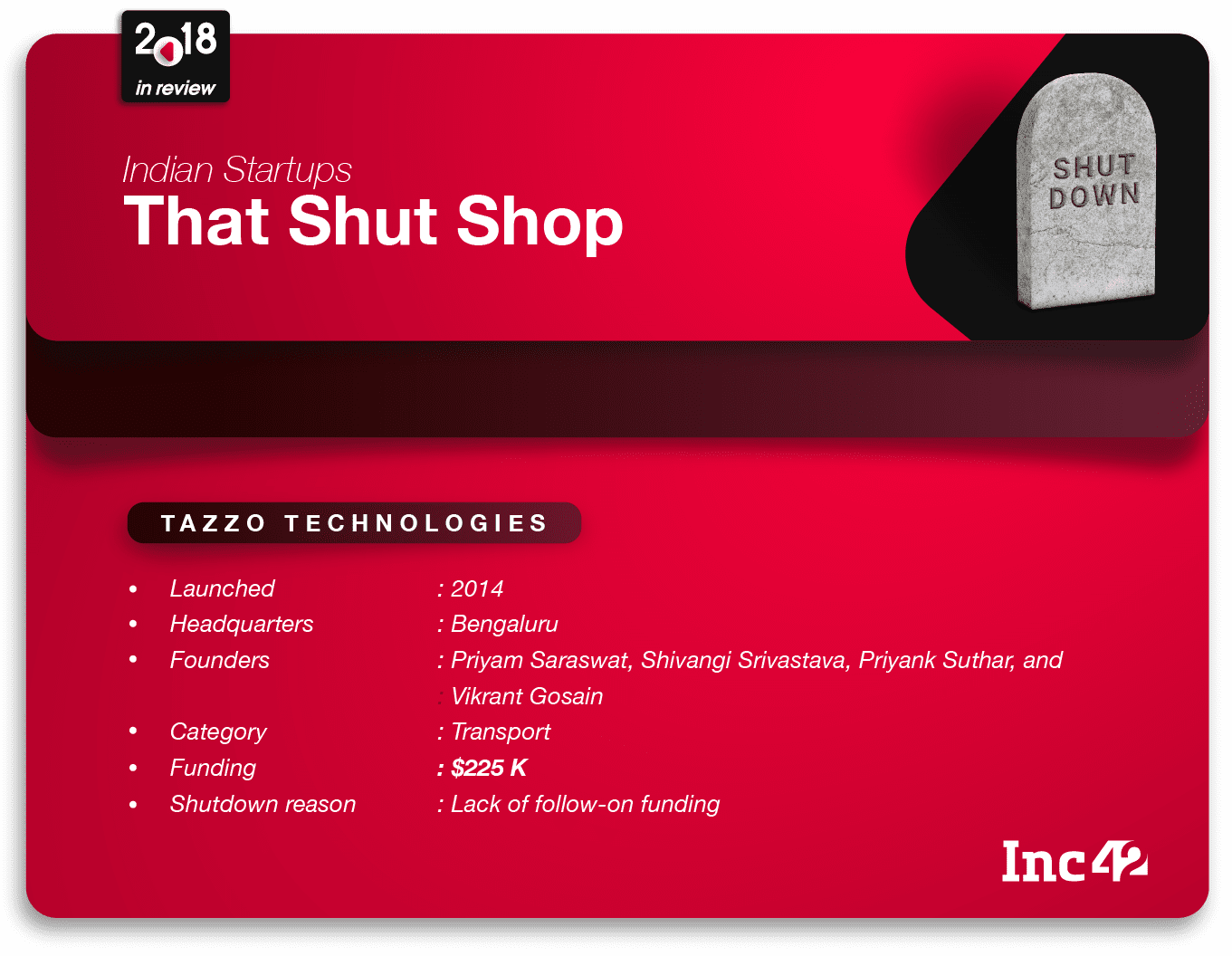

Tazzo Technologies Shuts Amid Funds Crunch

Overview

Bike rental startup Tazzo was focussed on point-to-point commuting service and charged INR 5 per km. Its mobile application was integrated using GPS technology and tracked every movement of its entire fleet in real-time, including overspeeding, theft, etc.

Why it failed

According to Deepak Shahdadpuri, founder and MD of DSG Consumer Partners — one of Tazzo’s investors — the startup failed to prove a profitable product market fit which led to drying up of funding. In October 2016, the startup had raised about $225K (INR 1.5 Cr) seed funding from DSG , but the capital-intensive nature of the sector it catered too, and the lack of profitable business model, forced the startup to halt its operations in September this year.

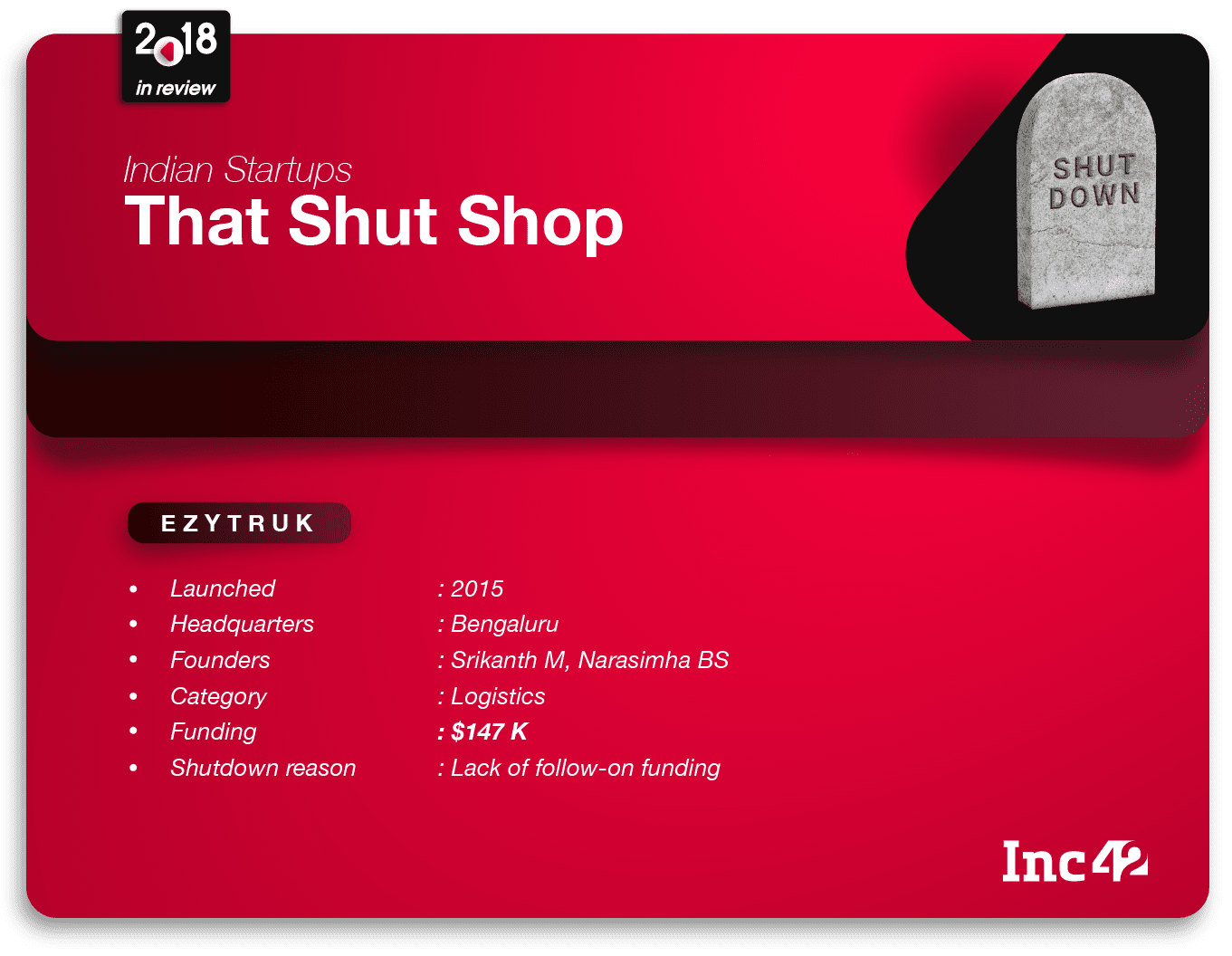

Ezytruk: Dearth Of Follow-On Funds

Overview

Trucks and logistics platform Ezytruk connected carriers, shippers and original equipment manufacturers (OEMs), to enable systematic transportation of goods. It offered services such as price comparison between carriers, real-time information of the goods, warehouse space management, etc.

Why it failed

Ezytruk had raised a seed funding of $147K (INR 1.02 Cr) from Dubai-based investors Ajith Nair and Anish K in January 2017. However, the startup could not scale and grow further as it was unable to raise further rounds of funding, reported Techcircle, which ultimately led the founders to shutdown the operation this year.

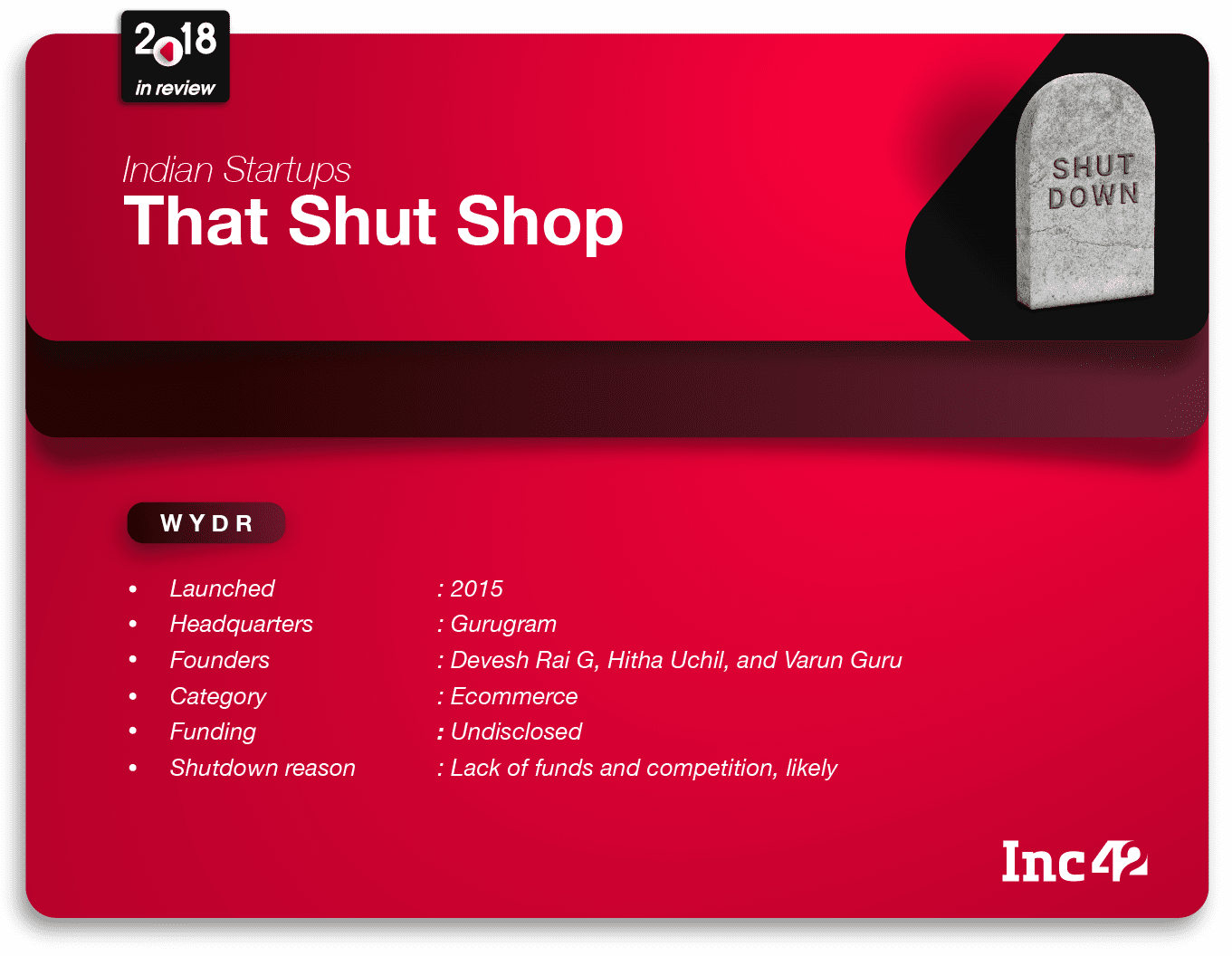

Wydr: Slips On Falling Performance

Overview

B2B wholesale marketplace Wydr offered a range of products across categories like fashion, home, automotive and electronics to manufacturers, wholesalers, and retailers. The platform allowed sellers to customise their requirements, negotiate prices, and instantly close deals. As at February 2018, the startup claimed to have added over 10K manufacturers and distributors across cities in India.

Why it failed

A report by Entrackr on November 3 cited ShopClues cofounder Sandeep Aggarwal and an early investor in Wydr as confirming the shutdown. The report said that “the company (Wydr) was scaling down for the past three months and finally pulled the plug a couple of days ago.” An email query sent to Wydr did not elicit any response. Its official website (www.wydr.in) is currently pulled down.

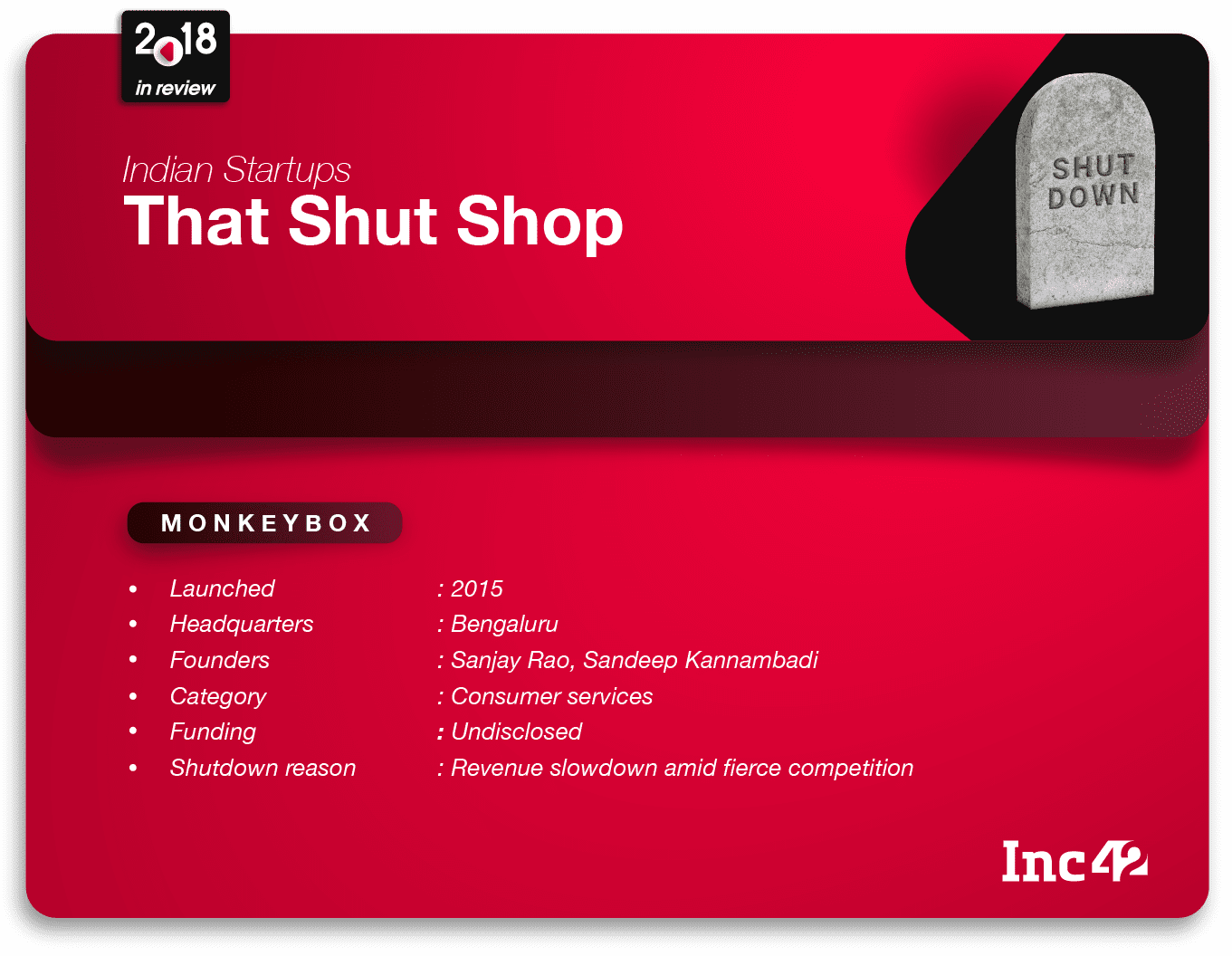

Monkeybox: Not An Out Of Box Idea?

Overview

Monkeybox provided Recommended Dietary Allowance (RDA) – approved vegetarian meals for kids in the age group of 3-18 at school. As on July 2017, the company claimed to be supplying over 1,500 meals per day to more than 85 schools in Bengaluru, with over 2K subscribers on its platform.

Why it failed

The Blume Ventures-backed foodtech startup shut down its operations amid much surprise and speculation. On one hand, the startup had been making quite a few acquisitions — such as food delivery company 75 In A Box, juice delivery startup RawKing — and, on the other, there was speculation that it was shutting down as it had failed to garner the required revenue to stay afloat amid fierce competition. On March 23, Monkeybox published a statement saying that “the operation will be temporarily terminated.”

However, the termination was final. Its official website (www.monkeybox.in) was pulled down.

Companies That Closed Their India Operations

Apart from Indian startups that shut shop, there are some companies that ceased their operations in India after facing stiff competition and declining revenue. Here are the top top international companies whose India operations were shut down this year.

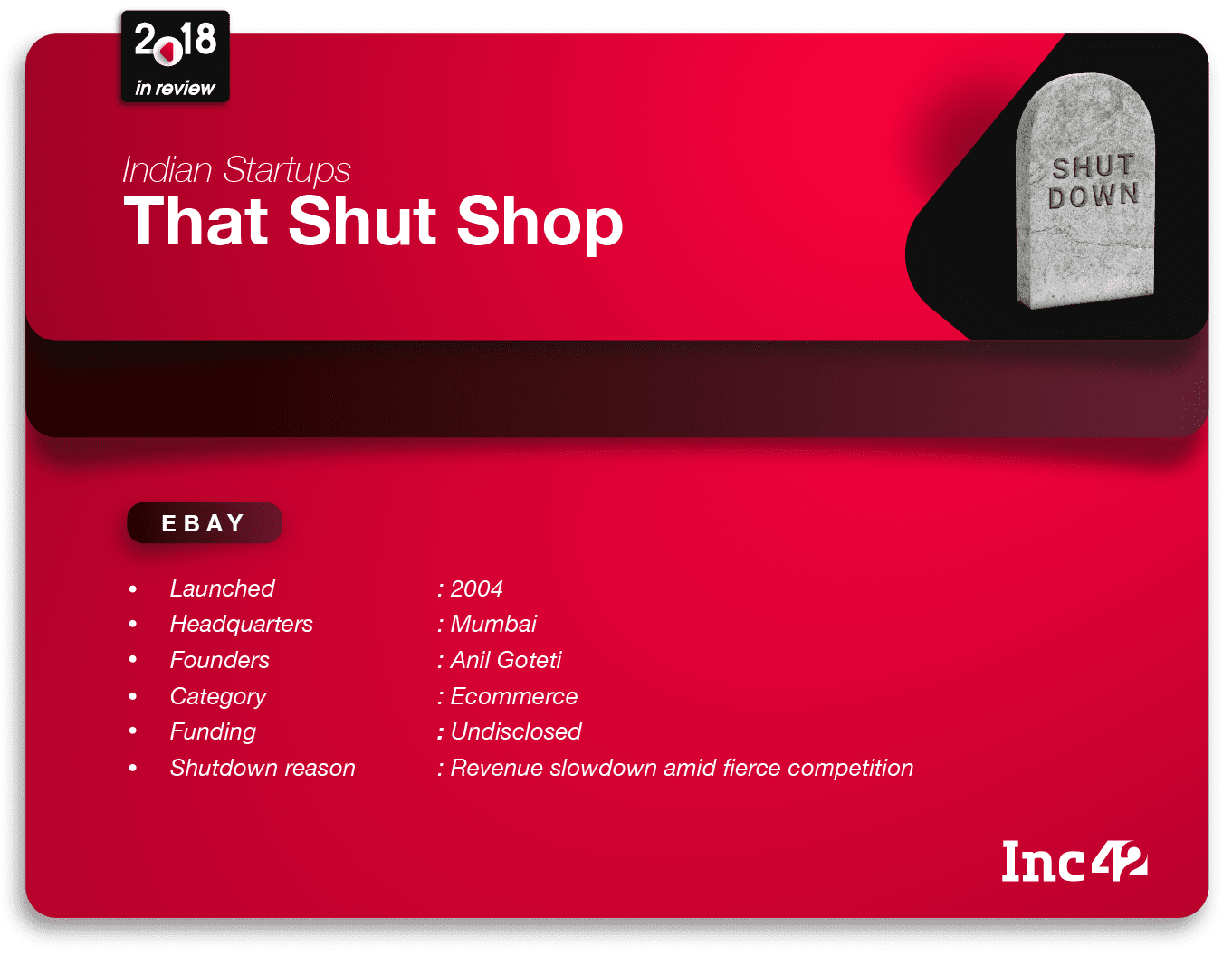

eBay Bows Out Of India

Overview

Walmart-owned ecommerce company Flipkart acquired the Indian arm of global retail company eBay in March 2017 for an undisclosed amount. Like any other ecommerce platform, eBay facilitates consumer-to-consumer and business-to-consumer sales through its website.

However, the big difference between eBay and the others is it enables trading on its platforms both in an auction or a fixed price sale. In a buyer’s auction, buyers bid for a specific product and in a seller auction, different sellers bid their fixed price for a single product and the buyer chooses the best offer.

Why it failed

In May this year, eBay announced that it was ending its partnership with Flipkart and also forbade the latter to use the eBay.in brand. As the partnership ended, Flipkart migrated eBay India sellers and customers to its platform. Although being among the first players in India’s ecommerce space, eBay couldn’t actually rake in much revenue and faced fierce competition from Flipkart and Amazon.

As the company slowed down, and before Flipkart took over, eBay India had fired more than 350 employees from its Indian arm.

The reasons for eBay’s failure in India have been many: the marketplace model was ahead of its time (eBay launched in 2005); there was no guarantee of product quality for either the buyer or the seller, and Indians never really warmed up to the idea of online auctions.

The company CEO, Devin Wenig, has announced eBay will be relaunched with a new business model in India.

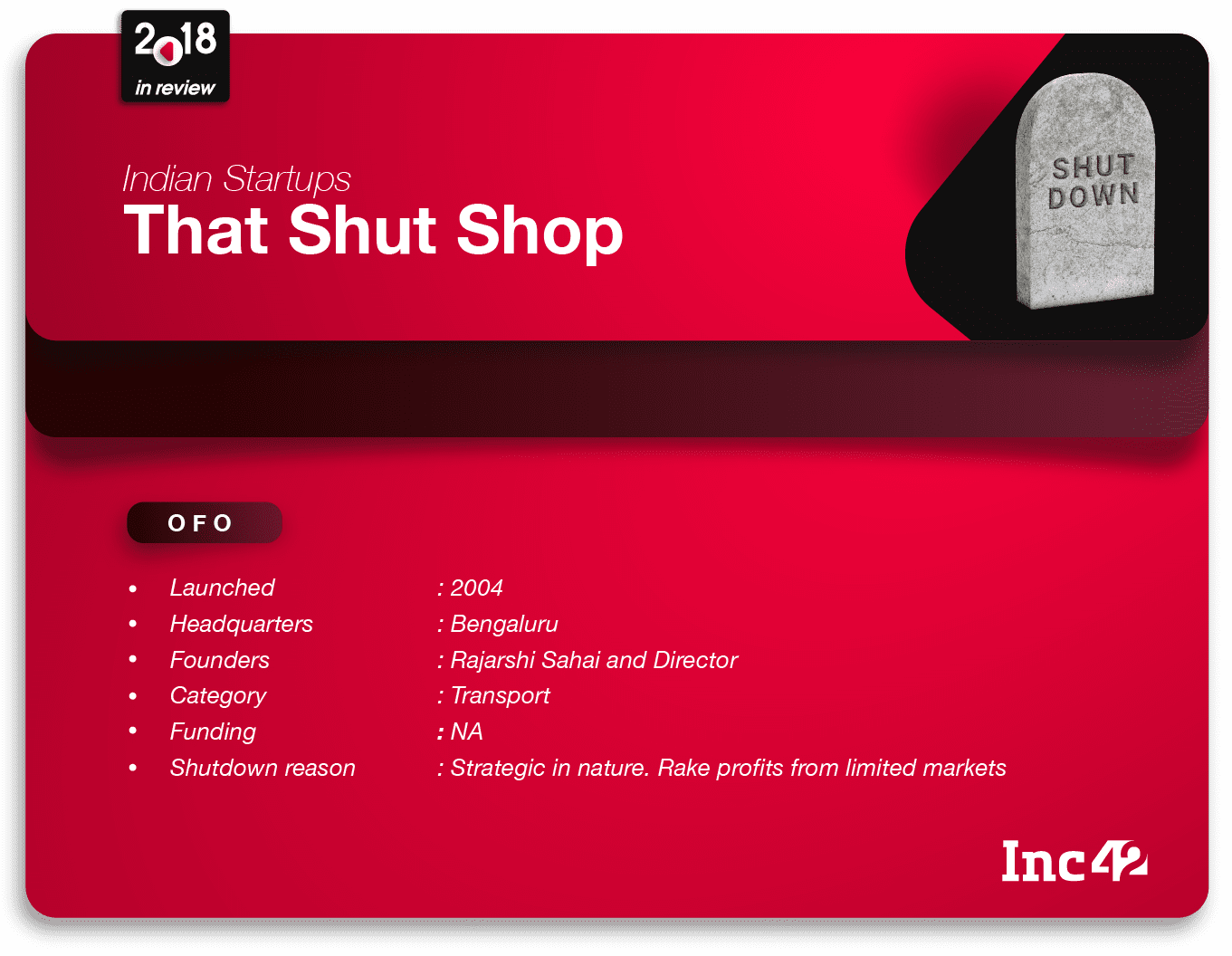

Ofo: India Gamble Backfires

Overview

The Alibaba-backed Chinese dockless bike rental company, Ofo, offered bicycles for rent on campuses and gated communities across New Delhi, Indore, Bengaluru, Ahmedabad, Pune, Coimbatore, and Chennai. At the time of announcing its India operations, the company claimed to have completed 1 Mn rides across seven countries.

Why it failed

Ofo’s move to shut down its dockless bike renting service in India is part of company’s strategy to scale down its operations in international markets, including countries such as Australia, Austria, Czech Republic, Germany, and Israel.

Ofo maintains that the move is aimed at remaining profitable. Techcrunch cited Ofo France general manager Laurent Kennel as saying that the company would focus on “mature and promising markets” such as Singapore, the US, the UK, France, and Italy. Moving forward, it is believed to be communicating with local markets about its plans.

Acquisitions And Shutdowns

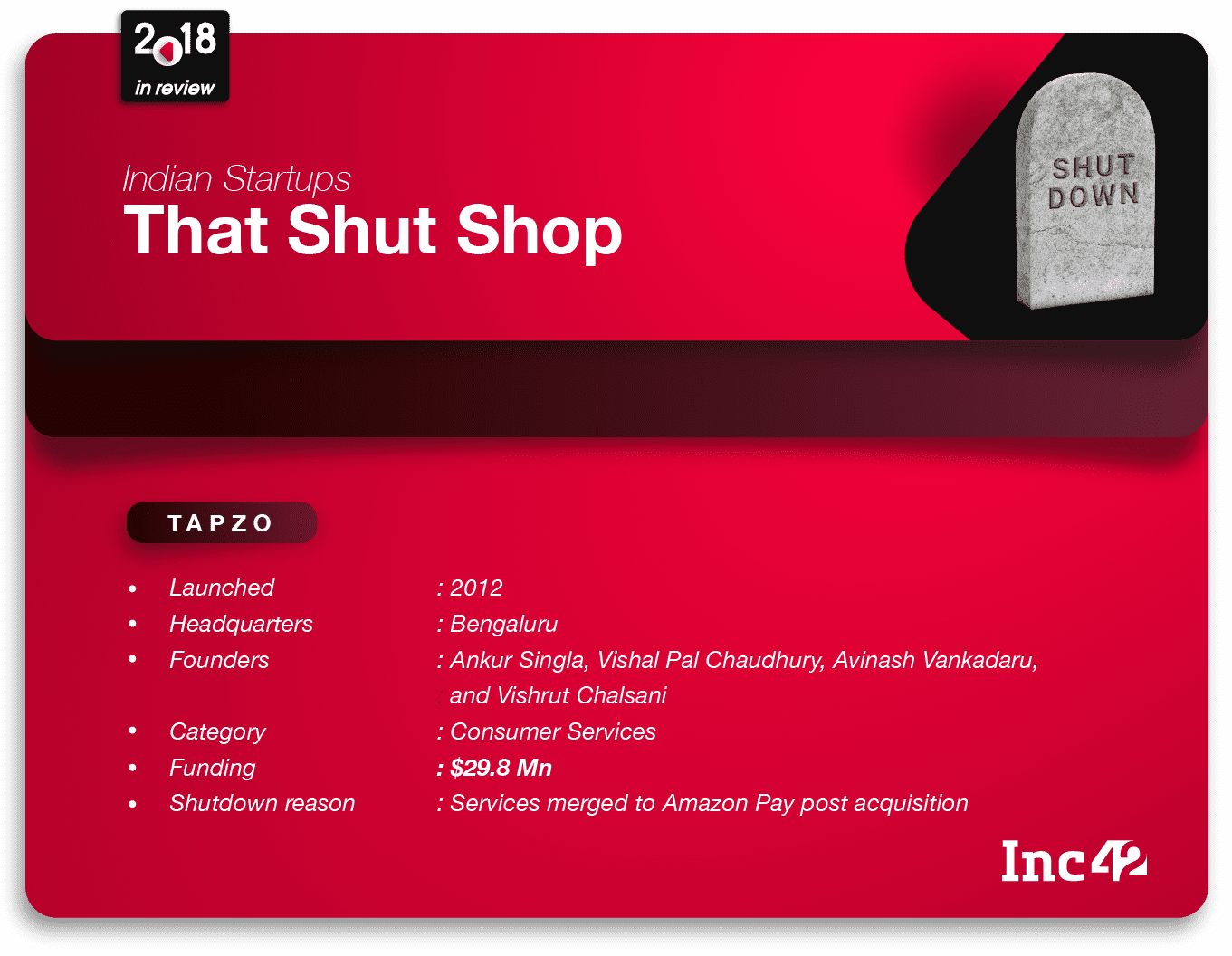

Tapzo

Overview

Tapzo was an “all-in-one” app that used to aggregate more than 35 different apps in one place, across categories such as cabs, food, recharge, bill payment, news, cricket, horoscopes, and more. Tapzo’s numbers were definitely impressive: 14,000 daily user base, 55K daily transactions, and an annual run rate (ARR) of INR 210 Cr in GMV/bookings.

Tapzo’s reduced valuation at its last funding round can be considered as a trigger towards its shutdown. Tapzo raised $1.9 Mn (INR 13.28 Cr) in December 2017 from existing investors RB Investments Pte Ltd and Ru-Net South Asia at a post-money valuation of $47.3 Mn (INR 308 Cr) — nearly 50% less than its valuation in the previous round — $85.54 Mn (INR 600 Cr).

Around mid of 2018, in August, the startup got finally acquired by Amazon. After the acquisition, Amazon has merged the entire Tapzo team with Amazon Pay, and it was working in the backend. Media reports said that Tapzo’s founders are likely to get on board Amazon Pay’s team in India.

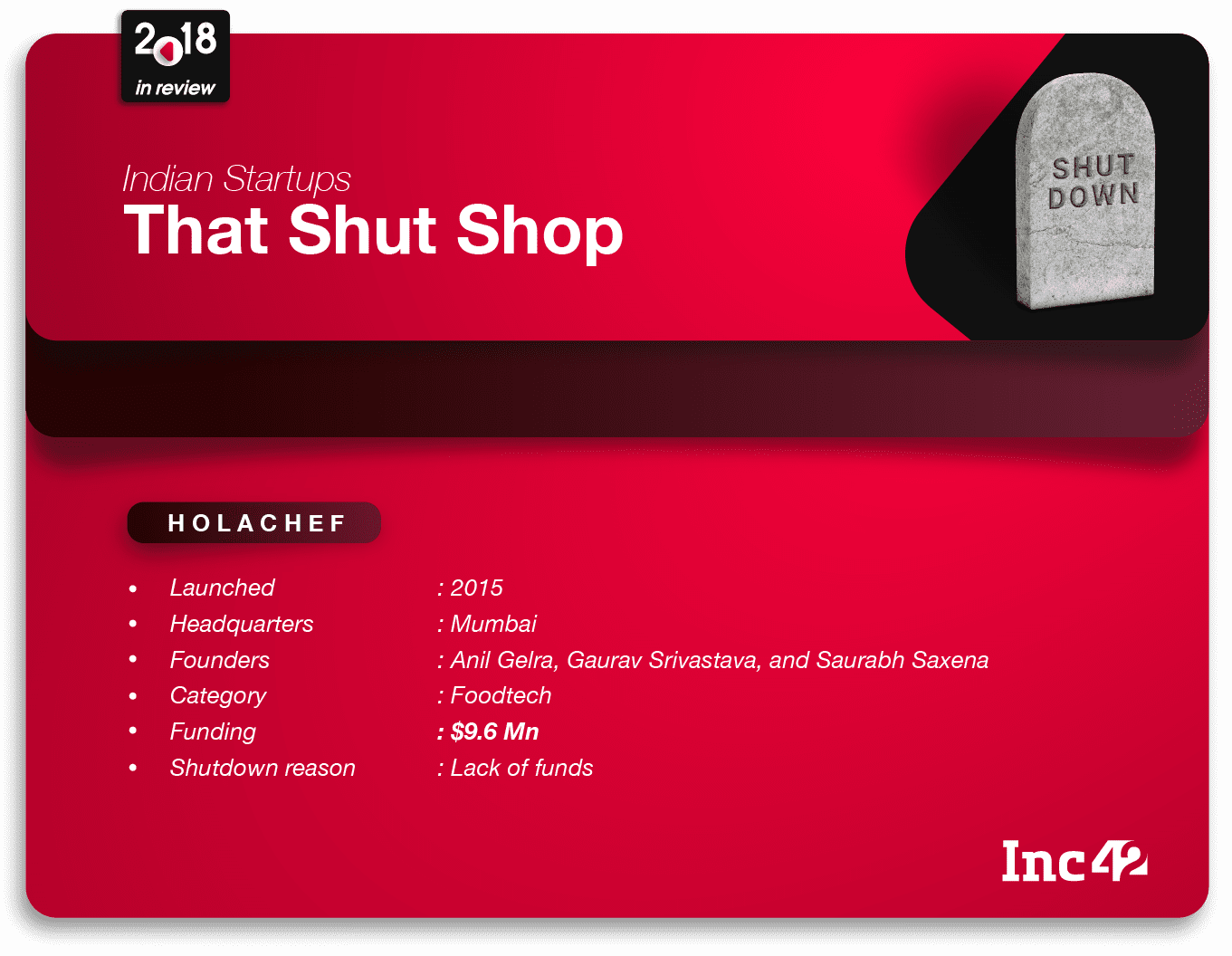

Holachef

Overview

HolaChef was a food aggregator that connected customers with chefs across the city, offering a new menu selection every day as per its website. Before shutting its operations three months back, the company was managing packaging, storage and delivery of the food.

The startup was shut down around May 2018 amid a cash crunch. A media report in August has suggested that Kalaari Capital and India Quotient had already resigned from the board of directors of HolaChef earlier in the year.

With the increased dominance of players like Foodpanda, Zomato and Swiggy in the online food delivery market, investors lost interest in the startup. This was coupled with a market correction to make things worse. The last funding raised by Holachef was in February this year when it raised $28,602 (INR 20 Lakhs) in Series B round.

Foodpanda pounced on the chance, acquiring the startup for cheap — the deal was said to fetch minimal returns HolaChef investors. For Foodpanda, the acquisition was an attempt to test waters in the cloud kitchen space, which its bigger rivals Swiggy and Zomato were already exploring.

A Parting Thought

A cursory glance at the startup shutdowns reported by Inc42 in the past three years shows that of the 32 startups that ceased their operations, most of them were from sectors such as consumer services, ecommerce, and fintech sectors. However, these sectors were among the top trending sectors in 2018, attracting investment, mergers, acquisitions, and new ventures. In fact, these are sectors that are expected to do better than all other sectors as well.

Goes to prove that it’s not all about the idea, doesn’t it?

What startups can learn from these stories is to buckle up their business strategy, take stock and identify even the most minuscule problems, and start rectifying them, immediately. They can also sleep on the fact that an idea — or even market demand — doesn’t alone make a brilliant startup. It’s also about execution and the right time, right place. As Edison also said, “I have not failed. I’ve just found 10,000 ways that won’t work.”

(Cowritten by Dipen Pradhan, Meha Agarwal and Suprita Anupam)

Update 1: Holachef and Tapzo have been acquired and not shutdown as was wrongly stated in an earlier version of this article.

Update 2: Bike rental startup Tazzo was unable to raise additional funding as it failed to prove a profitable product-market fit. We have updated the article to ensure clarity.

[ad_2]

Source link